| « Back to article | Print this article |

High gold prices let Indians feel richer, spend more

The data flow in recent months suggests that despite considerable tightening of monetary policy by the Reserve Bank of India over the course of 2010 and 2011, inflation, although it has declined, has exhibited a disquieting stubbornness. India has also been an outlier in relation to most of its comparators in the context of price stability.

The evolution of Indian inflation has brought forth several explanations, most with some merit. Among these both monetarist theories and structural explanations have been advanced, as well as internal and external factors. In the former category, a delay or insufficient tightening early in the cycle resulted in generalised inflationary expectations percolating through the economy; in other words, policy makers initially underestimated the risk. In the second category, domestic food price developments catalysed by changes in minimum support prices are drivers.

In addition, it has been argued that wage push on account of government-funded entitlement schemes in rural areas continues to put an upward pressure on prices. Among the external causes, the high oil prices since 2008 have been important in policy discourse. Another external variable that has, intermittently, lent itself as a contributor to price pressure at home is the high global prices of various food cereals.

Click NEXT to read more...

High gold prices let Indians feel richer, spend more

At its simplest, interest rate changes control inflation by tempering current investment and consumption through making it more expensive to borrow - in part, growth in aggregate demand is moderated through inducing a change in expected future market interest rates.

Usually, the private sector responds to the change in incentives more than the government. Cumulatively, over the cycle, the Reserve Bank of India's policy rate changes have been prima facie striking, even as the impact on inflation has been gradual and less effective than policy makers had probably hoped.

The repo rate was increased in 13 steps between March 2010 and October 2011 from 4.75 per cent to 8.5 per cent. Inflation measured by the wholesale price index has remained above the RBI's comfort zone of 5-5.5 per cent for three years now, and persists in the 7-8 per cent range.

The consumer price index, which analysts claim is important for assessing trends in inflation expectations, has stayed in the 9-10 per cent range since April 2012; that is why the RBI has refrained from further cuts since the 50-basis point reduction in April.

There can be several plausible reasons for the relatively slow price response to an activist monetary policy including, inter alia, persistent increases in seignorage, required by a deep fiscal malaise, which is feeding expectations of continuing inflation; "misbehaviour" of monetary policy transmission channels vis-a-vis the real economy; and so on.

Click NEXT to read more...

High gold prices let Indians feel richer, spend more

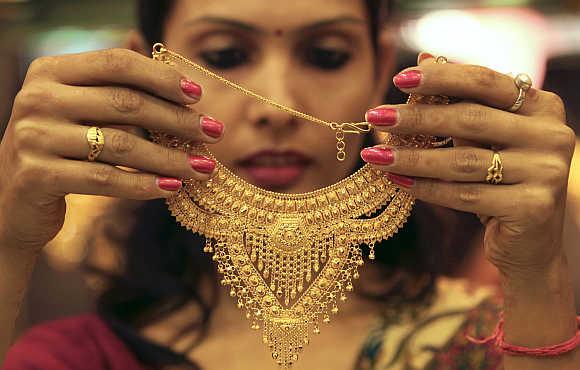

It is noteworthy that seignorage as a ratio to GDP has seen an uptick in India post-2007 compared to previous years. There might be an additional explanation. Indians in recent years have benefited from a huge positive boost to their private wealth (and private net worth); this wealth effect originates in the 75 per cent increase in global gold prices between October 2009 (roughly $1,000/ounce) and October 2012 (about $1,750/ounce).

In rupee terms, the increase is even greater. Even while keeping aside the rise in volume (that is, inflow) of gold imports in recent years, India's widely held private stock of gold is disproportionately lar#8805 a quick data scan reveals estimates of the stock ranging from a low of 13,000 tonnes to as high as 40,000 tonnes, although the latter is probably an exaggeration.

As an example, assume that the private stock of gold in India was 17,000 tonnes in 2009; the value of this in October 2012 would work out to about $960 billion (over 50 per cent of GDP) compared to around $550 billion three years earlier. The time frame is illustrative, and some other snapshot can be used.

There is little doubt that India is sui generis when it comes to the importance of gold in its citizens' portfolio of savings instruments and stock of wealth.

Click NEXT to read more...

High gold prices let Indians feel richer, spend more

While gold is not the only global commodity whose price has increased appreciably, gold has characteristics that are distinctive. Households rarely hoard other commodities to pass them from one generation to the next; the exception would be oil owned by Saudi princes.

Long after the gold standard become history, gold held by central banks, national treasuries and multilateral institutions is still counted as a foreign asset in official balance sheets. Physical gold as store of value and as a "guarantee to redeem promises" puts it in a class of its own among physical assets.

While the real value of most financial assets held by Indians has declined (in line with developments elsewhere), house prices have somewhat moderated and business investment has stalled against the background of poor governance, the boost in the value of the stock of gold may have engendered wealth effects that propped up household consumption to some extent even as policy has increased interest rates across the board.

It is not unreasonable that enhanced feeling of well-being due to higher wealth can induce a consumer to spend a higher amount from her recurring "normal" income.

Click NEXT to read more...

High gold prices let Indians feel richer, spend more

It is not that policy-induced interest rate hikes have been ineffective on prices and the real economy - the argument is that a coincidental, essentially external, dynamic may have helped to partially offset the effects of monetary tightening. Asset prices have been known to unravel - especially instances when the run-up is of the "bubble" variety rather than fundamentals-driven.

Therefore, households' perception of the permanence or temporariness of the gold price increase (and their increase in wealth) is critical for determining the extent to which their consumption has been impacted on account of this channel. In conclusion, if gold prices stay elevated or increase going forward, and wealth effects emanating from this externally generated feature are quantitatively important, then monetary policy has that much more work to do to tame inflation.

upatel@brookings.edu