| « Back to article | Print this article |

Equities remain attractive, caution on gold

Samvat 2066 was an average year for equities. But, commodities, led by silver and gold, and residential real estate, outperformed returns among all asset classes.

Going forward, equities remain attractive, but there is a sense of caution for gold in the short term. Commercial real estate is expected to perform better than its residential counterpart.

Click NEXT to read on...

Equities remain attractive, caution on gold

Click NEXT to read on...

Equities remain attractive, caution on gold

Equities remain attractive, caution on gold

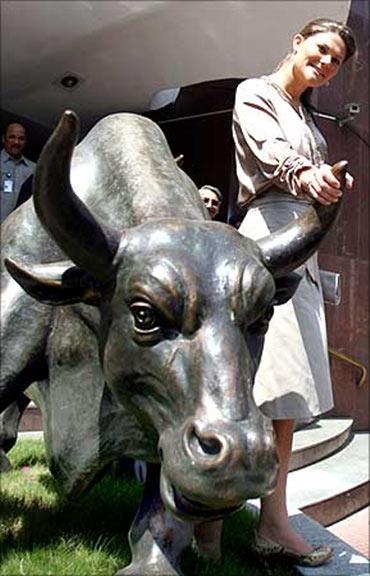

Case for equities

Going forward, 'slow and steady wins the race' seems to be the theme. ENAM Group Chairman Vallabh Bhansali said: "If the equity market rises steadily, it has the potential to give above-average returns in the coming Samvat year. Given where interest rates are, the next six months look very good for equities in any case."

ICICI Prudential Asset Management Deputy Managing Director Nilesh Shah advises patience.

He says: "India is benefiting from the wealth effect, through appreciation of land, gold and equity prices. If the government can raise productivity across the economy through better governance, this wealth effect can be sustained and not get converted into a bubble.

Equities remain attractive, caution on gold

ENAM Group's Bhansali also believes gold will continue to be an asset class to reckon with, given the currency problems the world is facing.

With a five-year return of 186 per cent compounded and 227 per cent for silver, bullion has been a best-performer asset class. Equity returned 163 per cent.

Commtrendz Research director Gnanasekar Thiagarajan said: "In India, commodities as an asset class have not gone beyond gold and silver. While in the coming months some exchange-traded products in commodities may be launched, bullion would remain a preferred commodity for allowing investments from a policy perspective."

Click NEXT to read on

Equities remain attractive, caution on gold

His logic is that investors will soon realise that second dose of stimulus or quantitative easing (QE2) will prove good for the US and result in growth, which could reduce gold's appeal for hedging, and profit-booking will bring a much-needed correction here. He does not rule out a $100 correction from the current level.

Click NEXT to read on

Equities remain attractive, caution on gold

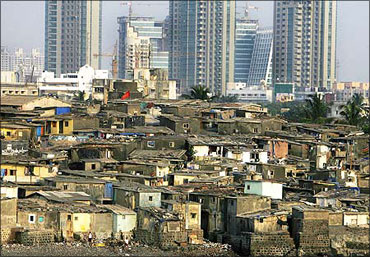

Chennai gave 83 per cent returns in the past three years, Mumbai 60 per cent, and Delhi returned just 10 per cent, with the Delhi index at 110 this June.

Click NEXT to read on

Equities remain attractive, caution on gold

Click NEXT to read on

Equities remain attractive, caution on gold

He says: "Except actual users, investors should be cautious while investing money in residential property, especially in cities like Mumbai, but commercial properties could give compounded returns of 50 per cent in the next three years and tenant-occupied properties will certainly give higher returns."

Click NEXT to read on

Equities remain attractive, caution on gold

Milestone Capital Managing Director Ved Prakash Arya says: "Over 50 per cent of the portfolio should be invested in equities and one may consider 10 per cent investment in unlisted firms through private equities, five to 10 per cent in bullion, 20-25 per cent in pre-rented real estate and the rest in debt."