| « Back to article | Print this article |

A comeback year for India's retail sector

To be or not to be? The debate over whether to relax FDI norms in the Indian retail sector gained momentum in 2010, a year which also saw many retailers resume their expansion activities after the global downturn of 2008-09.

To be or not to be? The debate over whether to relax FDI norms in the Indian retail sector gained momentum in 2010, a year which also saw many retailers resume their expansion activities after the global downturn of 2008-09.

The key question in front of India's $435 billion retail sector was whether the multi-brand retail sector should be opened up to foreign direct investment and if so, to what extent?

The year saw the government take up the issue with all seriousness when the Department of Industrial Policy and Promotion (DIPP) came out with a discussion paper seeking the opinions of all stakeholders.

Later on, the government formed an inter-ministerial panel to pursue the matter further and is understood to have completed the consultation process with all stakeholders.

Click NEXT to read on...

A comeback year for India's retail sector

While the discussions were going on, the sector saw the return of good times, recovering from two years of slowdown.

While the discussions were going on, the sector saw the return of good times, recovering from two years of slowdown. An upsurge in consumer demand helped stabilise the sector, especially in modern retail, which found its feet.

Having learnt lessons from the slowdown, a significant realignment of business helped most retailers register double-digit growth rates in 2010, which helped in acceleration of store additions.

In the previous year, most retailers saw low single-digit growth. "2010 has been a comeback year for the retail sector, especially during the festive season.

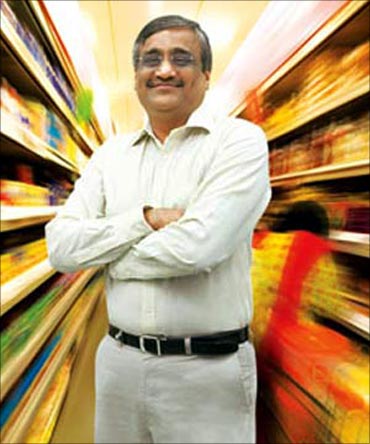

Retailers saw healthy sales as compared to earlier years. Consumers are coming back to the stores and feel secure while spending money," Future Group Chairman Kishore Biyani said.

Click NEXT to read on...

A comeback year for India's retail sector

At the same time, the traditional retail sector saw a growth of about 7-10 per cent in 2010 as per various industry estimates.

At the same time, the traditional retail sector saw a growth of about 7-10 per cent in 2010 as per various industry estimates. "Same store growth for most retailers has been in the range of 15-20 per cent. Big retailers have done really well after realigning their businesses in the last two years," Ernst & Young partner for retail and consumer product service Pinakiranjan Mishra told PTI.

Companies, including Reliance Retail, Shoppers Stop, Hypercity, RPG Enterprises' Spencer's Retail, Bharti Retail, Aditya Birla Retail, Marks and Spencer Reliance India, Bharti Walmart and Pantaloon Retail opened new stores across India and drew up aggressive expansion plans on the back of good growth in sales.

"Retailers have plans to expand their retail space by 50-80 per cent over the coming 24 months," according to a report by brokerage firm Motilal Oswal. It was, however, not song and dance all the way for the sector.

Click NEXT to read on...

A comeback year for India's retail sector

Some big names bit the dust during the year, reinforcing the fact that running a retail chain is not everybody's cup of tea.

Some big names bit the dust during the year, reinforcing the fact that running a retail chain is not everybody's cup of tea. Beleaguered Vishal Retail was forced to sell its business to Chennai-based business conglomorate Shriram Group and private equity fund Texas Pacific Group for Rs 100 crore (Rs 1 billion), subject to clearance from the Delhi High Court.

Indiabulls, which had entered the retail sector in 2007 through the acquisition of Piramyd Retail, later closed many stores during the downturn and froze expansions after finding that even after rebranding its stores as 'Happy Store', happiness was hard to come by. As for Subhiksha, which went bust last year, 2010 was yet another year when its promoter had to spend more time in court to slug it out with lenders. Nevertheless, the biggest good news for the sector was the government's willingness to consider relaxing the FDI policy in the retail sector, especially in the multi-brand format.Click NEXT to read on

A comeback year for India's retail sector

After the DIPP circulated a discussion paper, a six-member inter-ministerial panel took up the matter further.

After the DIPP circulated a discussion paper, a six-member inter-ministerial panel took up the matter further. Organised retailers, industry chambers like CII and FICCI have welcomed the move and the Consumer Affairs Ministry and Planning Commission have given the green signal for 49 per cent FDI in multi-brand retail.

However, the Micro, Small and Medium Enterprises (MSME) Ministry and the Ministry of Finance cautioned the government against further opening of the sector to FDI.

Some industry observers continued to be skeptical about the reason for the delay in a decision being taken on the contentious issue.

"The issue of opening FDI in retail sector is more political and has nothing to do with actual business reality. Unless the government decides to take a bold step, there does not seem to be an immediate chance of anything changing," FICCI Director (Retail and Consumer Goods) Sameer Barde said.

Click NEXT to read on

A comeback year for India's retail sector

The industry chamber has pegged the current size of the Indian retail sector at $435 billion. Preparing the ground, international retail giants such as Wal Mart, Carrefour and Tesco found different ways to make their voice heard in India during 2010. Wal-Mart Stores Inc's CEO and President Mike Duke arrived in India in October, ahead of US President Barack Obama's maiden visit to the country to pitch for a relaxation in the FDI policy. Duke, who announced Walmart's plan to partner with a large number of farmers in India and create employment opportunities, said he saw progress in the process of opening up the retail sector in India to FDI. In the case of French retail giant Carrefour, the company is eyeing an entry into the country through a joint venture with Kishore Biyani-promoted Future Group, which is likely to be announced in 2-3 months' time.

The industry chamber has pegged the current size of the Indian retail sector at $435 billion. Preparing the ground, international retail giants such as Wal Mart, Carrefour and Tesco found different ways to make their voice heard in India during 2010. Wal-Mart Stores Inc's CEO and President Mike Duke arrived in India in October, ahead of US President Barack Obama's maiden visit to the country to pitch for a relaxation in the FDI policy. Duke, who announced Walmart's plan to partner with a large number of farmers in India and create employment opportunities, said he saw progress in the process of opening up the retail sector in India to FDI. In the case of French retail giant Carrefour, the company is eyeing an entry into the country through a joint venture with Kishore Biyani-promoted Future Group, which is likely to be announced in 2-3 months' time. Click NEXT to read on

A comeback year for India's retail sector

Amid the existing restrictions, UK-based retailer Tesco -- which provides back-end support to the Tata Group's retail arm Trent Retail's hypermarket chain 'Starbazaars' -- is also keen to enter the Indian market by opening its first cash-and-carry store next year.

Amid the existing restrictions, UK-based retailer Tesco -- which provides back-end support to the Tata Group's retail arm Trent Retail's hypermarket chain 'Starbazaars' -- is also keen to enter the Indian market by opening its first cash-and-carry store next year. The firm said it will also increase sourcing from India for its global ventures. With the government and stakeholder deliberations on the proposed policy relaxation eluding a concrete outcome, the status quo of 51 per cent FDI in single-brand retail, none in multi-brand and 100 per cent in the cash-and-carry segment, remained through 2010.

This meant that some domestic companies which required funds to expand had to turn to the capital markets to raise money.

Click NEXT to read on

A comeback year for India's retail sector

In addition, leading kids' wear retail chain Catmoss divested a minority stake to Hong Kong-based private equity firm SAIF Partners for Rs 100 crore (Rs 1 billion).

However, for firms with deep pockets like Mukesh Ambani-led Reliance Brands, funding was not an issue.

The company went on to buy 49 per cent stake in Zegna South Asia Private Ltd for an undisclosed sum to form a joint venture with the Ermenegildo Zegna Group to sell the Italian menswear brand and expand its presence in India.

Cafe retail chain Cafe Coffee Day also entered the acquisition arena when it bought out Czech Republic-based Cafe Emporio in a deal worth Rs 15 crore (Rs 150 million) to expand its international presence.

Click NEXT to read on

A comeback year for India's retail sector

As the Indian market continued to prosper amid a slowdown in most Western markets, many global brands queued up to make their foray in India. Italy's industry body Fondazione Altagamma, which has 70 members, said it expects the total number of single brand stores of Italian firms in India to touch 200 by 2020 from 30 at present. What is more, the plans of labels like Missoni and Vivienne Westwood to enter India through Madura Garment's initiative, 'The Collective', were announced during the year. The year 2010 thus set a platform from where the Indian retail sector can build toward a secure future. With lessons learnt from the past, going ahead, the market is expected to grow at a rate of over 7 per cent in the next 10 years, reaching a size of $850 billion by 2020, according to projections by industry body Ficci.

As the Indian market continued to prosper amid a slowdown in most Western markets, many global brands queued up to make their foray in India. Italy's industry body Fondazione Altagamma, which has 70 members, said it expects the total number of single brand stores of Italian firms in India to touch 200 by 2020 from 30 at present. What is more, the plans of labels like Missoni and Vivienne Westwood to enter India through Madura Garment's initiative, 'The Collective', were announced during the year. The year 2010 thus set a platform from where the Indian retail sector can build toward a secure future. With lessons learnt from the past, going ahead, the market is expected to grow at a rate of over 7 per cent in the next 10 years, reaching a size of $850 billion by 2020, according to projections by industry body Ficci. Click NEXT to read on

A comeback year for India's retail sector

"By 2020, traditional retail is expected to grow at 5 per cent to reach a size of $650 billion, while organised retail is expected to grow at 25 per cent to touch $200 billion, making 24 per cent of the total retail market," Ficci said.

"By 2020, traditional retail is expected to grow at 5 per cent to reach a size of $650 billion, while organised retail is expected to grow at 25 per cent to touch $200 billion, making 24 per cent of the total retail market," Ficci said. As Biyani put it, the retail sector is expecting some New Year gift from the government in the form of FDI policy relaxation, especially in the multi-brand format.

This could be a game-changing decision in the Indian retail sector. Nevertheless, the prospects are bright. It remains to be seen how policy changes alter the Indian retail landscape in the days to come.