| « Back to article | Print this article |

India's biggest wealth destroyers, Reliance tops

While TCS cheered investors becoming India’s biggest wealth creator, Reliance which was a darling of the markets turned out to be a damp squib.

Shocking investors Reliance, which was the biggest wealth creator for five consecutive years till as recent as 2011, became the biggest wealth destroyer during the period 2008-13, says a study by Motilal Oswal.

The 2008-13 period saw unprecedented wealth destruction of over Rs 17 lakh crore, almost entirely wiping out the total wealth created by top 100 companies.

Reliance Industries

Rank: 1

Wealth destroyed: Rs 1,12,800 crore (Rs 1,128 billion)

Share of wealth destroyed: 7%

Price (CAGR %): -7

The irony is that the biggest wealth destroyer during this period Reliance Industries was the biggest wealth creator five times consecutive times from 2007 to 2011.

Click NEXT to find out more about India’s top wealth destroyers…

India's biggest wealth destroyers, Reliance tops

Reliance Communication

Rank: 2

Wealth destroyed: Rs 92,100 crore (Rs 921 billion)

Share of wealth destroyed: 5%

Price (CAGR %): -36

One-third of the wealth destroyed can be attributed to three broad ownership groups - Reliance (Mukesh Ambani), Reliance (Anil Ambani) and PSUs.

Click NEXT to read more...

India's biggest wealth destroyers, Reliance tops

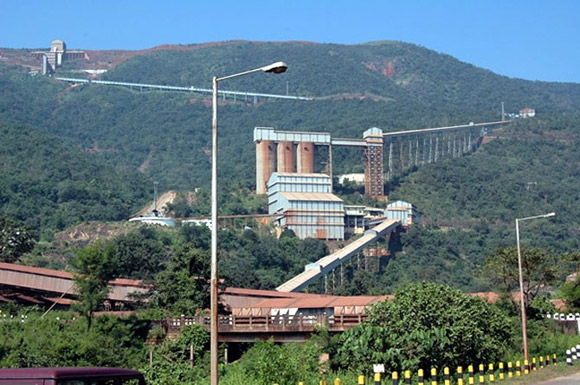

MMTC

Rank: 3

Wealth destroyed: Rs 89,100 crore (Rs 891 billion)

Share of wealth destroyed: 5%

Price (CAGR %):-29

The stock market's perception of ineffective management (including capital mis-allocation, consistent failure to deliver on guidance, low dividend payout etc) is a major source of wealth destruction.

Click NEXT to read more...

India's biggest wealth destroyers, Reliance tops

NMDC

Rank: 4

Wealth destroyed: Rs 82,200 crore (Rs 822 billion)

Share of wealth destroyed: 5%

Price (CAGR %): -17

When the market is disappointed, it does not spare even those stocks which were its darlings till recently, the study explains.

Metals/mining sector lost the worst loser with 124 companies among wealth destroyers.

Click NEXT to read more...

India's biggest wealth destroyers, Reliance tops

DLF

Rank: 5

Wealth destroyed: Rs 70,300 crore (Rs 703 billion)

Share of wealth destroyed: 4%

Price (CAGR %):-18

The top ten wealth destroyers saw an erosion of Rs 7,07,700 crore (Rs 7,077 billion).

Click NEXT to read more...

India's biggest wealth destroyers, Reliance tops

Reliance Power

Rank: 6

Wealth destroyed: Rs 61,900 crore (Rs 619 billion)

Share of wealth destroyed: 4%

Price (CAGR %):-21

Besides pace of earnings growth, markets also value longevity of earnings.

Thus, companies with above-average earnings power are likely to outperform markets even if their earnings growth is in line with average, says the study.

Click NEXT to read more...

India's biggest wealth destroyers, Reliance tops

BHEL

Rank: 7

Wealth destroyed: Rs 57,400 crore (Rs 574 billion)

Share of wealth destroyed: 3%

Price (CAGR %): -16

PSUs have lost out on their erstwhile wealth creating presence in sectors like utilities, metals & mining and capital goods.

Click NEXT to read more...

India's biggest wealth destroyers, Reliance tops

SAIL

Rank: 8

Wealth destroyed: Rs 50,600 crore (Rs 506 billion)

Share of wealth destroyed: 3%

Price (CAGR %):-20

Unlike younger companies, smaller companies (based on market cap of base year) seem to have an edge in faster wealth creation.

Click NEXT to read more...

India's biggest wealth destroyers, Reliance tops

Bharti Airtel

Rank: 9

Wealth destroyed: Rs 46,000 crore (Rs 460 billion)

Share of wealth destroyed: 3%

Price (CAGR %): -7

Bharti Airtel is the only telecommunications company among the top wealth destroyers.

Click NEXT to read more...

India's biggest wealth destroyers, Reliance tops

NTPC

Rank: 10

Wealth destroyed: Rs 45,400 crore (Rs 454 billion)

Share of wealth destroyed: 3%

Price (CAGR %): -6

The number of PSUs in the top 100 Wealth Creators is at an all-time low of only 11.