Photographs: Reuters. BS Reporter in Mumbai

The dark clouds of a slowdown are hovering ominously over everybody, except 81,000 households in India for whom the word 'downturn' just doesn't exist.

What would be music to the ears of luxury goods companies in India, members of these ultra high networth households (HNHs) refuse to acknowledge there is a downturn when it comes to spending.

...

It's a luxurious life for 81,000 households in India!

Image: A worker displays a miniature 22 carat gold replica of the historic Taj Mahal at the India international jewellery exhibition in Chennai.Photographs: Babu/Reuters.

"The slowdown in the Indian economy has not affected their spending patterns, with many of them stating that maintaining their lifestyle is an extremely important facet of their social life," says the second edition of a report titled 'Top of the Pyramid'.

And over 60 per cent of those who said there was no slowdown were from non-metros.

...

It's a luxurious life for 81,000 households in India!

Image: Chairman of Reliance Industries Mukesh Ambani (L) attends the TIME 100 Gala, with wife Nita.Photographs: Stephen Lovekin/Getty Images.

The report, a joint study by Kotak Wealth Management and CRISIL released on Tuesday, has defined an ultra HNH as one having a minimum average networth of Rs 25 crore.

According to the report, the ultra HNH tribe is set to zoom. Their number is estimated to have grown 30 per cent to around 81,000 in 2011-12, and are expected to treble to around 286,000 over the next five years.

...

It's a luxurious life for 81,000 households in India!

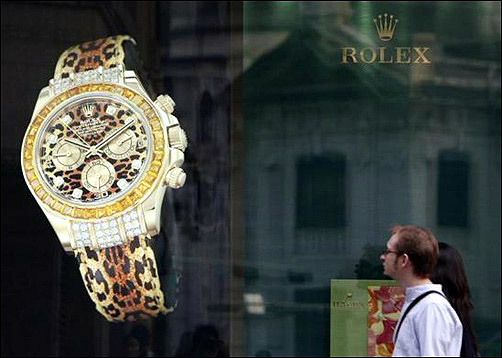

Image: Foreign visitors walk past a watch brand advertisement.Photographs: Reuters.

The networth of these households is estimated to surge five times from an estimated Rs 65 lakh crore in 2011-12 to Rs 318 lakh crore by 2016-17.

Over 50 per cent of them are in the four metros, and the next top six cities account for around 12 per cent.

Apparel and accessories are on top of their shopping list - evident from a 50 per cent jump over last year. That is followed by vintage spirits/liquor, jewellery and precious stones and luxury watches.

| INDIVIDUAL TAXPAYERS (FOR FY12) | |

| Taxable income | Taxpayers (million) |

| Up to Rs 5 lakh | 28.8 |

| Rs 5-10 lakh | 1.8 |

| Rs 10-20 lakh | 1.4 |

| Above Rs 20 lakh | 0.4 |

| Total | 32.4 |

| Source: Govt data |

...

It's a luxurious life for 81,000 households in India!

Image: Burj Al-Arab is a luxury hotel located in Dubai.Photographs: Courtesy, Jumeirah.com.

Last year, destination weddings were the 'in thing'. However, these seem to have lost their attraction.

Throwing lavish parties for ad hoc events such as business success or product launches has become a new area of spending.

...

It's a luxurious life for 81,000 households in India!

Image: Red cloth veils the scaffoldings at the renovation site of the Landwasserviadukt bridge as a train crosses near the eastern Swiss town of Filisur.Photographs: Arnd Wiegmann/Reuters.

If you thought shopping vacations in Paris or Switzerland was the ultimate luxury in life, the ultra HNHs think they are for the masses.

They now plan two to four international trips every year to exclusive locations like Machu Pichu, Bora Bora island and so on.

...

It's a luxurious life for 81,000 households in India!

Image: Customized Mercedes-Benz SL600s, Luxury Crystal Benz, studded with 300,000 Swarovski crystal glass, are displayed at the pavilion of custom car accessory company Garson/D.A.D at Tokyo Auto Salon 2010.Photographs: Reuters.

The report highlights that exclusivity is a major driving force behind ultra HNIs' luxury car purchases, and many a time even established brands/models are not considered because they lack exclusivity or are seen as mass luxury cars.

High-end luxury cars from Japan are still preferred for regular use, as they are seen as the most suited to Indian roads.

...

It's a luxurious life for 81,000 households in India!

Image: New Volkswagen Touareg.SUVs/crossovers continue to be the most preferred cars among ultra HNIs. Surprisingly, most ultra HNIs (65 per cent) buy cars on loan to avail tax benefits.

But it's a different story when it comes to investments.

The focus of ultra HNHs is on capital protection, low-risk instruments like fixed income and avenues they understand better.

article