Image: Joseph Stiglitz.

Jyoti Mukul

Former chief economist at the World Bank, Joseph Stiglitz, is known for his scathing criticism of the American economic policies under President George Bush and Barack Obama. For him, economic normalcy is not the same as the end of Freefall caused due to lax regulations in a free market. Speaking to Business Standard on the sidelines of the Delhi Sustainable Development Summit, the winner of the 2001 Nobel Prize for Economics says recovery could be difficult if the crisis in Egypt spreads to the entire region. Edited excerpts:

Jyoti Mukul

Former chief economist at the World Bank, Joseph Stiglitz, is known for his scathing criticism of the American economic policies under President George Bush and Barack Obama. For him, economic normalcy is not the same as the end of Freefall caused due to lax regulations in a free market. Speaking to Business Standard on the sidelines of the Delhi Sustainable Development Summit, the winner of the 2001 Nobel Prize for Economics says recovery could be difficult if the crisis in Egypt spreads to the entire region. Edited excerpts:

Egypt crisis: Petrol, diesel prices may rise more

Image: Reuters.Egypt crisis: Petrol, diesel prices may rise more

Image: Higher oil prices likely.

Could the crisis lead to another slowdown?

It is not so much Egypt itself. If it affects the entire region, there is obviously a possibility that it could go beyond, it would lead to higher oil prices.

In the short-run, it may make the recovery more difficult, especially, given the flawed policies of some European governments that are leading to slowdown as a result of excessive austerity.

Egypt crisis: Petrol, diesel prices may rise more

Image: A Chinese fisherman works on the Pearl River against a backdrop of a factory in Zengcheng, Guangdong.Photographs: Reuters.

Egypt crisis: Petrol, diesel prices may rise more

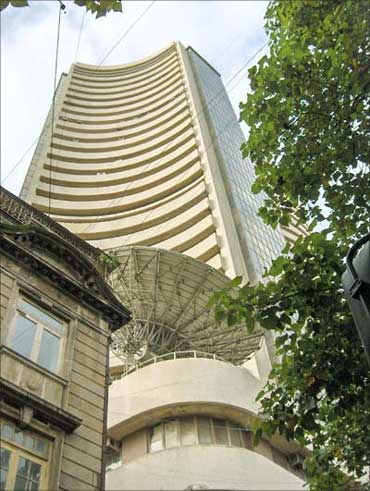

Image: Bombay Stock Exchange.

In India, the stock markets have witnessed volatility and there is an ongoing debate whether there should be curbs on inflows from foreign institutional investors. Do you think there should be any controls?

I think, unfettered capital flows can be very dangerous and we have seen that in the East Asia crisis. Most countries have at this point imposed interventions to stabilise capital flows.

Even countries that were reluctant to do so, like Chile, have decided with QE2 and it will be irresponsible not to impose some forms of interventions that will stabilise these capital flows that can be very destabilising.

article