| « Back to article | Print this article |

India's messy economy: Blame the non-functioning govt

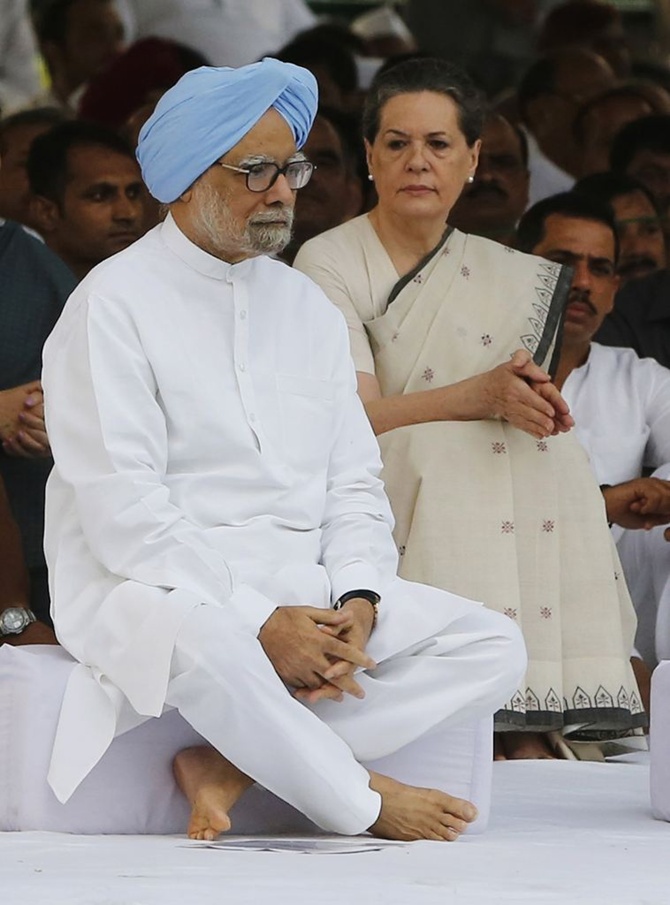

Persistent deficits, galloping inflation, stalled infrastructure showed up a non-functioning government, says Shreekant Sambrani.

The first wake-up call for the United Progressive Alliance, keen to shower entitlements on an India it believed was not Shining, came in early 2007. Food grain prices started shooting up.

Received wisdom places the start of the food price spiral a year later, but grains went up 15 per cent and all foods by 11 per cent in 2007. I had addressed a farmers’ meeting in April 2007 on ABCD (atta-besan-chawal-daal) inflation.

A global supply contraction affected India as well, but our economic wizards chose to treat it through their monetary policy toolkit designed to control demand. The alarm met with a snooze response.

The rash of farmer suicides in Vidarbha and Andhra Pradesh that year also tragically highlighted agrarian distress. The government responded to the deep-rooted structural problems by offering a palliative of a one-time debt-waiver of Rs 52,000 crore to 40 million farm families.

Click NEXT to read more…

India's messy economy: Blame the non-functioning govt

In its avowed quest for inclusiveness, it also committed simultaneously to spending Rs 20,000 crore annually on 5.5 million families of government employees and retirees.

States had to follow suit, staring at bankruptcy, but overdrafts from the central government could come to their rescue! While one hand of the government tightened money to control inflation, the other opened the floodgates.

Two fortuitous (but unintended) results ensued. One, the bumper crop of 2008 temporarily paused food inflation. Food prices continued their upward march the very next year, not checked till date.

Between 2007 and 2011, food inflation was 80 per cent, and fruit and vegetables doubled in prices. That trend continues to exacerbate, as is evident from onion prices literally causing tears lately. The government is entirely clueless. More on this in the next column.

The second consequence was that the additional liquidity helped cushion the shock of the global slowdown later that year. The official stimulus of lower service tax and export sops was mild in comparison to the size of India.

Click NEXT to read more…

India's messy economy: Blame the non-functioning govt

Growth dropped to 6.7 per cent, quite respectable under the circumstances. Policy makers again highlighted their skills of managing the economy and claimed that India had successfully decoupled itself from the global contagion, because of, you guessed it, its “strong fundamentals” and healthy domestic demand climate.

These words haunt them now since they blame the current crisis on the international situation, which is nowhere near as serious as in 2008.

A worse disaster followed the Mumbai terror attacks. Mr Chidambaram moved to the home ministry and that unreconstructed political fixer, Mr Pranab Mukherjee strode into the North Block.

His four Budgets from 2009 to 2012 paid mere lip service to sound macroeconomic concerns, but were textbook examples of flouting them in practice. Year after year actual results missed Budget targets.

Click NEXT to read more…

India's messy economy: Blame the non-functioning govt

Initially, these were confined to deficits and subsidy spending, explained away with verbal flourish but little logic by the then Chief Economic Adviser, Dr Kaushik Basu, famous for inventing two-handed Sudoku.

The growth target of Mr Mukherjee’s final Budget, hopelessly high to begin with, went the way his other forecasts did. Dr Basu said growth might not pick up until September 2012, which was considered heresy then, but turned out to be a woefully imprecise forecast in the correct direction.

It, of course, matters little that the usually ebullient Dr Basu now sounds gravely concerned from his new perch in the World Bank about the economy he was not too long ago trying to talk up.

Inflation persisted, despite the Reserve Bank of India tightening money supply quarter after quarter. Equally regularly, Dr Ahluwalia assured us that inflation would be in the “comfort zone” the next quarter, a forecast that was rolled over quarter after quarter without any discomfiture.

Click NEXT to read more…

India's messy economy: Blame the non-functioning govt

“Core inflation” was supposed to be under control, but the aam aurat continued to be cussedly worried about double-digit food inflation (possibly even these numbers are underestimates).

Seasonal factors, weather uncertainties, and of course, the ultimate fiend, the middleman, were blamed for the troubles, but that did not quite make the task of balancing the household budget any easier.

While the good ship India was caught between the Scylla of budget deficits and the Charybdis of equally frightening current account deficits, the Indian Railways behaved as a quasi-sovereign entity under Mamata Banerjee and survived on life support in the form of temporary loans from the Treasury.

Environmental concerns pursued zealously became roadblocks to already long-delayed projects that had the potential to reinvigorate desperately poor regions, if pursued wisely.

Power projects suffered huge cost overruns through delayed closures, clearances, and the missing coal link.

Click NEXT to read more…

India's messy economy: Blame the non-functioning govt

Most ministries and departments guarded their turf with a palpable “beggar-thy-neighbour” attitude.

Allies cocked a snook at the Congress, the opposition shed its sulk and became a die-hard obscurantist, fearing any mention of reforms since it believed that they had not made India Shine in its innings.

By 2012, a slowdown in all economic activities was evident. Business leaders entreated the government to end the policy paralysis, but the top Congress leadership maintained a posture that would have done the Sphinx proud.

When Mr Mukherjee was kicked upstairs, the prime minister moved Mr Chidambaram, just over a year ago, back into his old seat, amid huge expectations. He declared fiscal consolidation to be his first priority.

Click NEXT to read more…

India's messy economy: Blame the non-functioning govt

In September last, a series of “reforms” were unveiled - higher foreign direct investment in retail, partial decontrol of fuel prices, a cabinet committee for co-ordinating project clearances and monitoring, among other things.

Many noises and announcements later, the current situation is that the growth rate has sunk to below 5 per cent, the lowest in 10 years.

Food inflation continues to devour consumer confidence. Investments and industrial production are moribund. Budget and current account deficits may not be controllable, Mr Chidambaram’s confident assurances notwithstanding.

On August 28, a dollar was worth more than Rs 68, and the Sensex had fallen well below 18,000, its lowest level in a year.

Warren Buffet has given up on the Indian insurance sector. Jim Rogers gleefully admits to shorting the rupee. Paul Krugman, puzzled by the Indian situation, wonders aloud what he is missing.

Morass does not even begin to describe the situation.

The author taught at the Indian Institute of Management, Ahmedabad, and helped set up the Institute of Rural Management, Anand.