Photographs: Mark Thompson/Getty Images Abhineet Kumar in Mumbai

The once-upon-a-time king of good times still behaves like one. Look at Vijay Mallya’s television interviews every time Royal Challengers Bangalore wins a match in the ongoing Indian Premier League.

But the apparent exuberance cannot hide the hard reality that the king has little control over his once-empire.

Mallya, who inherited the scattered liquor business of father Vittal Mallya at 27, painstakingly built it into a Rs 19,000-crore (Rs 190 billion) empire.

But the irony is that the companies he controls now account for a mere 4.5 per cent of the UB Group’s revenue.

…

How Mallya lost most of his Rs 19,000-crore empire

Image: Vijay Mallya (C) at the F1 Rocks India Afterparty.Photographs: Andrew Caballero-Reynolds/Getty Images

Mallya has ceded management rights of one operating company after another in the past few years.

This solely controlled part of his empire accounts for less than 1 per cent of the UB Group’s current market capitalisation of Rs 60,636 crore (Rs 606.36 billion).

In this, the total value of Mallya’s holding is Rs 11,755 crore (Rs 117.55 billion) but Rs 8,505 crore (Rs 85.05 billion) worth of these shares are pledged with lenders, mainly for loans against the grounded Kingfisher Airlines.

A consortium of lenders led by State Bank of India has claimed over Rs 6,300 crore (Rs 63 billion) from Mallya and says even if all the secured assets are sold, their dues will not be covered.

…

How Mallya lost most of his Rs 19,000-crore empire

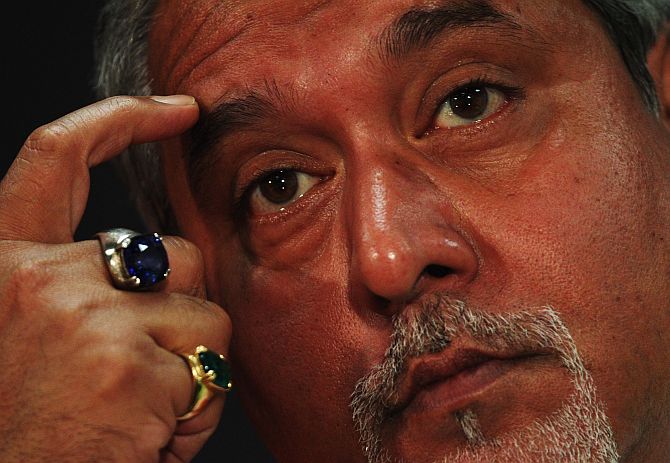

Image: Force India team owner Vijay Mallya is seen during practice for the European Formula One Grand Prix.Photographs: Mark Thompson/Getty Images

“Mallya did well till he stuck with the core of liquor and chemicals business as he really built on whatever his father left him,” says Jacob Mathew, managing director at investment bank MAPE Advisory. “But running an overleveraged airline has really cost him.”

Since Kingfisher Airlines sunk under a mountain of debt, Mallya has lost control of the group’s most valuable company, United Spirits. He also became the second largest shareholder in United Breweries, which he manages jointly with Heineken.

…

How Mallya lost most of his Rs 19,000-crore empire

Image: Chairman of Force India F1 team, Vijay Mallya, poses with the new Force India Formula One Team car on display at the launch held infront of the Gateway of India.Photographs: J. Adam Huggins/Getty Images

The five companies he controls are also showing signs of slipping out of his hands. Mangalore Chemicals & Fertilizers is in the midst of a bidding war.

According to a pact with Saroj Poddar’s Adventz, Mallya will continue to have considerable say in the management of MCF, even if Adventz wins the battle with Deepak Fertilizers for MCF.

In effect, the only operating company he will be left with is UB Engineering, which clocked Rs 213 crore revenue in the first nine months of 2013-14.

In the same period, UB Group firms earned revenue of Rs 12,566 crore (Rs 125.66 billion). A little over half of this was from United Spirits, in which Mallya sold his 14.98 per cent stake to British liquor giant Diageo.

…

How Mallya lost most of his Rs 19,000-crore empire

Image: Vijay Mallya walks in the paddock during the Australian Formula One Grand Prix.Photographs: Mark Thompson/Getty Images

Mallya’s stake in the company is now only 9.83 per cent, of which 9.37 per cent is pledged with bankers. While Mallya remains chairman of the company, Diageo controls the management.

“The best asset for Mallya was United Spirits in terms of cash flows,” said an analyst with a domestic brokerage who did not wish to be identified. “If you sell the crown jewel, selling secondary assets is a given.”

The second largest revenue contributor to the group, United Breweries, has also been out of Mallya’s control for long. It contributed Rs 2,819.6 crore (Rs 28.19 billion) in sales for the nine-month period.

In 2008, Dutch brewer Heineken acquired Scottish & Newcastle’s India assets. The deal gave Heineken a 37.5 per cent stake in United Breweries.

…

How Mallya lost most of his Rs 19,000-crore empire

Image: Vijay Mallya attends the press conference following practice for the Monaco Formula One Grand Prix.Photographs: Vladimir Rys/Getty Images

While Mallya had an equal 37.5 per cent stake in the company, 23.57 per cent was pledged with bankers. Of this, 1.35 per cent was offloaded by Citigroup last December, which was picked up by Heineken.

The rest of the revenue for Mallya’s empire came from the group’s non-operative holding companies, UB Holdings and McDowell Holdings, which contributed Rs 342.6 crore (Rs 3.42 billion) and Rs 12.36 crore (Rs 123.6 million) in sales, respectively. The grounded Kingfisher Airline that Mallya still owns contributed nothing.

“Banks will allow Mallya to wriggle out only if he is able to repay the loans but he does not have anything that can give him the cash flow to get out of this mess,” says the analyst.

article