| « Back to article | Print this article |

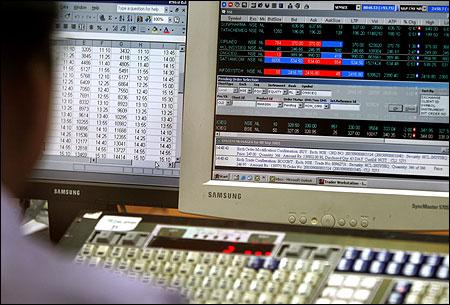

Credit Suisse on the Sensex crash in 2012

The Sensex is likely to rule between 13,200 and 14,400 points and the rupee may touch Rs 54-55 by June next, Credit Suisse India has said in a report.

"We remain bearish on the overall market, with downside risks to both multiples as well as earnings.

The Sensex is likely to fall in the range between 13,200 and 14,400 points

and the rupee may touch Rs 54-55 by June 2012," Credit Suisse India equity strategy head Neelkanth Mishra said.

Click NEXT to read more...

http://im.rediff.com/money/2011/dec/02bse5.jpg

The market is not trading at its face value and possibility of downtrend is most likely, he said while releasing the Credit Suisse India 2012 Outlook report.

The trend is already clear, he said and pointed out that "Q2 was the first quarter in two years to see a y-o-y decline in profits for companies in the Nifty. More worrying is that this happened despite a 20 per cent annual sales growth, thus indicating continuing margin depletion, which is already at a three-year low."

Click NEXT to read more...

Credit Suisse on the Sensex crash in 2012

"We fear that a potential slowdown could impact sales and could put further pressure on operating profit growth due to negative operating leverage," the report said.

The rupee has been one of the weakest currencies globally in 2011 and the weakest in Asia, falling 17 per cent since August alone. Credit Suisse believes the rupee would continue to be weaker.

Mishra pointed out that the rupee is likely to continue to weaken over the next three-to-six months, putting more pressure on inflation, delaying rate cuts and hurting foreign- investor returns.

Click NEXT to read more...

Credit Suisse on the Sensex crash in 2012

"We expect the rupee to touch Rs 54-55 by June next, but it is unlikely to touch Rs 60," Mishra said, adding only debt flows can potentially support the rupee.

However, the stress on European banks and depletion of risk appetite could keep the dollar access for domestic corporates restricted.

As a result, estimates and prospects for companies that have dollar revenues but rupee costs have not been updated so far, IT services and pharma exporters in particular, the report said.

Click NEXT to read more...

Credit Suisse on the Sensex crash in 2012

"We expect the domestic IT services sector to particularly get a second headwind with a structural downward revision in rupee estimates," it said.

In a sustained high interest rate and risk-averse environment, the agency believes rate sensitive sectors are likely to remain under pressure. Further, high interest rates and slowing growth will continue to pressure asset quality at banks.

On the high government borrowing, the report said it is also likely to put pressure on credit growth.