Often called Canada's version of Warren Buffet, Watsa preaches a long view that suggests it may be too early to assess his decision to take on a leading 10 per cent stake in BlackBerry.

Just over a year ago, Prem Watsa said Research in Motion Ltd, now re-named BlackBerry, was a "Canadian success story," a good buy and a likely turnaround story, despite declining market share.

BlackBerry's fortunes have only deteriorated since then, but Watsa, chief executive of top BlackBerry shareholder Fairfax Financial, is an old hand at looking wrong today and right tomorrow.

Fairfax, both an insurance holding company and Watsa's investment vehicle, was on the losing end of bets against the market in the mid 2000s as Watsa waited for the US mortgage industry to collapse.

…

Hyderabad-born Prem Watsa may bid for BlackBerry

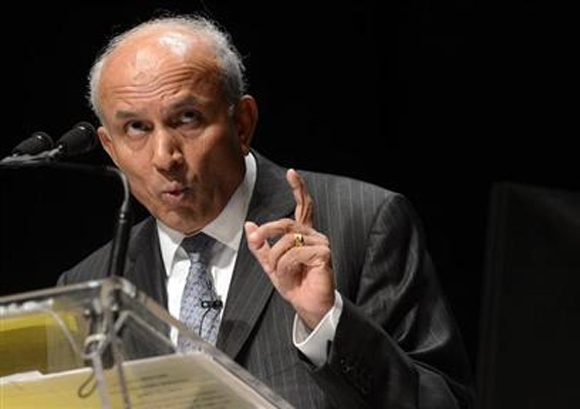

Image: Fairfax Financial Holdings Ltd. Chairman and Chief Executive Officer Prem Watsa gestures while speaking during the company's annual meeting in TorontoPhotographs: Aaron Harris/Reuters

The company's stock fell by 50 per cent between mid-2003 and mid-2006 as Watsa's purchases of credit default swaps flattened profits, while rivals feasted on a housing-fed bull market.

But when the market began to weaken in 2007, Fairfax began notching up investment gains, pulling in billion-dollar profits in 2007 and 2008. Then with markets still reeling and other investors licking their wounds, Watsa started to plow money back into equities, bringing another strong year in 2009.

Since their 2006 low of C$100, Fairfax's shares have more than quadrupled, and the stock is up 100-fold over 28 years.

Indeed, Watsa had already shown his investment chops by selling stock ahead of the 1987 stock market crash and buying Japanese puts - or rights to sell stocks at guaranteed prices - ahead of the Tokyo market's collapse in 1990.

…

Hyderabad-born Prem Watsa may bid for BlackBerry

Image: Prem WatsaPhotographs: Aaron Harris/Reuters.

Canada's Buffet?

Often called Canada's version of Warren Buffet, Watsa preaches a long view that suggests it may be too early to assess his decision to take on a leading 10 per cent stake in BlackBerry.

As it sits now, BlackBerry has not been a turnaround story under Watsa's watch. Since January 2012, a period when Fairfax has raised its stake in the company from just over 2 per cent to just under 10 per cent, BlackBerry's share price is down about 25 percent.

"Prem invests for the long term," said Paul Holden, an analyst at CIBC World Markets who follows Fairfax. "He's held his major stake now for what I would say is a fairly short period of time relative to his investment horizon, so I would say it's probably too early to put any score on that investment."

…

Hyderabad-born Prem Watsa may bid for BlackBerry

Image: Blackberry Headquarters.Photographs: Reuters

Watsa stepped down from the BlackBerry board on Monday, citing a potential conflict of interest, as the company said it was exploring the sale of itself and other options.

Holden said Fairfax, with a market capitalization of C$8.7 billion, would be too small to purchase BlackBerry outright. The smartphone maker has a market capitalization of C$5.8 billion.

But others said the signs that Watsa could be working behind the scenes were a positive.

"We have a lot of respect for the investment acumen and long-term track record Prem Watsa has established at Fairfax," said Todd Johnson, a portfolio manager at Winnipeg-based BCV Financial, which owns Fairfax debt.

"Hearing the announcement from BlackBerry accompanied by Prem's departure from the board should indicate something will happen this time on the strategic front."

…

Hyderabad-born Prem Watsa may bid for BlackBerry

Image: Prem WatsaPhotographs: Reuters.

Low Profile

Watsa, who was born in 1950 in Hyderabad, India, and trained as a chemical engineer, has a public profile that has at times bordered on the reclusive since he took over Fairfax in 1985.

For his first 15 years at the company, he barely spoke to a reporter, and he only started holding investor conference calls in 2001.

Fairfax has generally not been known as an activist investor, but Watsa has not shied away from a fight, launching a $6 billion lawsuit against a group of hedge funds in 2006, accusing them of conspiring to the drive the company's shares down so they could be shorted.

…

Hyderabad-born Prem Watsa may bid for BlackBerry

Image: People view the new Blackberry Z10 device at a Rogers store in Toronto.Photographs: Mark Blinch/Reuters

A short position enables an investor to profit when a stock drops.

To be sure, not all Watsa's moves have been golden. Fairfax had to write off most its investment in Winnipeg-based media company Canwest in 2009 as the company filed for bankruptcy protection.

It also wrote down a significant investment in publisher Torstar in 2008-09 and took losses on its holding of forestry company Abitibi Bowater.

Speaking last year, Watsa suggested investors looking for a short-term rebound in BlackBerry might be disappointed.

"Is it going to turn around in three months, six months, nine months? No," he told reporters. "But if you're looking four, five years ... We make investments over four or five years."

article