Photographs: Reuters. Ajay Modi in New Delhi

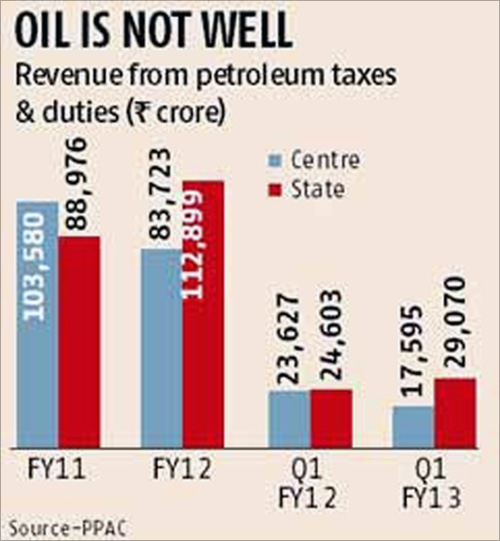

In a year that is certain to see a record fuel subsidy, the exchequer's earnings in the form of taxes and duties from oil and gas declined 26 per cent in the first quarter (April-June) to Rs 17,595 crore (Rs 175.95 billion), while states pocketed 18 per cent more in the same period.

States together earned Rs 29,070 crore (Rs 290.70 billion) from the sector, due to the ad valorem nature of taxes. States' combined revenue from the petroleum sector overtook the Centre's earning for the first time in 2011-12.

...

Govt's petro bill turns a headache

Photographs: Reuters.

The Centre's revenue from the sector declined after it eliminated the Customs duty on crude oil in June last year and also reduced excise on diesel by Rs 2.68 a litre.

"The fall would have been steeper, had the government not increased the cess on domestic crude oil production from Rs 2,500 to Rs 4,500 per tonne from March 14 this year," said an official at the petroleum planning and analysis cell of the petroleum ministry.

The government, which bears almost 60 per cent of the country's fuel subsidy bill, took a hit of Rs 83,500 crore (Rs 835 billion) in oil subsidy, while it earned Rs 83,723 crore (Rs 837. 23 billion) from the sector.

...

Govt's petro bill turns a headache

Photographs: Reuters.

The oil subsidy for 2011-12 was Rs 138,541 crore (Rs 1.38 trillion), of which Rs 55,000 crore (Rs 550 billion) came from the government-owned upstream oil companies, Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL).

The Centre regulates the prices of diesel, kerosene and domestic LPG (up to six per consumer).

It is the state-owned oil marketing companies - Indian Oil, Bharat Petroleum and Hindustan Petroleum - that together cater to the domestic demand for products.

...

Govt's petro bill turns a headache

Photographs: Reuters.

The losses incurred by the three for sale at government regulated prices are compensated partly by a cash subsidy and partly by discounts on crude oil by ONGC and OIL.

Going by last year's government share of 60 per cent, it might be required to shell out Rs 96,000 crore (Rs 960 billion) of the projected oil subsidy of Rs 160,000 crore (Rs 1.6 trillion).

So far, only a promise of about Rs 30,000 crore (Rs 300 billion) is made to the OMCs for this year.

...

Govt's petro bill turns a headache

Photographs: Reuters.

The fuel subsidy is higher this year, mainly on account of the sharp depreciation in the rupee against the dollar.

The high subsidy burden at a time when the Centre is struggling to maintain its fiscal deficit target is not good news.

Last month, subdued tax revenue and higher spending on subsidies forced the Centre to revise its fiscal deficit target to 5.3 per cent of gross domestic product for the current financial year from the Budget target of 5.1 per cent. Achieving 5.3 per cent, too, experts say, will not be easy.

article