Photographs: Yuri Gripas/Reuters

Expressing unhappiness over the contraction in industrial output numbers, Finance Minister Pranab Mukherjee said on Friday slowdown in global demand and investment activity has impacted IIP.

"The IIP figures are disappointing. . . Continued weak global business sentiments are also adversely impacting recovery in domestic private investment," Mukherjee told reporters in New Delhi.

Factory output, as measured by the Index of Industrial Production, contracted in March to a five-year low of 3.5 per cent.

. . .

IIP disappointing, weak sentiments hinder recovery: FM

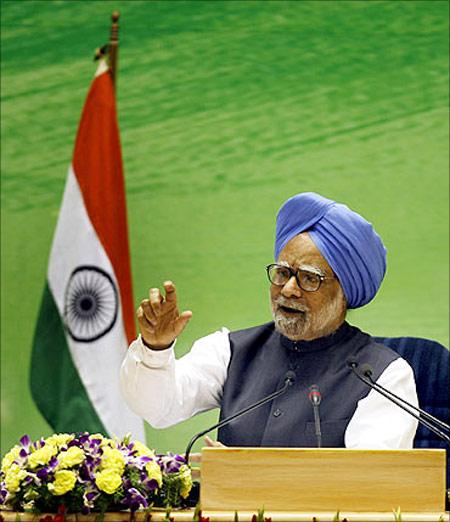

Image: Prime Minister Manmohan Singh.Photographs: Reuters

The IIP growth was higher at 9.4 per cent in March last year.

"Domestic investment recovery remains frail. . . .Though RBI's monetary stance has been reversed in last policy announcement, it will take some more time for interest costs to come down," Mukherjee said.

On an annual basis, the IIP grew by a meagre 2.8 per cent, as against 8.2 per cent in the 2010-11 fiscal.

Saying that the revival of manufacturing output in the January-March quarter was not on expected lines, Mukherjee said part of the dip in March IIP numbers is due to base factor.

. . .

IIP disappointing, weak sentiments hinder recovery: FM

Photographs: Reuters

Expressing 'deep concern' over the IIP numbers, Commerce and Industry Minister Anand Sharma said that he would be meeting the exporters this month to analyse the impact of slowdown in global demand.

As per the official data, output of the manufacturing sector, which constitutes over 75 per cent of the index, contracted by 4.4 per cent in March, compared to growth of 11 per cent in March 2011.

Output in the capital goods sector contracted by 21.3 per cent as against a growth of 14.5 per cent in the same month last year.

Mining output too fell by 1.3 per cent in March, from a growth of 0.4 per cent in the same month a year ago.

. . .

IIP disappointing, weak sentiments hinder recovery: FM

Photographs: Reuters

The dismal IIP numbers will put pressure on the Reserve Bank of India to further ease its monetary policy measures to pep up demand and investment activity, experts said.

The RBI had last month cut the benchmark interest rate for first time in three years by 0.5 per cent to provide relief to borrowers and revive sagging economic growth.

Sharma also urged RBI to ensure 'credit at affordable rates for domestic industry and dollar credit for exporters".

He said after discussion with the exporters, 'the government would intervene in the sectors which require support'.

A weak global economy, especially US and UK, is dampening export demand. Besides, a tight money policy by RBI to control inflation is hindering fresh investments.

In terms of industries, 10 out of 22 industry groups in the manufacturing sector have shown positive growth during March as compared to the same month a year-ago.

. . .

IIP disappointing, weak sentiments hinder recovery: FM

Image: Montek Singh Ahluwalia.Photographs: Reuters

No case for stimulus, focus on project execution: Montek

Disappointed over poor performance of industrial production, Planning Commission Deputy Chairman Montek Singh Ahluwalia today said solution lies in demand generation through effective project execution and not by a stimulus.

"IIP numbers are disappointing. . . I don't think, the solution is stimulus. In my view, there are a lot of these things to do with project implementation. That is not the result of stimulus," Ahluwalia said when asked whether there is any case for a fiscal package for the industry.

The factory output measured in term of Index of Industrial Production, declined by 3.5 per cent in March, 2012, against an impressive growth of 9.4 per cent a year ago.

The IIP growth for the entire 2011-12 too was very low at 2.8 per cent as compared to 8.2 per cent in the previous

fiscal.

On the Eurozone crisis effects, he said, "I don't think that you can link that to negative IIP.

"It is clearly an important factor which is depressing investment sentiment."

Ahluwalia stressed on the need for a lot of measures at domestic front for removing supply side bottlenecks to revive the economy.

"I think for most of the revival, we have to focus on things that we need to do domestically to remove supply side problems.

IIP numbers. . . point to urgency of trying to do more to get the economy back on track," he added.

article