| « Back to article | Print this article |

Bank CEOs earning crores in India

HDFC Bank's managing director, Aditya Puri, continues to remain the highest paid banking chief in the country, despite taking a lower increment than some counterparts during 2012-13.

Puri has been leading the country's second largest private bank since 1994. He earned Rs 5.02 crore (Rs 50.2 million) in FY13, 2.4 per cent more from a year earlier.

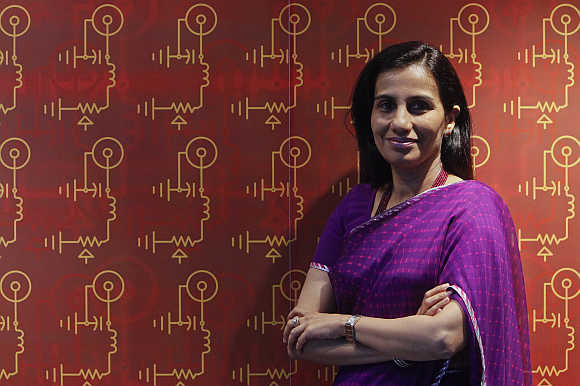

ICICI Bank's managing director and chief executive, Chanda Kochhar, earned Rs 4.1 crore (Rs 41 million). Axis Bank's MD & CEO, Shikha Sharma, received Rs 3.41 crore (Rs 34.1 million).

Click NEXT to read more...

Bank CEOs earning crores in India

Kochhar got 8.7 per cent more pay and Sharma's income increased by 14 per cent in 2012-13. The remunerations mentioned included basic pay, performance bonus, allowance and perquisites, plus retirement benefits such as contribution to provident fund, gratuity and superannuation fund.

Typically, the performance bonus accrued during a financial year is paid in the next year.

Click NEXT to read more...

Bank CEOs earning crores in India

In the Reserve Bank of India's guideline of January 2012, the performance bonus of private banks' chiefs is capped at 70 per cent of their fixed pay.

Also, if the amount of performance bonus is more than 50 per cent of the CEO's fixed pay, the payment needs to be spread over a period of time.

So, while the performance bonus accrued to Kochhar in 2011-12 was Rs 1.3 crore (Rs 13 million), she was paid only 60 per cent of that or Rs 0.78 crore (Rs 7.8 million) in 2012-13.

Click NEXT to read more...

Bank CEOs earning crores in India

Similarly, Puri got Rs 1.24 crore (Rs 12.4 million) and Sharma Rs 0.38 crore (Rs 3.8 million) as performance bonus in FY13. According to sector analysts, the top private banks have performed better than state-run rivals in the past few years and improved their profitability despite an uncertain macro-economic environment.

In 2012-13, ICICI Bank's standalone net profit increased by 29 per cent, HDFC Bank's by 30 per cent and Axis Bank's by 22 per cent. This and the growth in businesses have allowed private lenders to reward their CEOs with higher remuneration, they said.