Devangshu Datta in New Delhi

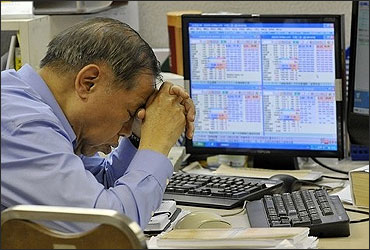

Bear markets are often shorter in duration than bull markets but they can have a devastating impact.

Sometimes, bear markets can also last several years -- 2000-2004 was one example.

When most stocks are dropping, a long-only trader needs to be very good or very lucky to keep finding the few stocks that are moving up.

Most traders are long-only by inclination. They usually shut down during sustained bear markets.

Most investors tend to panic and sell out close to the bottom.

The only way to trade profitably while prices are going south is to sell short.

Click on NEXT for more...

How to make profits in a bear market

Very few traders bother to learn how to short-sell systematically. Yet, it makes a big difference in the long run to your returns.

There are all sorts of caveats in borrowing shares - it also adds a component of interest cost.

It is, frankly, not worth borrowing shares. A retail short seller can in practice, do one of two things.

He can restrict himself to cash day-trades, closing out shorts before session-end. Or, he can sell futures, staying in the universe of F&O counters.

Click on NEXT for more...

How to make profits in a bear market

Either method of shorting means a good understanding of leverage and margin.

Losses or gains are magnified by big multiples (roughly 10 times in futures) and you must have the margin situation at your fingertips.

An advantage to shorting cash is that you can sell very small positions, whereas futures have minimum lot sizes.

However, the time element makes futures more efficient, since you can hold a series until settlement or roll-over.

Click on NEXT for more...

How to make profits in a bear market

Aspiring short sellers should limit themselves to the 10-20 most liquid counters in which they can afford to take positions.

They must set very clear limits to minimise losses. This means careful calculation of position size.

Things fall into place if you start by setting 'pain limits'.

Say, you are prepared to lose 30 per cent of your capital - then, your pain limit is 30 per cent. If you're operating a maximum of five positions, your pain limit per position is 6 per cent of your total capital.

Click on NEXT for more...

How to make profits in a bear market

Given your knowledge of futures lots, margins, and leverage ratios, that six per cent pain limit automatically translates into restrictions on the counters you can afford to trade.

Again, work backwards and set stop-losses according to that six per cent pain limit.

If your stop is hit, exit without exception. If your short gains, adjust the stop loss down to ensure a lock-in of some profit.

There are no guarantees. But if you manage your cash well and stick to the odds, there's every hope of making profits in any trending market.

And, sticking with the odds means being prepared to go short in a bear market.

The author is a technical and equity analyst

article