Photographs: Rupak De Chowdhuri/Reuters Swati Bhat in Mumbai

RBI will need to intervene to prevent a rupee slide as the currency is vulnerable because of a record high current account deficit.

The fall in the rupee to record lows has raised the prospect that the government or the central bank could take steps to support a currency seen particularly vulnerable because of a record high current account deficit.

Below are some measures the Reserve Bank of India and government could consider to protect the rupee.

Dollar-Window for Oil Companies

The RBI could open a dollar window for oil companies to buy dollars directly from the central bank instead of buying from markets, but it would drain foreign exchange reserves.

…

How India can tame the falling rupee

Image: A currency trader works in front of a screen showing the value of the Indian Rupee against the US Dollar.Photographs: Vivek Prakash/Reuters

Dollars for Oil Bonds

The RBI could hold auctions to buy bonds from oil companies, providing them dollars or other non-rupee currencies, but the outstanding amount of oil bonds is small as the government has been giving direct cash subsidy to oil companies.

Asking Exporters to Buy Rupees

The central bank could ask exporters to convert part, or their entire, overseas foreign currency earnings in the market immediately, providing near-term relief to the rupee.

…

How India can tame the falling rupee

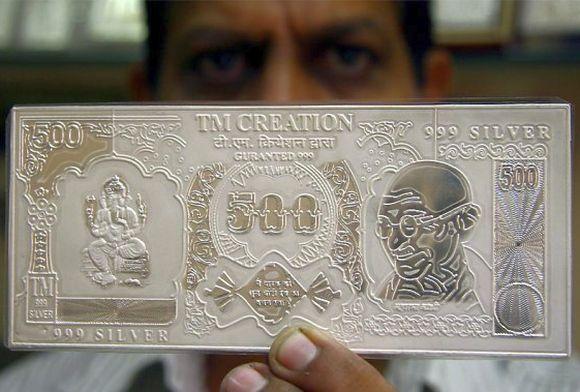

Image: A jeweller displays a silver plate in the form of a rupee note.Photographs: Ajay Verma/Reuters

Curbing Net Open Position Limits for Banks

The central bank could ask banks to limit their net overnight open position limits, making it difficult to short the rupee and prevent speculative trading.

Moral Persuasion

The RBI could persuade banks and financial institutions to raise funds in dollars abroad and lend them locally, a measure that has worked in the past when overseas rates were attractive.

…

How India can tame the falling rupee

Image: An employee counts U.S. dollar notes at a money changer.Photographs: Beawiharta/Reuters

Stagger Import Payments

The central bank could issue rules delaying or staggering import payments, which are typically made at the end of every month, although the RBI has not taken this step in recent years.

Additional Fiscal Reforms

The government could review sectors such as defence, or revive pension and insurance reforms, but passage through parliament could be tough.

…

How India can tame the falling rupee

Image: A supporter of veteran Indian social activist Anna Hazare wears a cap lined with fake currency notes while attending a public meeting by Hazare.Photographs: Babu Babu/Reuters

Government Backed Non-Resident Indian Bond

The government could issue a sovereign bond through State Bank of India to non-resident Indians, but such a move could increase external debt and interest liability.

Sovereign Overseas Bond

The government could issue sovereign bonds to raise dollars from overseas investors, but the RBI is reluctant to expose the country to foreign exchange risks during repayment.

article