Raghuvir Badrinath

The business model is actually quite simple.

If you want to get into value housing, it is better to approach the business like a manufacturer of steel or cement.

Land is the raw material; do not hoard it for value appreciation. Build the project as fast as possible and deliver in 18 months.

Don't get greedy for 80 per cent return on equity, be happy with 20 to 25 per cent. This is what Jaithirth (Jerry) Rao, 58, has embarked on with his Value & Budget Housing Corporation.

"Sometimes I wonder if it is worth all the effort at this age; but when I see the development going on at my first value-housing project in Anekal near Bangalore, it fills me with satisfaction," says Rao.

. . .

How Jerry Rao is building low-cost houses profitably

Budget housing is the latest twist in Rao's long career. He spent long years with Citibank in the US, and later started IT services company MphasiS which was acquired by global technology major EDS.

For a brief period following that, he was an active angel investor and mentor for a clutch of technology and technology-enabled companies. Value housing is his latest stop.

"The original intent was to build a scalable business and not a small boutique outfit focused on domestic consumption and targeted at the base of the pyramid. I looked at various things and saw that there is such a gap in housing," says Rao.

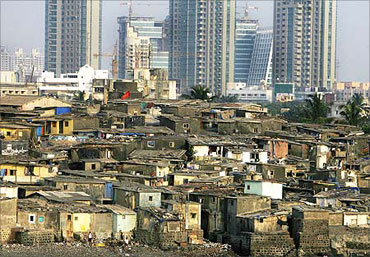

Indeed, there is no single national player in the value-housing segment; the regional players have little to offer below Rs 30 lakh (Rs 3 million).

. . .

How Jerry Rao is building low-cost houses profitably

Rao spent nearly six months trying to understand why most builders are not in this space.

"My conclusion is that the economics of the business favours large scale because most builders are not really developers but land-bank players. They make their principal profit on land appreciation. Buildings are an incidental part of the business," he holds forth.

To let value appreciation set in, most developers deliberately delay their projects. Buyers don't complain because they too see a rise in the value of their assets.

Need for speed

Based on this insight, Rao started the process, did reverse engineering and arrived at a plan where he would not ride the land-price game but sell quickly within 18 months.

. . .

How Jerry Rao is building low-cost houses profitably

"Then you become a manufacturer. Usually it takes at least five years for the land to appreciate in value; but if you are out of the project in 18 months, the land becomes a raw material. The key issue is not the cost of construction or even the cost of land but the time to complete the project," says Rao.

If one can deliver fast, you resemble a manufacturing line; and if you do not go for 80 per cent return on equity but settle for 20 to 25 per cent, you change the model and the assumptions. This, Rao feels, is a viable business model.

"We definitely know what we don't want to do. We don't want to cross the Rs 15-lakh (Rs 1.5 million) barrier per flat. If you do that you are out of value housing. There is a clear space to be a pan-India player to offer value houses in the Rs 5 to 11 lakh (Rs 500,000-1.1 million) segment and I am on my way to that."

Anuj Puri, the chairman & country head of Jones Lang LaSalle India, a real estate consultancy, says: "Rao's business model for building affordable housing projects is credible. He has set a rational ceiling on his expected profits, and this is probably the most decisive aspect of the formula he has adopted."

. . .

How Jerry Rao is building low-cost houses profitably

Rao's first project in Anekal is on the outskirts of Bangalore. He has plans to put up similar projects in Mumbai, Chennai, Hyderabad, Delhi and its suburbs, Nashik and Indore with the ambition to build a million houses in ten years' time.

The biggest challenge is to build a flat within Rs 5 lakh. The flat, of course, is small -- it starts from 350 square feet and goes up to 650 square feet.

"We first set out fixing the price ranging from Rs 5 lakh to Rs 11 lakh; then we worked backwards on how we can build the product something like what Ratan Tata did with the Nano," says Rao.

With this price in mind, the flat cannot be priced more than Rs 1,300 to 1,400 per square feet.

. . .

How Jerry Rao is building low-cost houses profitably

The trick, says Rao, is to target land parcel that doesn't cost more than Rs 300 per square feet, infrastructure costs cannot be more than Rs 150 per square feet and the cost of construction shouldn't exceed Rs 800 per square feet.

If one can reduce the time for a project, the interest payout will come down. And there are various fast-emerging technologies that help a builder reduce the turnaround time.

Rao is using aluminium-form technology which takes only two days to cure concrete instead of the regular 21 days.

"With this we significantly reduce the time. We are investing heavily in technology, especially on the project management and supply chain management side," says he.

. . .

How Jerry Rao is building low-cost houses profitably

More with less

Rao is packing more houses into his projects. At Anekal, for instance, there are 2,000 units in a 16-acre plot, while the norm is around 500 units. This helps Rao buy fittings etc cheap.

"We get better cost positions if we have to procure 2,000 kitchen counters or washbasins. Having said that, we may not be able to slash construction cost to a large extent in the first couple of projects; but eventually over a period of time we can bring it down by 10 to 20 per cent," he says.

The problems, however, are aplenty. The first is the location. If you want to price your flat at Rs 5 lakh (Rs million), you are naturally on the outskirts of the city. Compounding this is the lack of transportation infrastructure, the cost of which will be added to the family's monthly installments.

"Until the government acts fast on the public transport, the 25-million gap in value housing demand is only theoretical and not effective. People will just not move 30 km away from a city and will continue to stay in rented housing even if it's sub-standard," Rao says.

. . .

How Jerry Rao is building low-cost houses profitably

He is, however, hopeful that of a sample target of 10,000 families, around 2,000 will indeed opt for such a flat. "The challenge is converting the other 8,000. Things will change eventually," says he.

Another challenge is access to mortgage. Getting long-term housing loans at an affordable rate of interest isn't easy.

Many prospective buyers of low-cost houses either do not have the right type of proof of income or do not have the desired employment profile to access loans from banks and housing finance companies. Since these borrowers are committed to repaying the loan, they need support, particularly at the initial stages, for accessing mortgage loans.

Rao has a solution for this. "We along with our sponsors will enable financial inclusion by providing partial financial guarantee to banks or housing finance companies. Simultaneously, we are working with reputed lenders to provide loans based on partial guarantees."

. . .

How Jerry Rao is building low-cost houses profitably

It may be noted here that HDFC has picked up 10 per cent in Rao's company.

While there are issues on the demand side, there is no dearth of problems on the supply side as well. The documentation of land records, especially in the outskirts of any city, is in pretty bad shape.

To make matters worse, approvals from 16 government agencies are required before one can start work on the land.

"It is a time-consuming process and everything moves sequentially, not parallely. The level of transparency is changing, but there are some fundamental issues like access to electricity, water and sewage that remain," he rues.

. . .

How Jerry Rao is building low-cost houses profitably

With his houses aggressively priced at Rs 5 lakh and above, won't the project fall prey to speculators in the market and not reach the actual consumers who are in need?

Rao admits that this is a big problem and it is difficult not to sell when someone comes in with a cheque to buy a flat.

"Our understanding is that not many investors will come for flats of 350 square feet and 450 square feet. They may come for the 600 square feet units. Given the nature of our products, speculative resellers are few; even in a worst-case scenario, they are not the ones who will come in and stay in a 600 square feet flat," he reasons.

To further take the concept of value-housing to the actual needy, Rao has kicked off another service. The company will offer rental services to a buyer and will try to get in a clutch of tenants.

"Increasing the rental stock in the country is also fine. What we want to avoid to a large extent is people buying and keeping the flat locked for years to appreciate in value. Since such buyers are low in our scheme of things, we hope to keep them away," Rao says.

If that happens, real estate development in India will have got a new workable business model.

article