Photographs: Reuters

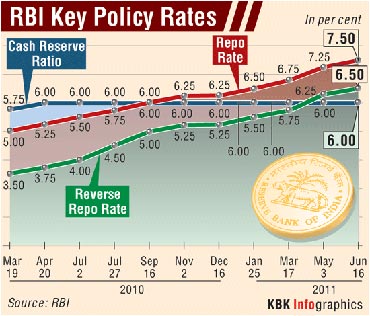

Be prepared to pay more every month on your home, auto and other loans, as the Reserve Bank on Thursday, for the 10th time since March, 2010, raised key interest rates by 25 basis points in its effort to control spiralling inflation.

While the short-term lending (repo) rate has been raised to 7.5 per cent, the borrowing rate has been hiked to 6.5 per cent.

Bankers said the move would put pressure on interest rates and may make loans costlier subsequently.

"It (RBI's move) will put pressure on short-term deposit rates and subsequently on the lending rates. But rate hike by banks would not be immediate," Indian Overseas Bank CMD M Narendra told PTI.

Subsequently, the marginal standing facility (MSF) has also gone up by 25 basis points to 8.50 per cent.

Other rates and ratios have been kept unchanged. The policy initiative, the RBI said, "is expected to contain inflation and anchor inflationary expectations by reining in demand side pressures."

Inflation stood at over 9 per cent in May, much above the central bank's comfort level of 5-6 per cent. The measures, the RBI said, would also help in mitigating the impact of "potentially adverse global developments."

Here's how the new rates will impact you...

RBI hikes rates: Home, auto loans to be costlier

Consumer and commercial loans are set to become costlier with the Reserve Bank hiking key short-term rates.

Since the Reserve Bank' Annual Policy Statement of May 3, the global environment has changed for the worse, while domestic conditions are broadly consistent with the Statement's projections, the Reserve Bank said.

Growth expectations in advanced economies are visibly moderating, even as inflationary pressures, primarily from commodity prices, have increased.

The capacity for conventional policy responses appears limited, with many countries having already committed to fiscal consolidation amidst growing sovereign debt risks.

From our monetary policy perspective, global commodity prices still remain the key external risk though some signs of moderation are becoming visible.

Domestically, inflation persists at uncomfortable levels. Moreover, the headline numbers understate the pressures because fuel prices have yet to reflect global crude oil prices.

On the growth front, even as signs of moderation are visible in some sectors, broad indicators of activity - 2010-11 fourth quarter profit growth and margins and credit growth do not suggest a sharp or broad-based deceleration.

Going forward, notwithstanding both signs of moderation in commodity prices and some deceleration in growth, domestic inflation risks remain high.

Against this backdrop, the monetary policy stance remains firmly anti-inflationary, recognising that, in the current circumstances, some short-run deceleration in growth may be unavoidable in bringing inflation under control.

RBI hikes rates: Home, auto loans to be costlier

Image: Labourers make roti under a truck at a roadside in Noida.Photographs: Parivartan Sharma/Reuters.

The GDP growth decelerated to 7.8 per cent in Q4 of 2010-11 from 8.3 per cent in the previous quarter and 9.4 per cent in the corresponding quarter a year ago.

For the year as a whole, GDP growth in 2010-11 was 8.5 per cent. While private consumption was robust, investment activity moderated in Q4 of 2010-11.

The Central Statistical Organisation (CSO) released the new series of industrial production with 2004-05 as the base. The new series represents a better coverage of the industrial structure in the country.

The trend in industrial production as revealed by the new series is significantly different from that indicated by the old series (base: 1993-94).

While the old series suggested a sharp deceleration from 10.4 per cent in the first half of 2010-11 to 5.5 per cent in the second half, the new series suggested broadly the same growth of a little over 8 per cent in both halves of the year.

While the y-o-y IIP growth moderated to 6.3 per cent in April 2011, growth in capital goods production at 14.5 per cent was buoyant. During April-May 2011, both exports and imports increased sharply and the trade deficit widened.

The progress of south west monsoon 2011 has so far been satisfactory, which augurs well for agricultural production.

Overall, even as there is deceleration in some important sectors, notably interest-sensitive ones such as automobiles, there is no evidence of any sharp or broad-based slowdown.

Corporate earnings growth and profit margins in the fourth quarter of 2010-11 were broadly in line with the performance over the past three quarters, suggesting that demand remained steady, and in the face of sharp increases in input costs, pricing power remained intact.

Credit grew steadily, while the composite Purchasing Managers' Index (PMI) for May 2011 suggests reasonably good conditions.

RBI hikes rates: Home, auto loans to be costlier

Image: A labourer rests at the construction site of a residential complex on the outskirts of New Delhi.Photographs: Danish Siddiqui/Reuters.

The headline WPI inflation rate was 9.7 per cent in March 2011. In April 2011, it was 8.7 per cent and rose to 9.1 per cent in May 2011. The numbers for April and May 2011 are as yet provisional and, given the recent pattern, these numbers are likely to be revised upwards.

Thus, the headline WPI inflation rate remains elevated, consistent with the projections made in the Annual Policy Statement of May 3.

The main drivers of WPI inflation in April-May 2011 were non-food primary articles, fuel group and non-food manufactured products.

The consumer price inflation for industrial workers (CPI - IW) rose from 8.8 per cent in March 2011 to 9.4 per cent in April 2011.

Non-food manufactured products inflation was 8.5 per cent in March 2011. Provisional data indicate that it increased from 6.3 per cent in April to 7.3 per cent in May 2011, numbers much above its medium-term trend of 4.0 per cent.

This pattern in non-food manufactured products inflation is a matter of particular concern. Besides reflecting high commodity prices, it also suggests more generalised inflationary pressures; rising wages and costs of service inputs are apparently being passed on by producers along the entire supply chain.

RBI hikes rates: Home, auto loans to be costlier

Image: A rickshaw puller transports onions at a wholesale market in Agartala.Photographs: Jayanta Dey/Reuters.

The year-on-year non-food credit growth moderated from 21.3 per cent in March 2011 to 20.6 per cent in early June 2011, but remained above the indicative projection of 19 per cent.

The y-o-y deposit growth increased to 18.2 per cent in early June 2011 from 17.0 per cent in March 2011.

Consequently, the incremental non-food credit-deposit ratio moderated to 80.5 per cent (y-o-y) in early June 2011 from 95.3 per cent in March 2011. The y-o-y increase in money supply (M3) was at 17.3 per cent in early June 2011 as compared with 16.0 per cent in March 2011.

Monetary transmission has been quite strong with 45 scheduled commercial banks raising their Base Rates by 25-100 basis points after the May 3 Policy Statement.

Cumulatively, 47 banks raised their Base Rates by 150-300 basis points during July 2010-May 2011. The higher cost of credit is restraining credit growth, but it still remains fairly high, suggesting that economic activity is holding course.

RBI hikes rates: Home, auto loans to be costlier

Image: Labourers fasten iron rods together at the construction site of a commercial complex.Photographs: Amit Dave/Reuters.

During the current fiscal year so far, liquidity conditions have remained consistent with the anti-inflationary stance of monetary policy.

The government's cash balances moved from a surplus of Rs 89,000 crore (Rs 890 billion) on an average during Q4 of 2010-11 to a deficit of Rs 29,000 crore (Rs 290 billion) during Q1 of 2011-12 (up to June 15, 2011).

Consequently, net injection of liquidity through LAF repos declined from an average of Rs 84,000 crore (Rs 840 billion) during Q4 of 2010-11 to Rs 41,000 crore (Rs 410 billion) in 2011-12 (up to June 15, 2011).

The net liquidity injection by the Reserve Bank was higher at Rs 60,000 crore (Rs 600 billion) as on June 15, 2011.

As articulated in the May 3 Policy Statement, the Reserve Bank will continue to maintain liquidity conditions such that neither surplus liquidity dilutes the monetary policy stance nor large deficit chokes off fund flows to productive sectors of the economy.

RBI hikes rates: Home, auto loans to be costlier

Image: A worker sorts broken biscuits on a conveyor belt at the Britannia factory.Photographs: Adnan Abidi/Reuters.

Given the high degree of integration with the global economy, recent global macroeconomic developments pose some risks to domestic growth. Domestic inflation remains high and much above the comfort zone of the Reserve Bank.

Particularly, non-food manufactured products inflation rose in May 2011 after showing some moderation in April 2011.

Domestic fuel prices do not yet reflect the current trends of global prices. Although global commodity prices moderated in recent weeks, it is too early to downgrade this as a risk factor.

Monetary transmission has strengthened. The impact of the Reserve Bank's recent monetary policy actions is still unfolding. The challenge of containing inflation and anchoring inflation expectations persists.

Thus, while the Reserve Bank needs to continue with its anti-inflationary stance, the extent of policy action needs to balance the adverse movements in inflation with recent global developments and their likely impact on the domestic growth trajectory.

These measure are aimed at curbing inflation and anchor inflationary expectations by reining in demand side pressures and to mitigate the risk to growth from potentially adverse global developments.

RBI hikes rates: Home, auto loans to be costlier

Image: Home loan rates to rise.Photographs: Amit Dave/Reuters.

After a rate hike, commercial banks normally increase their lending rates. They hike interest rates for home loans, car loans, personal loans and commercial borrowings.

In the last two years, interest on home loans has gone up by at least 200 basis points from about 8 per cent to above 10 per cent.

Floating home loan borrowers will end up paying more on their EMIs. Banks are likely to increase the interest rates on fixed deposits. If inflation does not come down, the central bank is forced to increase key policy rates again.A rate hike can also have a negative impact on interest sensitive sectors like consumer durables and realty. Many industry sectors have been demanding a lower interest regime to fuel growth.

How does this effect investors ?

The banks will want to park their money with RBI and not lend to investors since the reverse repo rate is hiked.

This will in turn make borrowing costlier for the investors.

RBI hikes rates: Home, auto loans to be costlier

Image: An employee works inside a bulb-manufacturing factory in Kolkata.Photographs: Rupak de Chowdhuri/Reuters.

It has been a tightrope walk for RBI trying to balance growth and inflation. The prime concern has been to tame inflation and suck out the excess liquidity from the system so that it does not trigger inflation.

Experts, however, feel tightening of rates cannot bring down rates as food inflation is a result of an inefficient food supply system and hoarding by unscrupulous traders.

A low inflation is favourable to long-term growth as interest rates decline, which in turn boosts growth.According to RBI governor Subbarao, it is a struggle to maintain the growth-inflation dynamics. "For inflation management, we have to raise policy rates. For protecting, promoting and preserving recovery, we need to keep interest rates low. So there is tension between raising interest rates and keeping them low."

The fast pace of economic growth needs huge investment. This in turn leads to demand for more money.

Thus, an easy availability of funds can lead to rise in inflation. RBI therefore, controls the demand of money by hiking the interest rates. It increases the interest rates so that people borrow less.

The central bank, in its annual policy, had accepted that inflation would remain a top priority in the next few months on account of high global commodity prices, particularly of crude oil.

In May, petrol price was hiked by Rs 5 per litre, the highest one-time rise. This is the eighth hike in petrol prices after the decision to deregulate petrol prices was taken a year ago.

RBI hikes rates: Home, auto loans to be costlier

Image: RBI headquarters.Photographs: Reuters.

Interest rate hikes adversely affect the long-term payments of the loans as they have a direct impact on your equated monthly installments (EMI).

For example, repayments may increase by over Rs 3.5 lakh (Rs 350,000) over a 20-year period on a Rs 20 lakh (Rs 2 million) home loan, if the bankers hike interest rates by up to 1 per cent.

This means that consumers may have to fork out up to Rs 1,500 more every month for a home loan of Rs 20 lakh.

RBI hikes rates: Home, auto loans to be costlier

Image: RBI headquarters.Photographs: Reuters.

Reverse Repo rate is the rate at which the RBI borrows money from commercial banks for a short-term. Banks are happy to lend money to the RBI since their money is in safe hands and they get good interest.

An increase in reverse repo rate can prompt banks to park more funds with the RBI to earn higher returns on idle cash. It is also a tool which can be used by the RBI to drain excess money out of the banking system.

What is a Repo Rate?

The rate at which the RBI lends short-term money to commercial banks is called repo rate. It is an instrument of monetary policy.

Whenever banks have any shortage of funds they can borrow from the RBI.

A reduction in the repo rate helps banks get money at a cheaper rate, while an increase in repo rate means that banks will have to borrow at higher rates.

RBI hikes rates: Home, auto loans to be costlier

Image: Indian rupee notes.Photographs: Reuters.

Bank Rate is the rate at which RBI allows finance to commercial banks.

Bank Rate is a tool that RBI uses for short-term purposes. Any upward revision in Bank Rate is an indication that banks should also increase lending and deposit rates.

What is CRR?

Cash reserve Ratio (CRR) is the amount of funds that the banks have to keep with the RBI.

If the RBI increases the CRR, the available amount with the banks comes down. The RBI uses the CRR to drain out excessive money from the system.

RBI hikes rates: Home, auto loans to be costlier

Image: Balancing growth and controlling inflation will remain RBI's main focus.Current growth and inflation trends warrant persistence with the anti-inflationary monetary stance.

Several upside risks are already visible in the global environment and more may surface domestically.

The monetary stance will be determined by how these factors impact the overall inflationary scenario.

Balancing growth and controlling inflation will remain RBI's main focus.

article