| « Back to article | Print this article |

How India became a ROARING Asian tiger!

Faced with a foreign exchange crisis in 1991, India embarked on gradual, erratic, but persistent economic reforms that in two decades transformed its living standards and place in the world.

In 1991 India was viewed globally as a bottomless pit for foreign aid, periodically hit by food and foreign exchange crises and hamstrung by an immense web of controls imposed in the holy name of socialism and then used by politicians to line their pockets and build patronage networks.

Early that year, The Economist magazine carried a survey on India titled 'The Caged Tiger,' which concluded sorrowfully that India would remain trapped in its cage, unable to join other Asian tigers that had become 'miracle economies.'

Many analysts saw India as a lumbering elephant, in stark contrast to the Chinese tiger.

Twenty years later, the Indian elephant has indeed morphed into a tiger. It averaged 8.5 per cent growth in the last decade and survived the Great Recession of 2007-09 with only minor bumps before returning to 8.5 per cent growth in 2010-11.

Table 1: India's GDP growth

| Years | GDP growth % |

| 1950-80 | 3.5 |

| 1980-92 | 5.5 |

| 1992-2003 | 6.0 |

| 2003-10 | 8.5 |

Source: Calculated from tables in Government of India, Economic Survey 2010-11

Its per capita income has shot up from $300 in 1991 to almost $1,700 today, and its gross domestic product this year will exceed $2 trillion in nominal terms and maybe $4.5 trillion in PPP (purchasing power parity) terms, which would make it the third-largest economy in the world after the United States and China.

Click NEXT to read on . . .

Reproduced with kind courtesy of The Cato Institute

How India became a ROARING Asian tiger!

It is hailed today as a potential superpower and has been proposed by the United States for a permanent seat on the United Nations Security Council. Political analysts see it as perhaps the only credible Asian check on Chinese hegemony in the 21st century.

Many analysts (including Goldman Sachs, who coined the term BRICs to mean Brazil, Russia, India, and China) predict that India will soon overtake China as the fastest-growing economy in the world.

Nevertheless the unfinished reform agenda remains huge. The Doing Business report of the World Bank ranks India at just 134th of 183 countries in ease of doing business. India ranks only 121st in the United Nations' Human Development Index, and its nutritional indicators are among the worst in the world.

A quarter of the country's districts suffer from some sort of Maoist insurrection. India needs major economic and governance reforms in the years to come.

The history

After Independence in 1947, India followed a socialist pattern of development, emphasizing self-sufficiency and public sector dominance. It was inward looking and sceptical of markets and international trade.

In the 1970s, marginal income tax rates went as high as 97.75 per cent, on top of which a wealth tax of up to 3.5 per cent was levied to promote the garibi hatao (abolish poverty) policies of Indira Gandhi.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

Yet poverty did not fall at all in the three decades after Independence, and GDP growth averaged just 3.5 per cent per year (the so-called 'Hindu Rate' of growth), just half of what had been achieved by Asian tigers with outward-looking, market-friendly policies.

Some economic liberalization plus runaway public spending helped accelerate GDP growth to 5.5 per cent in the 1980s. But this was based on unsustainable borrowing, and it ended in tears when India ran out of foreign exchange in 1991.

Rajiv Gandhi was widely expected to win the general election in June 1991 but was assassinated by a Sri Lankan terrorist. No party won an absolute majority in that election, and the Congress Party formed a fragile minority government headed by a political lightweight, Narasimha Rao.

So, both economic and political conditions were highly unfavorable. The Soviet Union was collapsing, making it clear that more socialism was not the answer. Meanwhile, Deng Xiaoping had revolutionized China, showing that the market was the way to go.

And so, more in sorrow than ideological triumph, India turned away from socialism to half-baked liberalism. There was no Ronald Reagan or Margaret Thatcher in India: reform was a very pragmatic process.

Opposition parties accused India of having sold out to the International Monetary Fund and swore to reverse the reforms when they came to power. But within two years the reforms restored India's finances, and in the three years from 1994 to 1997 India averaged 7.5 per cent GDP growth, a new record.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

This was too successful to reverse, and so India continued down the reform path even when other political combinations came to power. The reform process was halting, inconsistent, and sometimes partially reversed, yet the overall direction remained unaltered.

No party dared liberalize very restrictive labour laws, and so India failed to make its mark in labour-intensive industries. But, to everybody's surprise, it emerged as a major power in brain-intensive industries ranging from computer software and medical tourism to auto exports and research and development.

The Asian financial crisis of 1997-99 was the first test of the resilience of Indian reforms. Growth took a hit, yet -- in part because it was a relatively closed economy -- the country survived without serious damage, without imposing new controls on capital inflows, and without having to go hat in hand to the International Monetary Fund like so many other Asian neighbours.

Indeed, this was the period when India's computer software industry rose to prominence, playing a leading role in developing software to thwart the so-called Y2K problem.

The recession of 2001 led to greater outsourcing of software and business services, and India built on that opportunity. In the next decade it marched up the value chain, moving steadily into higher and higher levels of technology, proving that India had not just cheap labour but world-class skills.

In 2000 India was seen as globally competitive in services but not industry, where the Chinese juggernaut crushed all opposition. India's restrictive labour laws made it virtually impossible to shed workers in any company with over 100 workers. Labour inflexibility meant India could not follow the path set by the other Asian tigers, of export-led growth based on labour-intensive industries.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

Indian entrepreneurs were wary of setting up large labour-intensive factories for exporting items like garments, and so suffered the ignominy of being overtaken by Bangladesh in this sector.

But, after taking time to adjust to liberalization and globalization (which was opposed by an influential quasi-protectionist section of industry called the Bombay Club), Indian industries greatly improved their productivity and in many areas became globally competitive.

One measure of how far India has come is that in 1991 the then Finance Minister Manmohan Singh's first budget brought the maximum import duty down -- to a still whopping 150 per cent. Earlier it was as high as 300 per cent.

Today the standard import duty is down to 10 per cent, and the effective rate for many items is around 7 per cent, close to the average for Southeast Asian countries.

Back in 1991 more than 800 items were reserved for production by small-scale industries, and several more for the public sector. These reservations were whittled away gradually over more than a decade.

Controls on industrial production, imports, technology, and foreign exchange have been abolished or hugely relaxed.

The financial sector used to be a virtual government monopoly, but has now been liberalized with the entry of several private and foreign players, though the sector remains heavily regulated, and 70 per cent of banking is still in government hands.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

Foreign investment has been liberalized in most areas, though much remains to be done in service industries like retail, banking, and insurance. Privatization has been very limited, but private investment in infrastructure and other areas previously reserved for the government has transformed the country, especially in telecommunication.

When India started down this reform path 20 years ago, sceptics abounded. Leftist critics predicted that India was going down the World Bank-IMF path that had supposedly resulted in a 'lost decade' of economic growth in Africa and Latin America in the 1980s and warned that India would suffer a similar fate.

They predicted that opening up and cuts in import duties would cause massive unemployment and de-industrialize India. They warned that multinational giants would rapidly take over the Indian economy and that Indian companies would go bust or become subservient underlings of foreigners.

They also warned that the fiscal stringency imposed by the IMF would strangle social spending and safety nets, hitting the poor.

Every one of these dire predictions turned out to be wrong. Far from suffering a 'lost decade,' India became a miracle economy averaging 8.5 per cent growth in the 2000s. Far from getting de-industrialized, Indian industry rose to new heights with the abolition of controls, and many new Indian giants emerged.

A few Indian companies were indeed taken over by multinational corporations, but most Indian companies comfortably held their own, and dozens became multinationals in their own right, acquiring companies across the globe. Indeed, India began to rival China in making acquisitions abroad.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

Far from suffering a fiscal squeeze on social spending, such spending rose to new heights, financed by booming revenues that accompanied booming GDP growth.

However, failure to reform service delivery meant that much of the additional revenue was wasted or diverted to the undeserving, while corruption flourished. Despite such waste, India enjoyed a record increase in literacy in the two decades of reform, and poverty fell substantially.

However, some social indicators did not improve quickly, and India's proportion of underweight children -- a measure of malnutrition -- was the third-worst in the world at 46.7 per cent. This is one reason India remained far down in the Human Development Index of the UN.

Twenty years after reforms began, the Indian public is angry at high corruption arising out of crony capitalism, often a product of half-baked reform. Many analysts also worry that inequality is rising, the poor have not benefited enough, and poor states are getting left behind even as Maoist insurrection in many states worsens.

These criticisms are mostly exaggerated or plain wrong. There is plenty of evidence that poor people, states, and castes have benefited substantially. But the unfinished agenda remains large.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

Key achievements

The reforms have brought about far-reaching changes, many unanticipated. The key achievements of the last 20 years can be summed up as follows:

- Rapid GDP growth of 8.5 per cent in the last decade has created expectations that India will overtake China in growth in the coming decade.

Reforms being gradual and hesitant, they took time to have an impact. After three years of reform, GDP growth accelerated to 7.5 per cent per year from 1994-95 to 1996-97. Then growth slowed down to an average of 5.5 per cent per year because of the Asian financial crisis (1997-99), two major droughts (2000 and 2002), and the recession of 2001.

But after 2003 growth picked up sharply and averaged almost 9.5 per cent annually for three years from 2005-06 through 2007-08.

The Great Recession (2007-09) pulled growth down, but it was a still impressive 6.8 per cent in the trough of 2008-09, followed by rapid recovery to 8.0 per cent and 8.5 per cent in the next two years.

The savings rate shot up from 21.5 per cent of GDP in 1991-92 to around 34 per cent in 2010-11, enabling investment to rise from 22.1 per cent of GDP to around 37 per cent.

Table 2: India's savings rate

| | 1980-81 | 1990-91 | 2000-01 | 2010-11 |

| Savings rate/GDP, % | 18.5 | 22.8 | 23.7 | 34 |

Source: Government of India, Economic Survey 2010-11

This high investment level makes 8-9 per cent growth sustainable. High domestic savings mean India depends relatively little on foreign inflows and so is resilient in times of financial crisis.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

*** India's per capita income is up from $300 in 1991 to an estimated $1,700 today. This has not only directly raised incomes and employment but yielded a revenue bonanza that has financed huge increases in social spending, anti-poverty programmes and infrastructure.

*** India's fast growth has not been based on using cheap labour for labour-intensive exports, the development path taken by other Asian tigers including China.

India's booming exports are brain-intensive, not labour-intensive. This is a totally new development model unmatched by any other developing country. It means India is well positioned to march up the value ladder.

India is best known for its computer software exports, but this sector accounts for no more than 2 per cent of GDP. Other services exports (legal, engineering, and medical services, R&D) have risen fast and exceeded $10 billion in 2010-11.

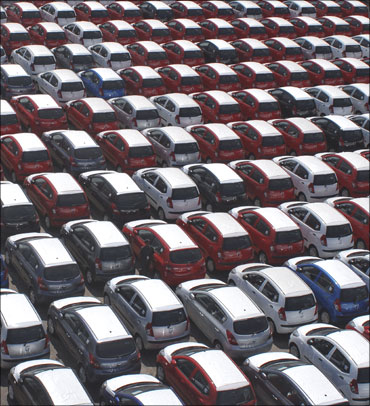

Exports of autos and engineering goods have soared, reflecting new skills in design and manufacturing. India remains an economy driven mainly by domestic demand, although the export share has risen substantially.

*** India has become the world leader in frugal engineering, a concept that did not exist a decade ago. Frugal engineering is the capacity to design and produce goods that are not just 10-15 per cent cheaper than in Western countries but 50-90 per cent cheaper.

Tata Motors has produced the cheapest car in the world, the Nano, costing $2,500. Bajaj Auto is about to launch a rival for $3,000 that gives 90 miles per US gallon.

India's telecom industry is the cheapest in the world, with calls costing just two cents per minute. Narayan Hrudalaya and Aravind Netralaya are hospitals providing heart and eye surgery respectively at one-twentieth or less the cost of surgery in the West, one reason for the emergence of what is called medical tourism.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

*** China and some other Asian countries stand accused of deliberately rigging their currencies to undervalued rates to run up large, mercantilist trade surpluses.

India has many capital controls, and its central bank has for decades unofficially intervened in markets to keep the real effective exchange rate at the 1993 level. This has typically meant running a modest current account deficit, not a mercantilist surplus.

The central bank has now stopped intervening, and India's current account deficit in 2010-11 was 2.8 per cent of GDP, financed by capital inflows. This is a healthier, more sustainable pattern of development than cheap-currency manipulation.

*** The Indian word jugaad has crept into management literature. Farmers wanting a vehicle got the idea of strapping an irrigation pump to a steel frame with four wheels, to create a functioning vehicle called a jugaad.

Subsequently jugaad has come to mean, simply, innovation around obstacles of all sorts -- in designing, selling, managing, and even surmounting government controls. Thus, jugaad includes forms of crony capitalism and tax evasion no less than frugal engineering, so it is not uniformly a good thing.

Theories have been floated that entrepreneurs who succeeded in managing the politician-bureaucrat jungle of controls attained such managerial skills that they can now conquer global markets.

Certainly some businessmen who rose on the basis of crony capitalism are today world class, winning global contracts and running huge global businesses.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

*** In 1991 many critics warned that Indian companies would not be able to compete globally, and so would either go bust or be taken over by multinational corporations. In fact, Indian companies have not only held their own but have become multinational corporations in their own right.

Indeed, in outward-bound foreign direct investment as a proportion of GDP, India (0.9 per cent) has beaten China (0.6 per cent). The multinational firm Arcelor Mittal, with roots in India, is now the world's largest steel company.

India's Tata Steel has taken over and turned around Corus, an Anglo-Dutch company six times its size. The Birla group has taken over Novellis of Canada to become the sixth biggest aluminum company in the world. Tata Motors has acquired and turned around Jaguar Land Rover, an iconic company that had run up huge losses under previous owners like BMW and Ford.

Many top Indian software and pharmaceutical companies have become multinationals through foreign acquisitions, and so have some auto parts companies. Reliance Industries Ltd. has built the world's largest oil refinery complex at Jamnagar, and its 'crack' (spread between crude and finished product prices) comfortably beats that of the best Singapore refineries.

Bharti Airtel has taken over Zain's telecom assets in 14 African countries and aims to slash telecom rates there toward Indian levels.

*** Back in 1991 India was viewed as a bottomless pit for foreign aid. By global standards aid inflows into India still look large. In 2009-10 the aid inflow was $5.9 billion, but this paled in comparison with foreign investment (equity plus portfolio inflows) of $51.2 billion, commercial borrowings (which were $68.2 billion gross and $10.4 billion net) and remittances from overseas Indians ($53.9 billion).

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

*** Remittances remained stable through the Asian financial crisis and Great Recession (2007-09) and have greatly helped counter the volatility of foreign portfolio capital in difficult times.

India has told smaller donors (like the Scandinavian countries) that the government will no longer accept aid from them, and they can give money directly to non-governmental organisations if they so please.

India has stepped up borrowing from the World Bank, but the share of soft loans in such borrowing has fallen from almost 100 per cent in the 1970s to under 30 per cent today.

India itself has become a substantial donor and recently granted a $1 billion aid package to Bangladesh. Prime Minister Manmohan Singh announced credits worth $5 billion to African countries during his recent tour of the continent.

*** India has gradually liberalized its FDI rules but still has significant barriers (especially in agriculture, retail, and finance) that have kept flows into India far below flows into China.

FDI peaked at $26 billion in 2009-10 and declined to $19.4 billion the next year. However, most of the Fortune 500 companies now do business in India, especially in business services, software, and R&D. Accenture and IBM have more employees in India than in the US.

Companies like Intel and Microsoft came to India initially for cheap labour but now use it as a base for high skills.

India has become a global production hub for Suzuki, Hyundai, Bosch, Ford, Abbot Labs, Daiichi Sankyo, Pfizer, and others. It has also become an important R&D hub for many pharmaceutical, software, and auto companies, with contract research and clinical trials costing far less in India than in the West.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

*** India's stock markets were rightly viewed as snake pits back in 1991, with a handful of brokers rigging prices, a plethora of fake share certificates, and settlement periods extended for months if it suited brokers.

A major scandal in 1992 led to a stock market overhaul, and India created a completely new electronic exchange with no floor at all, the National Stock Exchange, long before London or New York did.

This slashed costs and ended most forms of rigging. Shares were dematerialized and held in electronic form to end fake certificates. Settlement periods were compressed dramatically to T+3 (payment three days after a transaction), among the fastest rates in the world.

India's stock markets have been transformed to among the cleanest and most efficient in Asia, which is why portfolio flows into India have been among the highest in Asia, in contrast to the sluggishness of FDI.

Equity inflows into India are untrammeled, but debt inflows are subject to stringent restrictions still, one reason why the corporate debt market has not developed well.

*** In many developing countries, a handful of crony capitalists have dominated industry thanks to political contacts, and India was no exception until 1991. But since then economic liberalization has facilitated the rise to the top of a vast array of new entrepreneurs.

The best known are in software, but many have emerged in pharmaceuticals (Sun Pharma, Glenmark, Dr Reddy's Labs, Ranbaxy) infrastructure (Adani, Lanco, GMR, GVK, IVRCL), telecom (Bharti Airtel), steel (Jindal, Bhushan), and finance (ICICI Bank, HDFC Bank, Axis Bank, Kotak Bank, Yes Bank).

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

Some of the new businessmen (notably in real estate and infrastructure) are crony capitalists, but others have risen entirely on merit. Many illustrious business houses of past decades have crashed (Hindustan Motors, Premier Automobiles, JK Synthetics, DCM), indicating that there is also room for creative destruction in India's economy.

Of the 30 companies constituting the Sensex (India's equivalent of the Dow Jones Index) in 1991, only nine are still in the Sensex today, a business churn that indicates healthy competition.

Prime Minister Manmohan Singh has said of the new entrepreneurs, 'These are not the children of the wealthy. They are the children of liberalization.'

*** India is currently reaping a demographic dividend -- a rising share of workers and falling share of dependents in the population.

The western and southern states adopted birth control first and reaped a demographic dividend from the 1980s onwards.

The backward northern and central states are starting to do the same now. In the last decade, the number of children aged 0-6 years declined by 3.08 per cent for the first time since Independence, with the sharpest declines occurring in poor, backward states.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

A recent paper by two IMF economists, Shekhar S Aiyar and Ashoka Mody, estimates that the demographic dividend may explain 40 per cent of additional GDP growth since 1980.

They estimate the incremental growth at 1.74 per cent of GDP in the 2000s, and project it at around 2 per cent in the next two decades before tailing off.

China reaped its demographic dividend much earlier thanks to Mao's one-child policy, but that is about to end as the country starts aging. This is one reason why analysts like Goldman Sachs expect India to overtake China in GDP growth in the next decade.

How reforms benefited the poorer half

There has been widespread criticism that the reforms of the last 20 years have bypassed poor regions; have bypassed poor sections of the population like Dalits (formerly called untouchables); that poor people have in desperation taken to Maoism, which now affects almost a quarter of all districts; and that social and poverty indicators have not improved fast enough.

These criticisms are mostly exaggerations or falsehoods.

Poor regions: Many critics assert that poor regions have been bypassed by fast-growing GDP. For instance, James Lamont wrote a news story in the Financial Times headlined 'High Growth Fails to Feed India's Hungry.' This is false.

The proportion of people claiming to be hungry in some or all months has fallen from 17.3 per cent in 1983 to 2.5 per cent in 2004-05.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

Six poor, backward states accounting for half of India's population -- Uttar Pradesh, Bihar, Madhya Pradesh, Orissa, Chhattisgarh, and Jharkhand -- have grown exceptionally fast in recent years, many faster than the national average.

India's western and southern states have historically been dynamos, with the northern and central ones lagging far behind. But in the five years from 2004 to 2009, the mean growth rate surged in the poor northern and central states --Bihar (12.4 per cent), Chhattisgarh (9.7 per cent), Jharkhand (8.5 per cent), Madhya Pradesh (6.6 per cent), Orissa (10.2 per cent), and Uttar Pradesh (6.7 per cent).

Table 3: GDP Growth acceleration in poor states

| | Mean % growth 2000-04 | Mean % growth 2004-09 |

| Bihar | 4.5 | 12.4 |

| Chhattisgarh | 6.1 | 9.7 |

| Jharkhand | 1.9 | 8.5 |

| Madhya Pradesh | 1.9 | 6.6 |

| Orissa | 4.8 | 10.2 |

| Uttar Pradesh | 3.3 | 6.7 |

| All India | 5.6 | 8.5 |

Source: Calculated from data from Central Statistical Organisation

Click NEXT to read on . . .How India became a ROARING Asian tiger!

Critics have asked rhetorically, 'When will growth trickle down to the poor regions?' The question is meaningless in the Indian context. In some small mineral-rich nations, income is concentrated in a few hands, so mineral-based fast growth can bypass the bulk of the population.

This is not possible in a large, diversified country like India with a relatively egalitarian Gini coefficient of 0.37 (this coefficient is a measure of income inequality, and ranges from 0 for complete equality to 1 for complete inequality).

Growth of 8.5 per cent in such a country is possible only if the bulk of the population improves its productivity, as is the case in India. This fast growth of poor states trickled up to create record GDP growth at the national level.

India is mainly a case of trickle up, not trickle down, though of course fast national growth also produced more revenue that was shared with the states.

Maoist travails: Many critics think slow growth and lack of development have led to the rise of Maoist insurrection in some poor states. However, insurrection in India is correlated closely with ethnic and religious divisions, not with poverty or deprivation.

From 1978 to 1993 Punjab, India's richest state, had an insurrection led by the richest community (Jat Sikhs), while the poorest (Mazhbi Sikhs) remained loyal to India. Kashmir has the lowest poverty rate of all states, yet it has suffered insurrection by Kashmiri Muslims wanting independence, with a death toll of approximately 70,000 since 1988.

In Assam a secessionist insurrection has been led by upper-caste Hindus, mainly against poor Bengali immigrants. Maoist violence has been concentrated in tribal areas of central India and is best seen as ethnic conflict between tribesmen and non-tribesmen (though poverty adds fuel to ethnic tensions).

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

The poor states with the most Maoist violence (Bihar, Orissa, Jharkhand, and Chhattisgarh) have recorded exceptionally fast growth in GDP and in literacy. Industrial growth has averaged an impressive 15 per cent in Orissa, Jharkhand, and Chhattisgarh, and is based not simply on mining (which can deprive tribesmen of their land) but on manufacturing.

Dalits, the poorest of the poor: Critics believe that the economic liberalization has benefited just a small elite and left behind the poor, especially the lowest Hindu caste of Dalits. Their condition is worst in northern states like Uttar Pradesh, India's biggest state, with almost 200 million people.

But a recent authoritative survey in two districts of Uttar Pradesh revealed striking improvements in living standards of Dalits in the last two decades. Television ownership was up from zero to 45 per cent; cellphone ownership up from zero to 36 per cent; two-wheeler ownership (of motorcycles, scooters, and mopeds) up from zero to 12.3 per cent; children eating yesterday's leftovers down from 95.9 per cent to 16.2 per cent.

Even more striking was the improvement in Dalits' status. Cases where Dalits were seated separately at weddings were down from 77.3 per cent to 8.9 per cent; cases of non-Dalits accepting food and drink at a Dalit house up from 8.9 per cent to 77.3 per cent; halwaha (bonded labour) incidence down from 32 per cent to 1 per cent; Dalits using cars for wedding parties up from 33 per cent to almost 100 per cent; the Dalit proportion running their own businesses up from 6 per cent to 37 per cent; and proportion working as agricultural labourers down from 46.1 per cent to 20.5 per cent.

The Dalits themselves say the improvement in status matters more than income improvement. Some Dalits have become millionaire businessmen, and have also established a Dalit Chamber of Commerce and Industry. Dalits are still at the bottom of the income and social ladders, but they have gained substantially in the reform era.

Literacy: Literacy is a problem of the poor, not the elite, so it is heartening that in the two decades since 1991, India's literacy rate has shot up by a record 21.83 percentage points to 74.04 per cent.

Table 4: Literacy Rate Accelerates

| | 1950-51 | 1960-61 | 1970-71 | 1980-81 | 1990-91 | 2000-01 | 2010-11 |

| Overall Literacy | 18.3 | 28.3 | 34.4 | 43.6 | 52.2 | 64.8 | 74.0 |

Source: Government of India, Census of India 2011

Click NEXT to read on . . .How India became a ROARING Asian tiger!

In the earlier two decades, it rose only 17.8 percentage points. This figure would be even less if we adjusted for the fact that before 1991 the literacy rate referred to people aged 5 and above, and from 1991 onward referred to people aged 7 and above.

In the last decade, the improvement in all-India literacy (9.7 percentage points) was vastly exceeded by several poor backward states -- Bihar (16.82), Uttar Pradesh (11.45), Orissa (10.37), and Jharkhand (16.07).

Female literacy improved even more dramatically, by 11.8 percentage points across India, and at still higher rates in Bihar (20.2), Uttar Pradesh (17.1), Orissa (13.9), and Jharkhand (15.3).23

Poverty: The poverty headcount ratio, calculated from data from the National Sample Survey Office, has declined from 45.3 per cent in 1993-94 to 32 per cent in 2009-10.

Table 5: Poverty Rates Decline

| 1993-94 | 2004-05 | 2009-10 | |

| Poverty ratio, % | 45.3 | 37.2 | 32.0 |

Source: Government of India, Economic Survey 2011; PTI news item in Business World, April 20, 2011.

Some will say this is not fast enough. However, NSSO surveys now capture only 43 per cent of consumption measured by GDP data against 87 per cent in the 1970s.

Poor people may understate their living standards for fear of losing benefits targeted at the poor. Hence, the poverty headcount ratio may actually be much lower than suggested by the official data.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

The proportion of people saying they have been hungry in some or all months has declined sharply in the poorest states and has fallen overall from 17.3 per cent in 1983 to 2.5 per cent in 2004-05.

Table 6: Fewer households report hunger in last 12 months

| | 1983 | 1993-94 | 1999-2000 | 2004-05 |

| Hunger ratio, % | 17.3 | 5.2 | 3.6 | 2.5 |

Source: Angus Deaton and Jean Dreze, 'Food and Nutrition in India: Facts and Interpretations,' Economic and Political Weekly (India), February 14, 2009.

Booming revenues in the reform era have enabled the central and state governments to greatly increase outlays on subsidies and employment programmes aimed at the poor. These programmes are notorious for fraud and leakages, but nevertheless something is getting through.

However, casual labour wages have risen with fast growth, and labour shortages are being felt everywhere, even in agricultural and construction labour (traditionally viewed as unskilled labour).

Agricultural wages in the 35 months to December 2010 were up by 106.5 per cent and 84.4 per cent respectively in rich agricultural states like Andhra Pradesh and Punjab, and were up sharply even in poor states that normally suffer outmigration, such as Bihar (58.3 per cent), Orissa (62.9 per cent), Uttar Pradesh (62.4 per cent) and Madhya Pradesh (56.2 per cent). Rapid growth has done more to combat poverty than welfare schemes.

The unfinished agenda

Even after two decades of reform, a large unfinished agenda of economic reform remains, as does an even larger unfinished agenda for governance reform.

Economic freedom and doing business: The Heritage Foundation's 2011 Index of Economic Freedom ranks India at just 124th of 183 countries. The Fraser Institute's 2010 Economic Freedom of the World report ranks India a bit better at 87th of 141 countries.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

The Doing Business report of the World Bank places India at just 134th of 183 countries, showing it has a long way to go before it can be called business-friendly.

India comes close to the global bottom in ease of starting a business (165th), getting construction permits (177th), and enforcement of contracts (182nd).

This reflects controls, red tape, and delay (mostly at the state government level), even after significant liberalization by the federal government. India holds the world record for legal case backlogs (31.5 million) which will take 320 years to clear according to Andhra Pradesh High Court judge V V Rao.

Indian states are beginning to improve business conditions but have a long way to go. Meanwhile, the federal government continues with significant curbs on investment in infrastructure, natural resources, the financial sector, education, and retail.

Strict controls on land ownership and the movement of goods thwart agricultural growth. Rigid labour laws have not been amended at all and prevent India from moving into labour-intensive industries that could employ millions.

Social spending and waste: Social spending has boomed along with the economy.

Innovations in the reform era include a rural employment guarantee program; a forthcoming Food Security Act to greatly expand subsidized food for the poor; an expanded Education for All scheme along with a Right to Education Act; a rural health mission; special programs for rural infrastructure and urban problems; and schemes targeted at poorer sections, castes, and religious groups.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

Social spending broadly defined rose from 5.49 per cent of GDP in 2005-06 to 7.27 per cent in 2009-10.33 However, these schemes are dogged by corruption, waste, and leakages on a monumental scale.

Supposedly free government schools and health centers barely function, so poor people increasingly switch to paid private schools and doctors. Powerful trade unions ensure that there is no accountability from teachers, health workers, and other deliverers of government services; absenteeism is rampant and bribes are constantly demanded for supposedly free services.

Major administrative reforms are needed to change incentives and make service providers accountable to the people they serve.

Nutrition: India has some of the worst nutritional indicators in the world. Anaemia affects over 80 per cent of the population in several states. Child malnutrition, measured by low weight for age, affects 46.7 per cent of all Indian children, worse than in any African country.

A family health survey suggests virtually no improvement in child malnutrition between 1998-99 and 2005-06, despite rapid GDP growth. However, data from the National Nutritional Monitoring Board show some improvement.

By global standards Indian children suffer from stunting, low weight, and wasting. The puzzle is that malnutrition and anaemia affect high income groups too. Calorie intake is falling despite rising income -- poor people want to switch to superior, tasty foods rather than get more calories out of basic foods.

Nutrition is a bigger problem than hunger, so nutritional education and fortification of food with vitamins, iron, and iodine are on the future agenda.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

Skill shortage: Every sector in India (including farming and construction) complains today of a labour shortage, but the biggest bottlenecks are in skilled labour.

The government school system is deplorable, and millions leave school functionally illiterate. Both government and private colleges are highly unsatisfactory in both quality and quantity. India needs a huge improvement in education and vocational training if it is to fully harness its demographic dividend.

Voucher programmes can give parents the choice of sending kids to private schools and colleges. The government should allow for profit schools (currently banned) as well as easy entry of foreign universities into India.

Law, order, and justice: The police and courts have a terrible record and are seen as founts of corruption and injustice. Cases drag on for decades, and many criminals die of old age before being convicted beyond all appeals.

India's court case backlog guarantees that many legal controversies will never be settled at all. India has 14,576 judges as against approved and budgeted posts of 17,641. This works out to 10.5 judges per million population, against the Indian Supreme Court's suggested norm of 50 per million.

India has less than one policeman per thousand people against the UN standard of 2.2.

Politicians misuse powers of arrest and prosecution to protect wrongdoers in their own ranks and to target opposition groups. Vast areas of rural India have very few police, courts, or forms of administrative redress, and poor people complain that the few rural police are bought off by richer landowners and traders.

This is one reason why Maoists have come up in remote areas -- they hold courts and implement instant rough justice, filling a void created by state absence.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

In enforcement of contract, India ranks a shocking 182nd of 183 countries according to the World Bank. It's called a miracle economy, but the real miracle is how it manages to grow fast despite such a flawed institutional base.

A saving grace is that while civil cases go on forever, Indian courts are speedy and effective in checking arbitrary actions by the government, and this is highly valued by all businesses including foreign ones.

Corruption: This is the hottest political topic in India today. After decades of increasing criminality and corruption in politics and the bureaucracy, public anger over corruption has exploded.

This is a structural shift linked to the rise of an assertive middle class, exemplified and amplified by television channels.

Politics is widely seen as business, and politicians as millionaires, and this is now affecting politics where it hurts -- in election results. That is a hopeful sign. Most surveys show that people think corruption is getting worse, with the biggest culprits being politicians, the police, and bureaucrats, in that order.

However, it seems possible that India is experiencing more public outrage rather than more corruption, as suggested by the Corruption Perception Index of Transparency International. This ranks India 87th out of 178 countries, behind China (78th) but well ahead of Bangladesh (134th) and Pakistan (143rd).

India has actually improved its score slightly over the years, from 2.7 out of 10 in 2002 to 3.3 in 2010. This may be because corruption has been abolished by deregulation in several areas (industrial licenses, import licenses, monopolies clearance, foreign exchange permits), and this tends to offset rising corruption in areas of political allocations (natural resources, real estate, and government contracts).

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

However, rising corruption in these three areas has been so brazen as to make politicians richer and the public angrier than ever before, stoking criticism that liberalization amounts to a ploy to enrich politicians and business cronies alike.

Not everyone recognizes the problem as one of insufficient liberalization that leaves too much space for political discretion and favouritism.

Infrastructure: A major barrier to growth in the coming years will be insufficient infrastructure, and this is connected with corruption. Roads, power, ports, railways, and telecom are all connected with the three top areas of corruption -- natural resources, land, and government contracts.

Private coal mining is still not permitted save for captive industrial consumption. No agricultural land can be converted into non-agricultural land for industry or services without government permission, which provides huge kickback opportunities.

India needs more open, transparent procedures and the abolition of political discretion in these areas, not just to provide cleaner government but to accelerate infrastructure provision, too.

Criminals in politics: In the 2009 elections, 150 of 542 seats were won by politicians with criminal records, including cases of murder, rape, and theft. This was up from 128 such politicians in the 2004 elections.

The situation is about as bad in the state legislatures. The inability of courts to convict people beyond appeals means thugs can use money and muscle with impunity. This translates into a deplorable form of political clout, and so the thugs are wooed by political parties and join politics to stall cases they face.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

This deterioration of political morality is intimately linked with the rise of big-ticket corruption and of the public anger against it.

Possible reforms include independent institutions (like the proposed Lokpal, an ombudsman with teeth) to investigate corruption by ministers and top politicians. Another proposal is to decree legal seniority for all cases against elected legislators.

Once thugs find that getting elected expedites rather than stalls their criminal trials, they will lose interest in joining politics, which will automatically become cleaner.

Governance reforms are key today

India's unfinished reform agenda includes two main areas: economic reform and governance reform. Of the two, governance reform lags far behind and is thus more important.

After all, economic reform has already been deep enough to produce 8.5 per cent growth and give India a miracle economy status, but the same cannot be said for governance. Indeed, the real miracle is that India has grown so fast despite so much misgovernance.

Whereas economic reform can improve governance in key areas, good governance is desirable in itself and it is an essential ingredient for faster economic growth.

Free competition and a level playing field for business are not possible without decent governance. Reform of the police-judicial system will not just improve crime detection and redress of grievances, it will also improve contract enforcement and protection of property rights.

Click NEXT to read on . . .

How India became a ROARING Asian tiger!

If land, mineral licenses, and the telecom spectrum are auctioned transparently and not handed out to favored parties, that will not only check corruption but will also help make productivity more important than political connections, an essential condition for dynamic competition.

Eliminating corruption from government contracts will mean not only cleaner politics and administration but more bidders for every contract, reducing costs and speeding up projects.

Eliminating criminals from politics will not just signal that crooks and cronies cannot gain immunity by joining politics, but will reduce a significant cause of corruption and rent-seeking and can thus help create freer markets and increased competition. That is the way India needs to go.

Reproduced with kind courtesy of The Cato Institute

Dr Swaminathan S Anklesaria Aiyar is a Research Fellow at the Cato Institute's Center for Global Liberty and Prosperity and has been editor of India's two biggest financial newspaper, the Economic Times and Financial Express.