| « Back to article | Print this article |

Countries that don't have any income tax at all

Every year just about everybody rushes to file their last minute tax returns. But there are some nations where people don't struggle with tax returns or any hassles related to taxes.

According to a study based on a KPMG's survey, there are nations that don't have any income tax at all.

Here's a list of countries with no personal income tax.

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Click NEXT to read more...

Countries that don't have any income tax at all

The United Arab Emirates

Individual income tax is not assessed. Expatriate employees do not make contributions to UAE Social Insurance. However, the employer of a UAE national must make monthly social security and pension contributions of 12.5 per cent of the employee's basic salary and allowances (for a private employer) and 15 per cent of the employee's basic salary and allowances (for a public employer).

The employee must also make monthly contributions at a rate of five per cent of total remuneration. There is no capital gains tax for individuals. For branches of foreign banks and foreign oil companies engaged in the exploration and production of oil, the capital gains income of businesses is taxed as ordinary business income.

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Click NEXT to read more...

Countries that don't have any income tax at all

Qatar

The employee social security rate is five per cent and the employer social security rate is 10 per cent for Qatari local employees. Qatar levies no taxes on employment income, dividends, profits, capital gains, wealth, property or transfers, including death duties.

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Click NEXT to read more...

Countries that don't have any income tax at all

Oman

Oman does not have any personal taxation.

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Click NEXT to read more...

Countries that don't have any income tax at all

Kuwait

According to Kuwait tax law, individuals are exempted from Kuwait taxation. However, social security contributions are required for employees with Kuwaiti nationality.

There are no other individual taxes.

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Click NEXT to read more...

Countries that don't have any income tax at all

Cayman Islands

The Cayman Islands does not have income tax or social security. However under the Cayman Islands' National Pensions Law (Pensions Law) every employer must provide a pension plan for every person working for the employer, including expatriates who have been working for a continuous period of nine months in the Cayman Islands.

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Click NEXT to read more...

Countries that don't have any income tax at all

Bahrain

There is no personal income tax in Bahrain. However Social Insurance and Unemployment Tax apply. Bahraini citizens are subject to Social Insurance Tax on their total compensation at a flat rate of seven per cent. Employers of Bahraini citizens must pay Social Insurance Tax at a rate of 12 per cent for those employees.

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Click NEXT to read more...

Countries that don't have any income tax at all

Bermuda

While there is no income tax in Bermuda, a payroll tax equal to 14 per cent of compensation is payable by employers on the first BMD750,000 of compensation income per employee.

A portion of the payroll tax (up to 5.25 per cent) may be recovered from the employee at the discretion of the employer.

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Click NEXT to read more...

Countries that don't have any income tax at all

Bahamas

There is no income, capital gains, wealth, succession or gift taxes in the Bahamas. There are real estate acquisition taxes (stamp duty) and holding taxes (real property taxes).

No income tax filings required.

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Click NEXT to read more...

Countries that don't have any income tax at all

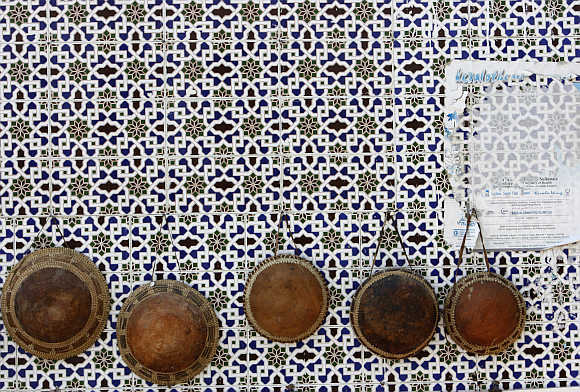

Saudi Arabia

Saudi Arabia does not impose a tax on salaries. However, self-employed expatriates are taxed at a rate of 20 per cent. There are no other individual taxes.

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Click NEXT to read more...

Countries that don't have any income tax at all

Brunei Darussalam

There is currently no personal income tax in Brunei Darussalam. There is an Employee Trust Fund and Supplemental Contributory Pensions Scheme. There are no other individual taxes.