Photographs: Amit Dave/Reuters Sohini Das, Rutam Vora and Vinay Umarji

India's largest passenger carmaker Maruti Suzuki India, global auto makers Ford and PSA Peugeot Citroen, US-based pharma giant Abbott, Israel's Teva, FMCG behemoths Amway and Colgate as well as Nestle all have something in common.

They all chose Gujarat, being touted as the most business-savvy state in the country, for setting up their manufacturing plants.

Already home to Reliance and Essar, Gujarat has also caught the fancy of a large number of corporate heavyweights over the past year. And many more are vying to enter the state.

It's always been smooth sailing for Gujarat as far as investments are concerned. The state has emerged as the top investment destination in the country, attracting proposals worth Rs 16.28 lakh crore, a recent report by industry body Assocham says.

...

In the fast lane: Gujarat's new growth story

Image: Girls performing the garba dance in Ahmedabad.Photographs: Reuters

Accounting for a 13.5 per cent share of total investments of over Rs 120.34 lakh crore across 20 states in India (till 2011-end), Gujarat has lived up to its image of being the country's most attractive investment destination.

What's more interesting in the state's growth story is that most investment proposals have come in the form of big-ticket projects in the manufacturing sector.

Gujarat has an 11 per cent share of the net foreign direct investment (FDI) proposed in 2011-12; in all, 13 FDI proposals totalling Rs 20,258 crore (Rs 202.58 billion) came to Gujarat in 2011-12, according to another Assocham report.

What makes Gujarat an attractive business destination? The reasons are well-known: good infrastructure, availability of power, readily available land, port connectivity and a pro-industry government.

...

In the fast lane: Gujarat's new growth story

Image: An employee stands inside the Tata Nano plant at Sanand in GujaratPhotographs: Amit Dave/Reuters

As M Athar, infrastructure consultant, PricewaterhouseCoopers (PwC) says, "The state has been able to develop an industry-friendly image over the last decade, not just in India but abroad. The international community now understands what Gujarat has to offer. Government delegations visiting parts of the globe to promote the state during various Vibrant Gujarat Global Investors Summits have helped to create a brand for the state."

Talking about the government's keenness to help set up industry in the state, insiders say, "Corporates have easy access to government officials, right from the ground level to the top-most bureaucrats. There have been instances when a particular company requiring coordination from six to seven government departments has been able to meet representatives from all under one roof, as a pro-active state machinery would promptly organise such meetings to expedite the process."

The proof is all too visible. From a sleepy, non-descript town to an emerging auto, FMCG-cum-pharma hub, Sanand has come a long way in the last three years. The Tata Nano is no longer its sole claim to fame. Apart from car majors like Ford India and PSA Peugeot Citroen, global players like Nestle, Colgate-Palmolive, Procter & Gamble, Teva Pharma and Amway have firmed up plans to set up shop in the neighbourhood.

...

In the fast lane: Gujarat's new growth story

Image: Nestle India has been allotted about 50 acres of land at Sanand to set up a new manufacturing facility.Photographs: Joao Vieria/Reuters

Nestle India, the subsidiary of Swiss dairy major Nestle, is all geared to set up its ninth plant in the country. The company has been allotted about 50 acres of land at Sanand and plans to invest Rs 400 crore (Rs 4 billion) to set up a new manufacturing facility.

Direct selling FMCG company Amway India has chosen Gujarat over Tamil Nadu to set up its first company-owned manufacturing plant in the country, with an investment of around Rs 400 crore. Oral and dental hygiene products manufacturer Colgate- Palmolive started construction work at its site at Bol village in Sanand around June this year.

Adding to the long list of foreign companies entering Gujarat are China's transformer maker TBEA, Japan's Hitachi (power equipment), Korea's Hyundai Corporation (a transformer facility), US-based Allied Mineral Product Inc (a refractory project) and Germany's Bosch Rexroth (drive and control solutions).

The latest entrant is India's largest passenger carmaker Maruti Suzuki India, which has zeroed in on Hansalpur -- around 110 km from Ahmedabad -- for its first plant outside Haryana. Maruti's plant is also likely to attract a battery of Japanese and Indian auto component makers. During a recent meeting with Gujarat Chief Minister Narendra Modi, Osamu Suzuki, chairman, Suzuki Motor Corporation, informed the CM that many vendors from Hamamatsu -- Japan's leading auto hub -- are keen to invest in Gujarat.

...

In the fast lane: Gujarat's new growth story

Image: PSA Peugeot also sees Gujarat as a land of opportunity.Photographs: Benoit Tessier/Reuters

The state government has already drawn up plans to develop a 500 sq km zone as a manufacturing investment zone comprising 44 villages. Hansalpur, which is between Mehsana district and the Sanand-Viramgam area, is part of the state government's Mandal-Bahucharaji special investment region (SIR) master plan.

Gujarat will catapult itself to the big league of car manufacturing hubs by 2015-16. By then it is expected to touch a car roll-out capacity of 1,015,000 units per annum (pa) -- this will be the aggregate capacity of the facilities at Sanand, Halol and Hansalpur.

Besides the already operational plants of Tata Motors (250,000 cars pa) and General Motors (110,000 units pa), the upcoming facilities of Ford India (240,000 cars pa), PSA Peugeot Citroen (165,000 cars pa) and Maruti Suzuki (250,000 units pa) will add to the numbers.

What do global corporates see as Gujarat's advantages? Phillippe Varin, chairman and managing director, PSA Peugeot, cites three reasons for choosing Sanand. "Availability of greenfield land and ready infrastructure are two reasons why we chose Sanand for the plant. Moreover, it is the enterprising nature of Gujarat that attracted us to the state," Varin had said while announcing the company's foray into Gujarat.

...

In the fast lane: Gujarat's new growth story

Image: Thar Dry Port in Sanand in GujaratPhotographs: Amit Dave/Reuters

As Gujarat takes the fast lane in positioning itself as India's manufacturing capital, not just auto, but global healthcare companies too have lined up a slew of investments here. The $38.9 billion (Rs 2.15 lakh crore) global pharma giant Abbott Laboratories, headquartered in Illinois, USA, has plans to invest Rs 360 crore (Rs 3.6 billion) in a nutraceutical plant at Jhagadia near Halol. Israel's Teva Pharmaceutical Industries is setting up a plant at Sanand through a joint venture with US-based Procter & Gamble to produce the Vicks brand of inhalers, throat drops and cough syrups.

Encouraged by the response from industrial houses, GIDC has hiked the price of land at the Sanand industrial estate to Rs 3,225 per sq mt (around Rs 1.3 crore per acre), making it one of the most expensive industrial estates in the state. Private land at Sanand is up for sale at Rs 3 crore (Rs 30 million) for an acre now.

Hansalpur is also on the road to similar prosperity after Maruti announced its project in the area. Locals there are waiting for good fortune to knock on their doors, as land prices in the vicinity of the upcoming Maruti plant have shot up to Rs 3 crore an acre now, from Rs 2 lakh per acre four-five years ago.

...

In the fast lane: Gujarat's new growth story

Photographs: Reuters

So, is land availability going to be a challenge in the coming years? Senior state government officials don't think so. "For big-ticket manufacturing projects, land cost is around 5-6 per cent of total project cost. Even if land prices are higher by 15-20 per cent, cost of land as a proportion of net project cost would rise marginally. In contrast, if corporates are offered ready-to-occupy land, they would not mind paying a slight premium," said one.

The challenge in the coming years, they think, would be to maintain a 'green' environment, since more industries in the state will mean more pressure on the environment.

...

In the fast lane: Gujarat's new growth story

Image: The cargo port at Dahej in Gujarat.Photographs: Reuters

Creating infrastructure for growth

In a bid to develop world-class economic hubs in Gujarat, the state government has set its focus on infrastructure development, and is developing additional port capacities for marine trade, special investment regions (SIRs) and manufacturing as well as logistics parks and services.

With a coastline of over 1,600 km -- longest among all states in the country -- Gujarat has over 40 non-major ports adding to the economic prosperity of the state. According to a report of the Union ministry of road transport and highways -- An Update on Indian Port Sector -- Gujarat accounted for 73.7 per cent (or 259 million tonnes) of the 351.5 million tonnes of traffic handled by non-major ports in India in 2011-12.

The Gujarat Maritime Board (GMB), which monitors non-major ports, aims to more than double cargo handling capacities over the next three to four years. It is expected that after the doubling of cargo handling capacity, Gujarat will be able to handle more than 40 per cent of the country's cargo traffic.

...

In the fast lane: Gujarat's new growth story

Image: A crane unloads coal from a ship at the Adani Cargo Port at Dahej in Gujarat.Photographs: Amit Dave/Reuters

"By 2015-16, GMB ports will have traffic handling capacity of more than 500 million tonnes per annum, and will cross 1,000 MTPA by 2020," GMB Chairman Pankaj Kumar said. Private port operators including Adani, Essar and APM Terminals Pipavav have a combined installed capacity of over 100 MTPA.

At least eight greenfield ports (private and GMB ports) are being planned along the state coastline, while 'port-cities' will come up at Mundra and Pipavav ports. For dry ports and multi-modal logistics parks, government has identified five locations.

Also, Gujarat is the only state in India to have two liquefied natural gas (LNG) terminals -- at Hazira (Shell India, Total) and Dahej (Petronet LNG). One more LNG terminal is at the planning stage at Mundra (jointly by Adani Group and state-owned GSPC Gas Company Ltd).

...

In the fast lane: Gujarat's new growth story

Image: LNG terminals have improved the availability of imported gas for industries not only in Gujarat but nationally.Photographs: Reuters

LNG terminals have improved the availability of imported gas for industries not only in Gujarat but nationally. The state government-owned GSPC has implemented city gas distribution (CGD) networks at about 190 locations, including cities, towns and villages. This network supplies 4 million metric standard cubic meters per day (MMSCMD) of gas to over 300,965 households, 120 CNG stations, 1,068 commercial and 1,443 industrial consumers in the state.

The gas distribution business has also attracted private sector players like Adani Gas and Gujarat Gas Company Limited. Interestingly, Gujarat is the first state in India to attempt a cooperative model for CGD. Anand-based Charotar Gas Sahakari Mandali Ltd is a cooperative gas distribution company, whose annual revenues of over Rs 81 crore (Rs 810 million) come from selling gas to more than 15,000 domestic, 445 commercial, 130 industrial customers and educational institutes.

"Gujarat's growth is quite impressive. The first level of basic development has already been achieved. Now the aim should be the second level of development, where it competes with international companies. The challenge is to provide a higher quality of life encompassing all aspects of infrastructure in Gujarat," said R K Jha, director, Gujarat International Financial Tech-City -- an ambitious project of the Gujarat government to attract IT and financial services firms.

...

In the fast lane: Gujarat's new growth story

Image: Central government plans to develop a Dedicated Freight Corridor (DFC) between Dadri (in Haryana) and JNPT Mumbai, of which 38 per cent part passes through Gujarat.Photographs: Reuters

In order to strengthen its presence in the IT and financial services space, the state aims to set up a multi-services special economic zone (SEZ) under GIFT City near Gandhinagar. GIFT is targeting a 6-8 per cent share of the financial services potential in India and plans to create about 500,000 direct jobs and an equal number of indirect jobs.

Further, the Central government plans to develop a Dedicated Freight Corridor (DFC) between Dadri (in Haryana) and JNPT Mumbai, of which 38 per cent part passes through Gujarat. Also, 150 km of the area along the DFC will be developed as the Delhi Mumbai Industrial Corridor (DMIC).

Along the DMIC, the state government has planned five special investment regions (SIRs) to attract large-sized investments. The Gujarat Special Investment Regions Act 2009 was enacted to make these SIRs global industrial hubs with superior infrastructure. So far, five SIRs have been notified on a combined area of over 1,800 sq km.

...

In the fast lane: Gujarat's new growth story

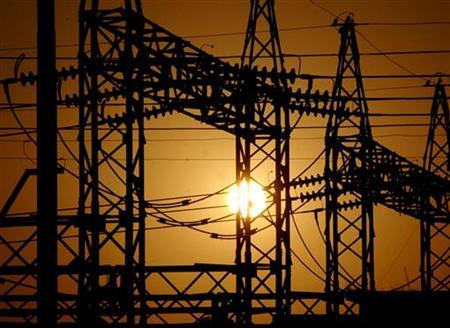

Image: Gujarat is the largest power generating state in the country.Photographs: Jitendra Prakash/Reuters

Gujarat's power-packed performance

A few weeks ago, the whole of northern India was engulfed in darkness for two consecutive days, as some power-deficit states overdrew power, triggering a grid failure. Gujarat, in stark contrast, is a power-surplus state that sold 5,105 million units of surplus power to states such as Rajasthan, Haryana, Punjab, Delhi and Maharashtra — at rates varying between Rs 7.70 and Rs 9.52 per unit.

With installed generation capacity of over 18,900 Mw from thermal sources alone, Gujarat is the largest power generating state in the country. And, it aims to add 10,000 Mw in the next five years, to touch the 30,000 Mw generation capacity mark by 2017.

Uninterrupted power supply is one of the major reasons why investors are flocking to Gujarat. However, the scenario was quite different over a decade ago — in early 2000, power shortage was a key concern. Electricity supply for agriculture, industry and domestic consumption posed a major challenge in the context of the need for faster growth.

The turnaround was a result of the state's power sector reforms, which involved corporatisation and unbundling of the generation, transmission and distribution activities of the state power utility. The reforms helped persuade a large number of private investors to set up power plants in the state.

...

In the fast lane: Gujarat's new growth story

Image: According to CEA data, as on July 31, 2012, installed thermal power capacity in Gujarat was 18,962 Mw.Photographs: Amit Dave/Reuters

Early this year, the chief minister, Narendra Modi, had expressed satisfaction over the state's performance in power generation over the past decade. "In 2001, Gujarat faced a power shortage to the tune of 2,000 Mw. The country, as a whole, continues to face a similar situation even now. But Gujarat has become a power-surplus state with generation of 4,000 Mw of surplus power. And it will generate 7,000 Mw of surplus power by the end of 2012," Modi had said at a public function in January this year.

According to Central Electricity Authority (CEA) data, as on July 31, 2012, installed thermal power capacity in Gujarat was 18,962 Mw, which includes coal, gas and diesel. Of this, state utilities control 5,481 Mw, while the share of the private sector is 10,648 Mw and Central sector utilities control 2,833 Mw.

"We have surplus power but other states do not have sufficient power to meet their demand, nor do they have money to buy it from others. The situation is so bad that we are closing down our plants because of non-purchase of power by different states," Saurabh Patel, Gujarat's minister of state (energy), said at the Business Standard Round Table Conference in Ahmedabad.

...

In the fast lane: Gujarat's new growth story

Photographs: Parivartan Sharma/Reuters

Gujarat has surplus power — its total electricity generation in 2010-11 was 71,256 million units (MUs) while consumption was 58,670 MUs. Industry accounted for close to 40 per cent of total electricity consumption, agriculture 22.65 per cent, domestic users 16 per cent, other users 10 per cent and commercial users 7.52 per cent.

The state, with gross state domestic product (GSDP) growth of 10.5 per cent (2010-11), has higher per capita consumption of electricity at 1,486 kilowatt hours or units (2007-08) against the national average of 717 units. By 2010-11 the state's per capita consumption had increased to 1,512 units.

Conducive policies, good infrastructure and encouragement to corporatisation of the power sector combined to draw many private players into the power business in Gujarat. The Kutch region is slowly emerging as a power hub, with leading private players lining up projects here. Companies such as Tata Power (4,000 Mw), Adani Power Ltd (4,620 Mw) and OPG Power (300 Mw) are setting up generating stations near Mundra. The Adani Group wants to increase capacity from 4,660 Mw in 2012 to 10,000 Mw by the end of 2013.

Videocon Industries (through its subsidiary, Pipavav Energy) is setting up a 1,200 Mw project near Pipavav port that will use imported coal as fuel. Gujarat Power Corporation Ltd is to set up a 1,000 Mw coal-based power plant jointly with Torrent Power at Pipavav, and a gas-based 700 Mw plant at Kovaya in Amreli district in association with GSPC Pipavav Power company Ltd.

...

In the fast lane: Gujarat's new growth story

Photographs: Reuters

Among Gujarat's other leading thermal power producers are Essar Group's Essar Power Limited (about 1,200 Mw) and Torrent Power Ltd (around 1,647 Mw).

"By 2017 we expect a big jump and are likely to touch a capacity of 30,000 Mw. The figure one might think is very high, but it is a fact, as most of the power plants have started work. This is going to be the most important strength of Gujarat in the years to come," said Patel.

As fuel supply issues continue to haunt power companies, especially coal-based units, Gujarat's focus on renewable energy has brought some relief to companies and consumers. Gujarat was the first state to announce a dedicated Solar Power Policy in January 2009.

The initiative proved successful, as more than 80 companies signed memorandums of understanding (MoUs) for the generation of 968.5 Mw grid-connected power by December 2011. As on June 30, 2012, 689.81 Mw of solar photo-voltaic projects have been commissioned in Gujarat, while 2,934.305 Mw of wind power capacity has been set up along the coast of Saurashtra and Kutch.

The Sardar Sarovar Project on the Narmada river in south Gujarat adds to the state's renewable energy capacity. The project has an installed hydro-electric capacity of 1,450 Mw. Besides, hydro-electric power capacity has also been set up at Ukai Dam (305 Mw) and Kadana Dam (240 Mw), both in south Gujarat.

Initiatives like solar roof-top generation and canal-top power projects are examples of Gujarat's innovative ways of encouraging participation from investors and the public in power generation.

The state is now looking to rope in investments worth Rs 65,000 crore (Rs 650 billion) towards new capacity addition in the renewable energy sector over the next three to four years. This will include wind energy (4,000 Mw), biomass energy (1,000 Mw) and solar energy (716 Mw). Gujarat, which has remained at the forefront of power generation, appears likely to continue maintaining its numero-uno position among Indian states as the years go by.

...

In the fast lane: Gujarat's new growth story

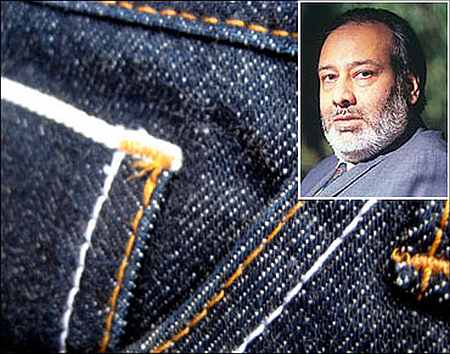

Image: Sanjay Lalbhai, CMD Arvind Ltd (inset)They played an important role in shaping Gujarat's economy:

King of branded apparel: Sanjay Lalbhai, CMD Arvind Ltd

From being known as the denim king to reinventing his company as one of the foremost apparel retailers in the country, Sanjay Lalbhai (the pioneer of denim manufacturing in India and Chairman and Managing Director of Arvind Ltd, has come a long way. Led by Lalbhai, Arvind Ltd — the flagship company of the $1.2 billion Lalbhai Group -- has reinvented itself from a traditional ethnic fabric manufacturer to a dynamic company that professionalised its management and is now a force to reckon with in apparel brands and retail.

At the same time, Arvind has also now become one of the largest denim manufacturers in the world. Arvind has since become one of India's largest manufacturers of other woven fabrics as well, vertically integrated into garment manufacturing, and built one of India's most impressive apparel brand portfolios.

Lalbhai, who holds a bachelors degree in science from Gujarat University and a masters degree in management from the Jamnalal Bajaj Institute of Management Studies, Mumbai, displayed vision, innovation and courage in the late 1980s and early 1990s, when fierce competition was taking a toll on Arvind Mills. Lalbhai withdrew from the market all 250 products that the company was manufacturing -- from handkerchiefs to saris -- and focused exclusively on denim by modernising its factories.

Later, many of Arvind's pioneering achievements in the apparel brands and retail space were accomplished under Lalbhai's guidance — be it the acquisition of India's first denim brand Flying Machine in 1981 or the penetration of denim to the hinterland of India through the introduction of the Ruf'n'Tuf brand. Lalbhai was also instrumental in introducing India's first international apparel brand (Arrow, 1993) and India's first factory outlet (Megamart, 1995).

Today, Sanjay Lalbhai is working on creating the future growth engines for Arvind and setting it on its path to achieving the goal of being a $2 billion company in sales revenue by 2015.

...

In the fast lane: Gujarat's new growth story

Image: Lalbhai is also a member of the board of governors of the Indian Institute of Management, Ahmedabad (IIM-A).Photographs: Courtesy, IIM-A

Even on the social front, he is actively involved in shaping Arvind's engagement with society at large. Two such initiatives have flourished under his supervision. The first involves Arvind working with over 7,000 farmers to grow sustainable cotton across 60,000 acres of impoverished areas in Gujarat and Maharashtra. Through this project Arvind, one of the large buyers of cotton in India, is attempting to build a business model that integrates socio-economic benefits to farmers, a greener textile supply chain and financial benefits to industry.

The second initiative involves Arvind working with the municipal school system of Ahmedabad to build an education intervention model that helps impoverished students progress through the system and access opportunities for employment. Currently, this project benefits about 1,000 students each year.

Sanjay Lalbhai currently holds several positions of responsibility beyond Arvind. He serves on the board of Torrent Pharma — one of India's top 10 pharmaceuticals companies. He also serves on the board of several premier educational and research institutes. As the president of the Ahmedabad Education Society (AES) and Ahmedabad University, Lalbhai has been involved in bringing in world-class education and incubation facilities for these institutes. Lalbhai is also a member of the board of governors of the Indian Institute of Management, Ahmedabad (IIM-A).

He is the chairman of the Ahmedabad Textile Industry's Research Association and a member of the Council of Management of the Physical Research Laboratory. He is also Chairman of CEPT University, and a member on the governing body of the Adani Institute of Infrastructure Management.

Sanjay Lalbhai is married and has two sons.

...

In the fast lane: Gujarat's new growth story

Image: Pankaj Patel, CMD, Cadila Healthcare Ltd (inset)Photographs: Reuters

Seasoned deal-maker: Pankaj Patel, CMD, Cadila Healthcare Ltd

Making smart moves is par for the course for Pankaj Patel, Chairman and Managing director, Cadila Healthcare Ltd. By making strategic acquisitions and alliances, Patel, a second generation entrepreneur, has propelled a Rs 250 crore (Rs 2.5 billion) company into an empire with annual revenues of more than Rs 5,200 crore (Rs 52 billion) -- and, that too, in a period of less than two decades.

Patel, who has a master's degree in pharmacy, has been the guiding force behind Cadila Healthcare's (Zydus Cadila's) fast-paced growth, making it one of the top ten companies in the pharmaceuticals space in India, with a market capitalisation exceeding Rs 18,000 crore (Rs 180 billion) as on August 2012. He is hailed as a dynamic and far-sighted business leader who has taken smart decisions like de-risking the group's core pharma business through diversification into consumer products through its subsidiary, Zydus Wellness.

Brands like EverYuth, Sugarfree, Nutralite and the newly launched adult health-drink brand Actilife are household names. With a strong presence in the regulated markets of the US, Europe (France and Spain), Japan and growing markets of Latin America and South Africa, the company has also tapped 25 other emerging markets worldwide.

It all started in 1995 when the original Cadila, founded by Pankaj Patel's father Ramanbhai Patel and Indravadan Modi in 1952, was restructured into two separate entities and Cadila Healthcare came into existence. Under the stewardship of Patel, Cadila Healthcare has made over a dozen acquisitions over the past decade.

...

In the fast lane: Gujarat's new growth story

Photographs: Reuters

The group's first acquisition -- in 1995 -- was a 56-year-old company, Indo Pharma Pharmaceutical Works Ltd. This was followed by a slew of acquisitions by the ace dealmaker; including Recon Healthcare (2000); German Remedies (2001); Banyan Chemicals (2002); Alpharma France SAS (2003); Carnation Nutra-Analogue Foods Ltd, which makes Nutralite (2006); and Liva Healthcare (2007). Then came Nippon Universal Pharmaceuticals of Japan, Quimica e Farmaceutica Nikkho do Brasil Ltda (Nikkho), Sarabhai Zydus Animal Health Ltd in 2007 and Laboratorios Combix, Spain, Simayla Pharmaceuticals of South Africa and Etna Biotech of Italy in 2008 and 2009.

Patel was early to spot the opportunities in a fast globalising world, and had spread wings overseas to make Zydus a formidable global player. After touching the billion dollar mark (consolidated revenues over Rs 5200 crore [Rs 52 billion] in 2011-12), Patel now aims to make Zydus a $3 billion (Rs 16,719 crore [Rs 167.19 billion]) company by 2015, and a global research driven company by 2020. "Our focus has always been on delivering robust, consistent growth and on exploring how we can do things differently. The next leap forward, 'Beyond the Billion', will be to achieve sales of $3bn by 2015," he says.

A seasoned dealmaker, Patel has leveraged his business acumen to take his business to new heights. Zydus Cadila strengthened its presence in the domestic formulations market through its acquisition of Biochem Pharma in December 2011. The 50:50 joint venture with Germany's Bayer Healthcare, formed in January 2011 and operating in key segments, including women's healthcare and anti-diabetic treatments, is expected to boost Zydus' topline significantly.

Patel's decision to acquire US-based Nesher Pharmaceuticals in June 2011 will help the company make a fast re-entry into the US markets possible, as the USFDA has revoked the warning letter issued to the company's Moraiya plant. Zydus will be able to market injectables and nasal products made at this facility from the Nesher stable in the US.

Once again exhibiting his golden touch, Patel acquired Germany's Bremer Pharma in July 2011 to strengthen the group's animal health portfolio. His strategic decision soon showed results, as the company's animal health business posted 38 per cent revenue growth in 2011-12.

With his eyes focused firmly on the future, Pankaj Patel says, "The thrust will be on value-added products based on innovations, niche technology platforms like vaccines, biosimilars, inhalables, injectables and transdermals, and also on products which are complex to produce."

article