| « Back to article | Print this article |

Currency slide gives FIIs the jitters

Foreign investors, who hold 40% of free float, have lost 10% on rupee fall this year so far.

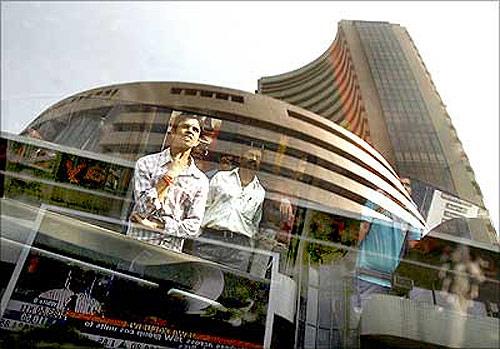

The biggest buyers in Indian markets over the past 10 years are staring at huge losses as a falling rupee chips away at their portfolios.

The BSE Sensex has fallen only 0.52 per cent since the beginning of 2013, from 19,426.71 to 19,324.77 on Monday.

However, foreign institutional investors (FIIs) have seen losses of about 10 per cent because of the rupee depreciation. Some have seen losses of nearly 20 per cent on account of the fall in the market.

This could pose a risk of outflows from the equity market, said experts, who point out that FIIs collectively hold 43.4 per cent of the publicly held shares, or free float, in Indian markets.

Click NEXT to read more…

Currency slide gives FIIs the jitters

However, the sharp decline in the rupee might be a deterrent for many foreign investors to exit Indian stocks, as many of the investments were made when the currency was at much higher levels.

In 2012, FIIs poured in close to $26 billion. Since FII shareholdings are valued in the rupee, any fall in the currency would impact them.

Selling by FIIs, the biggest buyers of Indian stocks in the past decade, could hit sectors that have experienced high inflows, according to a July report, India Strategy, by Motilal Oswal Securities.

Click NEXT to read more…

Currency slide gives FIIs the jitters

“If FII selling was to continue in the coming months, we believe sectors that saw high allocations earlier will be impacted,” said the report, authored by Navin Agarwal, Rajat Rajgarhia and Dipankar Mitra.

The report noted FIIs bought in $124 billion in 10 years, about half of which came in after 2010. Foreign institutions have bought in $67 billion since January 2010. They were net sellers by $1.6 billion in Indian equities during June.

U R Bhat, managing director at Dalton Capital Advisors (India), a registered FII, said high foreign holdings can pose a peril. “That (FII ownership) is quite a risk…. They generally factor in a four-five per cent depreciation in the currency. This is dramatically more than that.”

Click NEXT to read more…

Currency slide gives FIIs the jitters

The depreciating rupee, he said, has caused severe underperformance for anyone who chose India over developed markets.

“This needs to be compared with the 13-14 per cent gain in the American markets. So, an institution which chooses to put its money in India as opposed to the US is sitting on relative losses of over 25 per cent,” he added. FIIs have been net buyers in India equities by $13.42 billion in 2013.

Anish Damania, business head-institutional equity at Emkay Global Financial Services, said investors would continue to watch the rupee. “Flows have been weak because there has been a global trend (to move) away from emerging markets. Inflows into India have pretty much stopped. People are worried the rupee depreciation could get worse and are also keeping an eye on corporate earnings,” he said.

Click NEXT to read more…

Currency slide gives FIIs the jitters

The Motilal Oswal report said financial sector companies, excluding public sector banks, accounted for 25 per cent of the flows since 2010. Utilities accounted for 12 per cent, consumer companies 11 per cent, information technology nine per cent and automobile companies eight per cent.

The rupee touched a new low on Monday, falling past 61 against the dollar on fears that the US might cut back on its injections of liquidity into the global financial system. It has depreciated 10.22 per cent against the dollar since January and 13 per cent since May.

FII ownership had hit its previous high at the end of 2007, at 41.9 per cent. It had touched a low of 35 per cent in March 2009, according to data from Motilal Oswal Securities.

Click NEXT to read more…

Currency slide gives FIIs the jitters

Some are more optimistic on foreign flows. Rajesh Cheruvu, chief investment officer-India at The Royal Bank of Scotland’s private banking division, said there could be an impact on account of money coming in from short-term arbitrageurs, but said longer term money was unlikely to exit in a hurry.

“There had been a fall in risk appetite for emerging markets (EMs). But over the last one week, interest seems to have returned. As return of appetite and improvement in EM flows is in place, India is expected to attract flows into the market on account of superior growth and structural advantages, including strong domestic demand,” he added.