| « Back to article | Print this article |

India Inc hopes this is the last rate increase

While a section of companies admitted they would be able to pass on the increase in costs to customers, others say they may bear the cost only by taking a further hit on their margins.

Leaders from the corporate sector who hoped the central bank would take a pause, or at least indicate one, were disappointed after the policy announcement, since RBI clearly indicated the fight to bring down prices would continue, even at the price of some deceleration in growth.

Click NEXT to read more...

India Inc hopes this is the last rate increase

"In the face of sharp increases in input costs, the pricing power remained intact," RBI said on Thursday in the mid quarter review of monetary policy. RBI on Thursday raised the repo rate by 25 basis points to 7.5 per cent. The industry was quick to point out its disappointment.

"We hope this is the last increase in rates, amidst growing signs of a slowdown in economic and investment activities in the country. Monetary tightening, on the other hand, has resulted in a drop in the growth of industrial and economic indicators," said Chandrajit Banerjee, director general, Confederation of Indian Industry.

Click NEXT to read more...

India Inc hopes this is the last rate increase

"Corporates would actually start feeling the real pressure in the coming quarter. It would affect profitability, investments and growth," said V Ashok, group chief financial officer, Essar.

Ominous signs have already started appearing. The results of 2,305 manufacturing and services companies, to a large extent, point to a slowdown in the growth in earnings.

Barring the blip in the June 2010 quarter, this quarter has seen the lowest profit growth since the last six quarters.

Rising raw material costs is a major reason for this. The costs of raw materials rose 25.5 per cent year-on-year.

Click NEXT to read more...

India Inc hopes this is the last rate increase

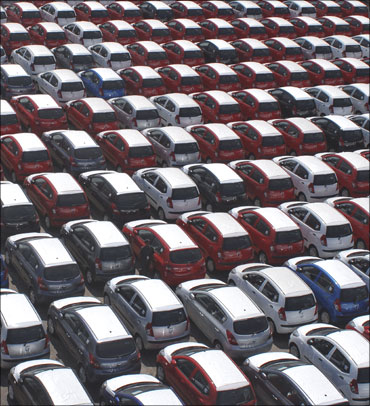

Among the sectors that saw a pressure on margins are auto, realty, steel, mining and the fast-moving consumer goods sector. A Crisil Reserach study warned going forward, the margins would contract further.

The inflation in raw material costs led to companies increasing the prices of their products. Many of these companies haven't passed the entire rise in costs to consumers, leading to lower margins.

The increase in prices is also partly responsible for the sales growth looking robust (for some of them) - the highest in the last four quarters.

Click NEXT to read more...

India Inc hopes this is the last rate increase

"There is very steep deceleration in demand in the industry. This would push the customer to a point where he would refuse to purchase. We recognise this threat and so, are prepared to suffer a reduction in our margins," said K Sridharan, chief financial officer, Ashok Leyland.

"Going forward, there could be a moderation in demand as a result of the price rise," said P Ganesh, chief financial officer, Godrej Consumer Products Ltd.

B Anand, chief financial officer, Future Group, summed it up by saying: "Normally, business plans are based on a mid to long-term outlook, and not on quarterly trends.

"Very clearly, with the cost of capital going up, people are unsure of the degree of the pass-through to sustain the margins and keep the economic return feasible."

Click NEXT to read more...

India Inc hopes this is the last rate increase

"In certain capital intensive sectors, we are seeing weakness creeping in. But on the consumption side, we are still positive."

Rate-sensitive sectors like real estate, already reeling under pressure, are hopeful the situation would be temporary.

"Looking at the industry, the interest rate rise in home loans would have a negative impact and would touch double digits. If it moves between 10-11 per cent, we may see some negative impact.

"If it goes beyond 11 per cent, we would see a significant downward impact on home loan off-take. However, we feel this particular high interest rate regime would not continue beyond two quarters.

"We can expect the interest rates to ease by the end of this monsoon, or during the festive season in September," said Pujit Aggarwal, managing director and chief executive officer, Orbit Corporation.