Photographs: Reuters. Devangshu Datta

Even a marginal hike in global demand for petroleum could trigger price jumps and impact the Indian economy.

Cartels are similar to monopolies - they fix prices and control supplies. Like monopolies, cartels end up making markets uncompetitive and lead to inefficiency and lack of innovation.

Most governments frown on private sector cartelisation while cheerfully indulging themselves in both monopolies and cartels.

...

If oil demand rises, India to be hit hard

Image: Oil worker Hesbert Moreno analizes a sample of recent extract crude.Photographs: Reuters.

The 12 OPEC nations own about two-thirds of proven reserves and contribute about 35 per cent of global production.

OPEC first flexed its muscles as a punitive measure in 1973 when the Arab states embargoed nations that supported Israel during the 1973 Yom Kippur War.

If oil demand rises, India to be hit hard

Image: A member of Iran's Basij militia holds a gun with a rose on its muzzle during a parade in Tehran.Photographs: Morteza Nikoubazl/Reuters.

In the 1980s, OPEC's unity broke down due to the Iran-Iraq war when both nations flooded the markets.

The 1991 invasion of Kuwait also led to a price spike. But after Kuwait was liberated, prices dropped. Prices remained low through the 1990s when supplies from the former USSR also became easily available.

...

If oil demand rises, India to be hit hard

Image: US soldiers in Iraq.At the same time, strong global growth led to rising demand for crude oil between 2004-2007. In 2007 and 2008, prices hit record levels. In 2008 and 2009, recession outpaced production cuts and prices slid from $140/ barrel to below $40.

In 2010, prices have risen as the global economy recovers. Nymex crude is at two-year highs at about $87 range.

...

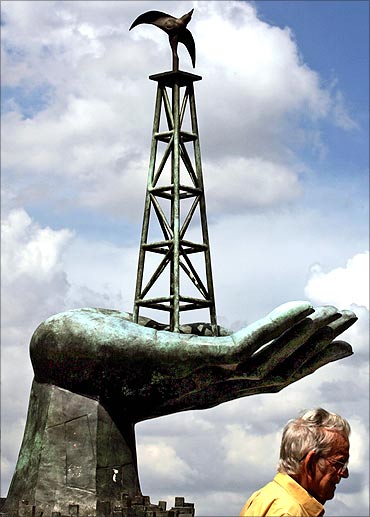

If oil demand rises, India to be hit hard

Image: An oil rig.It concurs with other forecasters (like the International Monetary Fund) in saying the rebound through 2010 and 2011 will be stronger than initial estimates.

In 2010, OPEC estimates consumption has grown by 1.3 million barrels per day (bpd), which is around 190,000 bpd more than earlier estimates, to 85.7 million bpd.

In 2011, consumption is expected to grow by 1.2 million bpd over 2010 (310,000 bpd above earlier estimates) to 86.9 million bpd....

If oil demand rises, India to be hit hard

Image: Consumption-demand can trigger big price jumps.Previous OPEC projections have sometimes been wrong by substantial amounts. The 2011 price estimates could also be off the mark. Global GDP may not grow as strongly as expected (leading to lower prices).

OPEC members have ignored production quotas before and may do so again. The $ could also swing either way, making dollar-denominated prices misleading. Speculators who have been hoarding may release supplies.

...

If oil demand rises, India to be hit hard

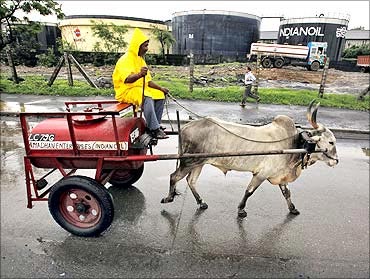

Image: A worker transporting kerosene in a bullock cart travels past Indian Oil Corporation's fuel depot.Photographs: Danish Siddiqui/Reuters.

Even for domestic production, it pays prices benchmarked to international rates for newer gas fields. Alternatives like natural gas and coal also have strong correlations to crude oil and prices usually rise in tandem with petroleum.

This should, under normal circumstances, mean super-normal gains for producers like Reliance, ONGC, Cairn, OIL and others.

It would also mean further pressure on PSU marketing-refining outfits such as IOC, HPCL and BPCL.

...

If oil demand rises, India to be hit hard

Image: Air India.Photographs: Reuters.

The other thing is, energy prices impact the rest of the economy. The most obvious reactions are in transport and power. Automobiles for instance, tend to sell more when petrol prices are relatively lower.

Fuel costs account for maybe 35-40 per cent of Indian aviation expenses so that industry is liable to struggle if there's a price hike.

On the other hand, there tends to be a surge in renewable energy projects because wind for example, becomes more competitive.

...

If oil demand rises, India to be hit hard

Image: An oil rig.However, a sudden jump, could cause a shock that leads to a growth hiatus.

In a free market, sudden price hikes would be unlikely because supply would expand organically to meet demand. This is where one hopes OPEC gets its quotas right.

article