Photographs: Reuters Deepak Korgaonkar and Viveat Susan Pinto in Mumbai

Five sectors have helped prop up the numbers for India Inc in an otherwise dismal quarter ended March.

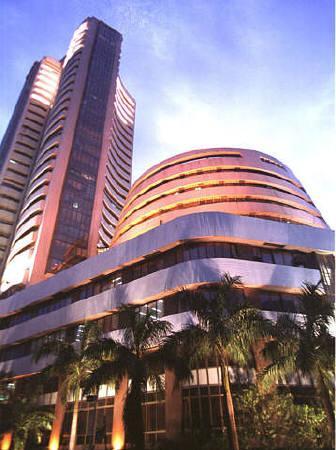

An analysis of 989 companies that account for 52 per cent of the total market capitalisation on the Bombay Stock Exchange shows net profit growth of 2.7 per cent over the previous year was reported mainly due to strong profit numbers registered by players in banking, cement, information technology, pharmaceuticals and fast moving consumer goods.

Take these out, and the net profit of the sample size sees a substantial decline -- as much as 9.6 per cent for the quarter.

What's worrying is the quality of overall earnings.

. . .

Fab five sectors salvage India Inc's bottom line

Image: Reliance Industries Ltd chairman Mukesh Ambani.Photographs: Reuters

In a May 12 report, Dipojjal Saha of Edelweiss Securities says, "For companies within our coverage universe which have declared results so far, year-on-year earnings growth came in at three per cent (the Edelweiss expectation was four per cent).

"The disappointment is on the core earnings front, as some part of the earnings surge may have been driven by higher other income (e.g. PSU banks, RIL and Maruti Suzuki).

For companies that have declared results so far, we estimate that other income as a proportion of sales is at 2.7 per cent, which is a multi-quarter high (11 quarters)."

Saha adds, "Margins continued to disappoint, contracting 320 basis points year-on-year. Even if balance earnings (of remaining companies, which are yet to announce results) were to come in line, earnings growth for our coverage universe would be 3-3.5 per cent year-on-year, implying a fifth consecutive quarter of sub-10 per cent earnings growth."

. . .

Fab five sectors salvage India Inc's bottom line

Image: A man pulls a hand-drawn cart in front of the Reserve Bank of India building in Mumbai.Photographs: Danish Siddiqui/Reuters

Just how important the five sectors have been to India Inc's performance in March 2012 quarter can be gauged from this: Of 989, as many as 229 companies have reported a net loss, while another 212 firms have reported a drop in net profit.

These companies are all out of the fab five list.

So, how did these entities in the five key sectors manage to sustain profit growth at a time when inflation as well as interests costs have been biting hard?

In FMCG, for instance, analysts attribute this trend to consistent price hikes taken through the quarter as well as the full year ended March.

On average, companies took up product prices by at least 5-7 per cent during each quarter for the fiscal ended 2012.

. . .

Fab five sectors salvage India Inc's bottom line

Photographs: Reuters

That resulted in overall profit growth of 27 per cent for FMCG companies as a whole.

Sunil Duggal, CEO, Dabur India, says the strategy has been to take measured hikes rather than pass on all of the commodity inflation in one go.

"Who wants to add to the general inflation prevalent around?" he asks.

This point is corroborated by A Mahendran, managing director, Godrej Consumer Products.

"Given that consumers' wallet share is coming down, a prudent strategy would be to take small but consistent price hikes," he says.

This strategy has paid off, with companies seeing good sales volume growth in the quarter as well as the full year ended March.

. . .

Fab five sectors salvage India Inc's bottom line

This, say analysts, also contributed to healthy profit numbers in the quarter under review.

Besides, FMCG companies have played around with their advertising and sales promotion expenditure to help them log better profits.

On average, for the quarter as well as the full year ended March, FMCG companies spent 11-12 per cent of net sales on ASP as opposed to 13-14 per cent in the year-ago period.

Their operating performance obviously improved as a result of this.

Analysts say the trend could continue into the next few quarters as companies continue to battle inflation.

While headline inflation has been just below seven per cent, consumer price inflation, which measures product prices to the end-consumer, has been in the region of about 7.5 per cent.

. . .

Fab five sectors salvage India Inc's bottom line

Photographs: Reuters

The result of this has been demand moderation, as indicated by Mukesh Agarwal, senior director, CRISIL Research.

"Corporate India continues to feel the pinch of demand moderation, higher input costs and a lack of pricing power," he says.

For IT, what helped report good profit numbers in the March quarter was a falling rupee, down 4.12 per cent during the three months ended March.

According to analysts, a weak rupee is generally a positive for the IT sector, as it earns mostly in dollars.

Every single percentage point fall or rise in the rupee has an impact of 30-50 basis points on margins, they say.

There were other positives, too, like the relatively steady demand for outsourcing and offshoring services, which is a key monitorable going ahead, given the muted guidance by some large players.

. . .

Fab five sectors salvage India Inc's bottom line

Photographs: Sherwin Crasto/Reuters

Also, many smaller IT firms reported a strong performance.

For instance, Hexaware surpassed its Q1 (quarter ended March) revenue guidance and reported topline growth of 28.8 per cent at Rs 438.3 crore (Rs 4.38 billion), compared with Rs 318.5 crore (Rs 3.18 billion) in the same quarter last year.

Mastek registered a net profit of Rs 7.1 crore (Rs 71 million) for the quarter ended March after it reported losses for the last six quarters.

Analysts say the demand for Mastek's products and services remains strong.

The company's 12-month order backlog was Rs 401 crore (Rs 4.01 billion) as on March 31, 2012, as compared to Rs 369 crore (Rs 3.69 billion) at the end of the quarter ended December 31, 2011, reflecting an increase of 8.7 per cent in rupee terms.

. . .

Fab five sectors salvage India Inc's bottom line

Photographs: Reuters

Banking, in contrast, benefited from lower provisions, higher fee income, and growth in interest income from advances.

This was especially true for private banks like HDFC Bank, ICICI Bank and Axis Bank. ICICI Bank MD & CEO Chanda Kochhar said: "We followed a strategy of profitability, growth and risk management during the year.

"We saw a healthy rise in other income mainly due to dividend from our subsidiaries. This was the year when our subsidiaries started becoming profitable and contributed to handsome dividends for the parent."

HDFC Bank's performance was in line with the past trend of 30 per cent profit growth.

It has enhanced focus on retail lending, helping it earn higher yields.

. . .

Fab five sectors salvage India Inc's bottom line

Image: ICICI Bank.Overall, private banks did better than public ones, with the latter showing higher stress on asset quality.

Saha notes, "PSU banks' results were characterised by weak asset quality with slippages coming in higher by 150-200 basis points than average delinquencies in nine months of FY12.

"Their PAT was higher than expected, but was driven by a lower tax rate and investment write-back depreciation."

Cement firms gained from better control over costs and rise in realisations.

Volume growth was decent, given slowing economic growth.

So, margins improved and net profit growth was ahead of topline growth.

. . .

Fab five sectors salvage India Inc's bottom line

Photographs: Reuters

Pharma firms, too, posted strong results, especially Ranbaxy, which gained from the strong contribution of its Lipitor generic drug as it is in the exclusivity period.

However, on the whole, the FY13 outlook doesn't look good. Edelweiss analysts say the FY13 earnings trajectory for the Sensex, which had shown signs of bottoming out in March, is once again exhibiting some weakness.

"Since the results season began, there have been (earnings) downgrades of 1.2 per cent, with heavyweights RIL, Infosys, Bharti Airtel and Wipro being downgraded 3-7 per cent," says Saha.

In association with Shivani Shinde and Somasroy Chakraborty

article