Photographs: Fayaz Kabli/Reuters

The rupee dived to a record low of 61.21 against the dollar on Monday after better-than-expected US jobs data raised concerns about the US Fed easing its stimulus programme but the currency regained some lost ground to close at 60.61 after the RBI intervened.

The rupee opened at 60.95 a dollar compared with Friday's close of 60.22 and dipped to 61.21, past its previous all-time low of 60.76 on June 26. Local shares were sluggish amid sustained dollar demand from importers, mainly oil refiners.

The rupee bounced back after the Reserve Bank of India (RBI) intervened through public sector banks, reaching a high of 60.58 before settling at 60.61, still a fall of 39 paise, or 0.65 per cent, the second straight day of losses.

"After US non-farm payrolls data, rupee was expected to open with steep losses. However, RBI was seen selling dollars which helped the local currency recover," said the forex head of a leading private bank.

…

Rupee drops to record low of 61.21, recovers

Photographs: Reuters

A falling rupee has a cascading effect on inflation as imports like oil become costlier, widens the current account deficit (CAD) and increases the risk of capital outflows.

"Expect spot rupee to trade over 62 levels in coming days," said Pramit Brahmbhatt, CEO, Alpari Financial Services. The benchmark S&P BSE Sensex on Monday fell 171.05 points, or 0.88 per cent, while FIIs sold shares worth Rs 204.46 crore, as per provisional data with the BSE.

The dollar index, which was trading at a nearly three-year high, was down by 0.09 per cent against a basket of six major currencies.

"The US dollar index was trading at its three-year high and the euro was sustaining near $1.2850 levels, which was making a strong case for the rupee weakness," said Abhishek Goenka, Founder & CEO of India Forex Advisors.

On Friday night, data showed that US non-farm payrolls for June saw an addition of better-than-expected 195,000 jobs. This fuelled speculation that Fed will announce tapering of its stimulus as early as July, said traders.

…

Rupee drops to record low of 61.21, recovers

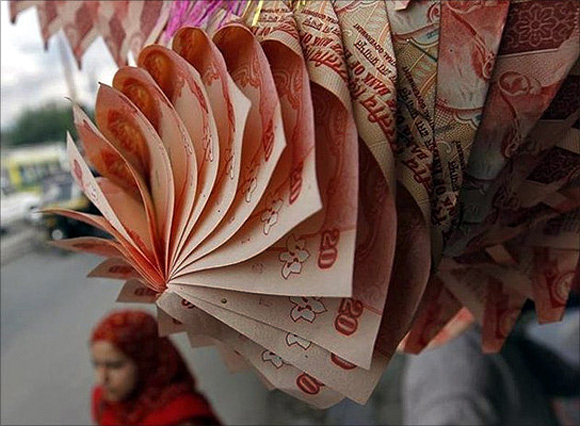

Image: A Kashmiri woman walks under a garland made of rupee notes on display at a market in Srinagar.Photographs: Fayaz Kabli/Reuters

Rupee has depreciated over 13.50 per cent in past nine weeks. "The current account deficit and the strengthening dollar has been eroding the value of the rupee over the past few months," said Sandesh Kirkire, CEO of Kotak Mutual Fund. "This had increased the currency risk for unhedged FII investments, necessitating liquidation and delay of investments to protect value in dollar terms."

Meanwhile, the premium for forward dollars remained weak on continued receipts by exporters.

The benchmark six-month forward dollar premium payable in December eased to 169-1/2-171-1/2 paise from last Friday's close of 171-172-1/2 paise.

Far-forward contracts maturing in June also moved down to 346-348 paise from 348-350 paise. RBI fixed the reference rate for the US dollar at 61.0455 and for the euro at 78.2746.

The rupee fell back against the pound sterling to 90.31 from last close of 90.18 and turned negative to end at 77.82 per euro from 77.56.

However, it improved further against the Japanese yen to 59.90 per 100 yen from previous close of 60.21.

article