Photographs: Reuters Daniel Gros

Back in 2007-08, when the financial crisis was still called the "sub-prime" crisis, Europeans felt superior to the United States.

European bankers surely knew better than to hand out so-called "NINJA" (no income, no job, no assets) loans.

These days, however, Europeans have little reason to feel smug. Their leaders seem unable to come to grips with the eurozone's debt crisis.

Banks in Ireland and Spain are discovering that their customers are losing their jobs and income as the construction bust hits the national economies.

And one could argue that a loan to the government of Greece or Portugal affords little more security than a NINJA loan.

...

Europe's sub-prime quagmire

Image: Banks in Spain are going through a rough time.Photographs: travelkat.com

Indeed, lending to governments and banks on the European periphery represents the European equivalent of sub-prime lending in the US (which was also concentrated in a few sunshine states).

Given the many similarities between the two crises' basic features, European leaders could learn a lot from the US experience.

The first lesson is that, despite the limited overall volume of subprime loans, the subprime crisis could blow up into the biggest financial crisis in living memory, because an overstretched financial system was unable to cope with even limited losses.

Similarly, the combined debt of Greece, Ireland and Portugal is small relative to the eurozone economy, but the European banking system is still so weak that these countries' debt problems can create a systemic crisis.

...

Europe's sub-prime quagmire

Image: Greece's debt is comparitively low.Photographs: theodora.com

Then, once the financial system has been stabilised, a combination of debt restructuring and recapitalisation is required. Has the European Union followed this recipe?

After some hesitation, Europe showed that it could manage the first phase - a liquidity injection to prevent systemic collapse. Greece and Ireland received funding when they were shut out of the capital market.

And the last EU summit announced the creation of a permanent European Stability Mechanism - a sort of European Monetary Fund with an effective lending capacity of euro 500 billion.

...

Europe's sub-prime quagmire

Image: Ireland's economy has gone from boom to bust.Photographs: custompokertables.com

The ESM should be sufficient to deal with the refinancing needs of Greece, Ireland and Portugal.

It might even be sufficient to address the Spanish government debt, though this would be a stretch.

But just as the $700 billion TARP did not assuage the nervousness of financial markets in 2008, the ESM's euro 500 billion seems to have left investors unimpressed.

The risk premia on the sovereign debt of Greece, Ireland and others have not diminished.

...

Europe's sub-prime quagmire

Image: Premia paid by Portugal have risen.Photographs: trekexchange.com

In the US, the turning point came with the authorities' stress tests of banks in the early 2009.

The tests were seen as credible; their results prompted US officials to force several major banks to increase their capital.

This did not happen in last year's European version of the US stress tests, and this year's stress tests in Europe are unlikely to be tougher.

...

Europe's sub-prime quagmire

Image: Debt reduction is comparatively easy in the US.Photographs: Reuters

By contrast, European authorities refuse to test the scenario that the market currently fears most: losses on loans to banks and governments on Europe's periphery.

A third lesson derives from a little-noticed but vital aspect of the US experience: debt reduction is comparatively easy in the US, because the no-recourse feature of most mortgages there limits repayment obligations to the value of the house.

Moreover, the US bankruptcy code can free consumers of their debt within months.

...

Europe's sub-prime quagmire

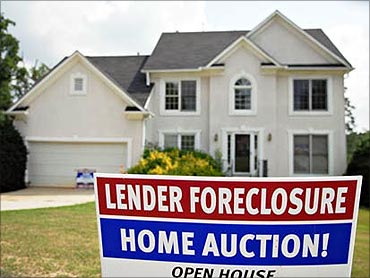

Image: Home foreclosures provide debt relief.Photographs: cdloanmod.com

This steady flow of debt relief is allowing US consumer spending to recover slowly.

By contrast, debt restructuring for either banks or governments is politically unacceptable in Europe.

This implies that the crisis is likely to persist much longer than in the US, because households in Spain and Ireland will labour for decades to service mortgages on houses that they can no longer afford.

...

Europe's sub-prime quagmire

Image: Debt relief created fewer problems for US banks.Debt relief created fewer problems for banks in the US because a significant proportion of the sub-prime loans packaged into AAA-rated securities had been sold to gullible foreigners.

A good proportion of the losses on sub-prime lending was, thus, borne by banks from Northern Europe, leaving these banks in no position to sustain further losses on their European peripheral lending.

But this should compel a strong recapitalisation programme - not weak stress tests.

Europe is making a fundamental mistake by allowing the two key elements of any resolution of the crisis - debt restructuring and real stress tests for banks - to remain taboo.

As long as successive EU summits persist in this mistake, the crisis will fester and spread, eventually threatening the stability of the eurozone's entire financial system.

The author is Director of the Centre for European Policy Studies.

Copyright: Project Syndicate, 2011

article