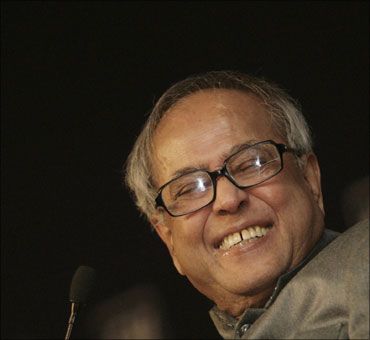

Photographs: Reuters

Under pressure from civil society to take concrete action on black money, the government said on Monday it has enough tools to deal with transactions arising from non-cooperative jurisdictions and would take action as and when necessary.

"We have developed a toolbox. . . We have enabled ourselves to declare (tax havens) as non-cooperating jurisdiction and countries as and when the situation arises. We will take appropriate steps," Finance Minister Pranab Mukherjee told reporters in New Delhi on Monday.

. . .

Have toolbox to deal with reticent tax havens: FM

However, he added that as of now, 'no country' has been put in the category of a 'non-cooperating jurisdiction'.

India, the minister said, is negotiating Double Taxation Avoidance Agreements with several countries and also entering into Tax Information Exchange Agreements with tax havens.

"We are getting substantial cooperation," he said.

. . .

Have toolbox to deal with reticent tax havens: FM

The government, the minister further added, has developed a 'toolbox' to deal with non-cooperative jurisdictions by making appropriate changes in the Income Tax Act, 1961.

As per the 'toolbox' to check black money, payments made to entities located in countries and tax jurisdictions that refuse to share tax-related information will attract a withholding tax, or tax deducted at source, of 30 per cent or more.

. . .

Have toolbox to deal with reticent tax havens: FM

The G-20 leaders had asked each country at their Seoul summit last year to develop a toolbox of counter-measures against non-cooperative jurisdictions.

Under the proposed provisions, the government will notify the countries and jurisdictions that are reluctant to share banking information and other details with it.

. . .

Have toolbox to deal with reticent tax havens: FM

'End banking secrecy'

According to another report, Finance Minister also called for stepping up multilateral cooperation to end the era of banking secrecy and deal with the 'abusive' transfer pricing mechanism that is robbing developing nations of their scarce natural resources.

Mukherjee, while addressing a seminar on international taxation jointly organised by his ministry and the Organisation for Economic Cooperation and Development, regretted that the banking system is still opaque in various non-tax and low tax jurisdictions.

. . .

Have toolbox to deal with reticent tax havens: FM

Despite efforts made at the global level and statements issued by G-20 leaders at their London summit in April, 2009, "We cannot say with certainty that the bank secrecy is over in all cases", the minister said.

"While the countries have accepted to end bank secrecy in general, come countries have agreed to do so only from a prospective date and are not willing to exchange past banking information," Mukherjee said.

. . .

Have toolbox to deal with reticent tax havens: FM

Image: Pranab Mukherjee.Such issues put a question mark on the efficacy of the present legal provisions for exchange of banking information, he said, adding, "There is an urgent need to revisit the existing legal framework developed by the OECD in this regard".

The OECD is a club of developing countries and has been playing a key role in reforming the international taxation system.

Referring to the issues concerning transfer pricing, the minister said, "This abusive behaviour is robbing developing countries of their scarce resources, which is required for financing development programmes."

article