Photographs: Reuters

Indian stocks may see further downslide in the coming months, although it already figures among the worst performing markets across the world, experts believe.

According to global equity research firm CLSA, the Indian market is still trading with a 'premium', although it has come down considerably.

"Despite the underperformance, MSCI India (a globally accepted index for Indian stocks) still trades at 15 per cent premium to MSCI Asia leaving room for downside," CLSA said in a research report.

. . .

Indian stocks markets may FALL further!

Photographs: Reuters

It further noted that Indian market is now 10 per cent away from its March 2009 lows and this should limit the downslide to a range.

The Bombay Stock Exchange benchmark index Sensex is now hovering around 15,500 level, representing a fall of 23 per cent since the beginning of 2011.

Earlier on December 19, CLSA had said that the Sensex could fall to the levels of 11,000-12,000 and the Indian rupee could drop to 60 per dollar.

. . .

Indian stocks markets may FALL further!

Photographs: Reuters

"With the RBI hamstrung by stubbornly strong non-food core inflation, a violent selloff down to the 11,000-12,000 levels on the Sensex, combined with a further depreciation in the rupee to the Rs 60/$-level, now appears quite possib#8804 most particularly in the context of any potential Euroquake," CLSA's Christopher Wood had said.

In its today's report, CLSA said that Indian markets have traded at a 25 per cent premium over Asian peers over the last five years, but this gap has now come down to 17 per cent.

Indian markets are now cheaper than many other Asian markets, like Indonesia, Malaysia, Philippines and Taiwan.

. . .

Indian stocks markets may FALL further!

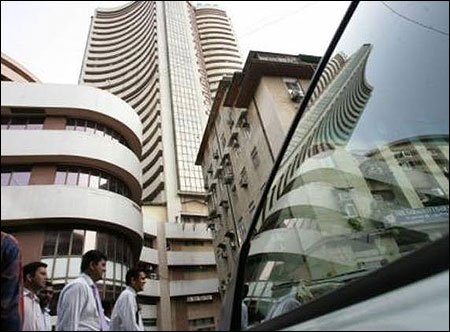

Photographs: Reuters

CLSA said that governance is a drag for the markets and with a near rollback of foreign direct investment in retail, the government inaction is once again in the forefront.

Earlier this month, the government was forced to suspend FDI in multi brand retail amid stiff political opposition.

"The possibilities of agitation by Anna Hazare, on the 'Lokpal bill' remains an outstanding issue," CLSA's Mahesh Nandurkar said adding that the 'Government paralysis' is not really new.

. . .

Indian stocks markets may FALL further!

Photographs: Reuters

Stocks of many of the "government facing" industries like infrastructure/property have already corrected by 50 per cent over the last one year and earnings have been lowered by 20-50 per cent.

"While more damage can happen but we believe downside is limited," CLSA said.

As consumer demand is on a downslide, the brokerage firm has reduced its weightage from banks and industrial sector.

article