Photographs: Reuters Ajay Chhibber

Food inflation must be managed by supply-side factors, but on the demand side the burden must not be on monetary policy alone - fiscal policy must play a key role as well.

India’s rampant inflation remains a hotly debated puzzle. Without a better understanding of inflation, policymakers are shooting wildly in the dark and could end up making costly policy mistakes with huge unwanted consequences.

India’s inflation has been persistently high and has risen in the last five years to the highest level among all emerging economies, matched only by Vietnam - a much smaller and more open economy.

Global inflation, and inflation in many other emerging economies, has in fact fallen in the last years.

…

Why inflation is so high in India

Photographs: Vivek Prakash/Reuters

In its latest monetary policy announcement, the RBI surprised the markets by increasing the repo rate on concerns over inflation.

Many experts and business groups have criticised the RBI, as they assert that inflation is related to supply-side factors — especially in the food sector — and therefore tighter monetary policy will have little effect on it.

Tighter monetary policy will only hurt growth without helping control inflation. These differences of opinion will persist unless we get a better understanding of the causes of inflation.

A complicating factor peculiar to India is the multiplicity of inflation rates. Should one target wholesale (WPI) or retail (CPI) inflation? Or “core” inflation — defined as non-fuel, non-food inflation?

…

Why inflation is so high in India

Image: A trader sleeps on sacks of onions at a wholesale market in Ahmedabad.Photographs: Amit Dave/Reuters

In the past, WPI and CPI inflation moved closely together, so ambiguity on which rate to focus on was not such an issue. But over the last five years they have consistently diverged — largely due to food inflation, which has a much bigger weight in the composition of the CPI Index.

So, why is food inflation so high, and why does it persist? A food supply shock in the past caused a food price increase but needed accommodating fiscal and monetary policy to translate it into inflation. But now we have seen food inflation over several years.

One explanation is that the procurement price for cereals has been rising very rapidly, well above the increase in the cost of production. Over the last five years the procurement price of cereals has increased over the cost of production by almost 15-60 per cent for a cumulative differential of around 150 per cent.

As a result, the food subsidy has increased hugely, doubling from around `40,000 crore in 2008-09 to over `80,000 crore in 2012-13 — and it is likely to rise further in 2013-14, as the new food bill is implemented and the issue price at which the grains are sold is reduced.

…

Why inflation is so high in India

Image: A shopkeeper arranges signs with prices on bags of rice at a shop in Mumbai.Photographs: Arko Datta/Reuters

So the rapid increase in purchase prices has two effects: it increases the off-take of grain from the market, thus increasing grain prices in the open market; and it increases the food subsidy bill, which adds to the fiscal deficit and thereby fuels inflation.

Surprisingly, the government has not released the grain above the buffer stock norms, and we have seen a perverse outcome — rising food stocks and rising food inflation.

Instead of releasing grain in the open market to reduce prices, India arranged the largest export of grain ever in its history in 2012-13, exporting 10.1 million tonnes of rice, 6.5 mt of wheat and 4.8 mt of corn, as domestic prices were below international prices.

One option now, especially as another bumper crop is expected in 2013-14, is to switch from an open-ended grain purchase policy to a policy of only procuring what the government needs for its PDS operations and to meet the buffer stock needs.

…

Why inflation is so high in India

Image: A labourer fills a sack of wheat at a wholesale grain market in Chandigarh.Photographs: Ajay Verma/Reuters

This will mean more grain will be left in the market, and government stocks will decline over a period of one year. But selective imports of pulses and oilseeds may also help contain inflation.

Another factor cited for rising food inflation is rising agricultural wages, generally ascribed to a labour market that is tightening due to the rural employment guarantee programme.

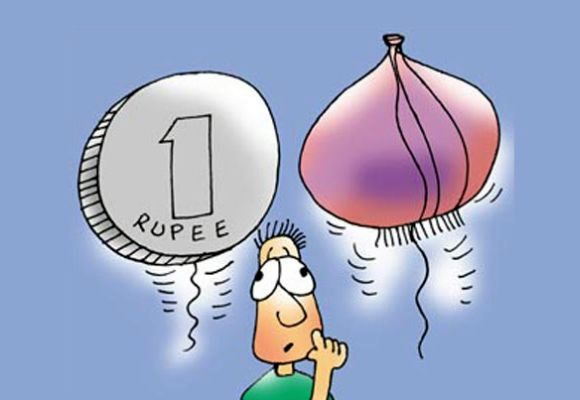

Rural wages have risen, which explains the declining poverty despite rising food prices. But they also contribute to higher costs of production, especially for vegetables, onions and horticultural crops.

The solution here is to find out what can be done to help farmers for these products switch to less labour-intensive methods of production, more consistent with higher rural wages.

…

Why inflation is so high in India

Photographs: Uttam Ghosh/Rediff.com

But supply-side factors are not enough to explain the persistence of inflation. High fiscal deficits typically have immediate inflationary consequences all over the world. In the past, India ran high fiscal deficits without high inflation.

Everyone thought India was different. But in reality India was simply financing the deficit by forcing the banking system to hold government paper cheaply. Financial repression was the outcome, with lower growth.

But as the capital account was opened up, foreign inflows came into the country — and as these inflows were not adequately sterilised, they helped fuel inflation.

The prices of non-tradables, such as real estate, skilled sector wages and services went up sharply — exemplified best by the former RBI governor being puzzled by why he had to pay so much more for a haircut with a receding hairline.

A large fiscal deficit in 2008-09 could be justified as a necessary stimulus to manage the global crisis.

…

Why inflation is so high in India

Image: A labourer removes dust from paddy at a grain market in Chandigarh.Photographs: Ajay Verma/Reuters

But persistently high fiscal deficits, with huge increases in subsidies and cuts in public investment which would crowd in private investment, have hurt growth and fuelled inflation.

Fertiliser and fuel subsidies must be brought down, but will have short-term adjustment costs before they produce long-term benefits.

For example, diesel price increases will have pass-through effects - a one per cent increase in diesel prices increases inflation by almost 0.1 per cent in the short term. But, as it reduces the fiscal deficit, the longer-term impact is lower inflation.

But, managing this trade-off before an election, especially with the impact of the rupee depreciation still to be fully passed through, is clearly on policymakers’ minds.

…

Why inflation is so high in India

Photographs: Ajay Verma/Reuters

So the inflation story is not simply a supply-side issue, as some believe. India’s inflation is a combination of demand and supply side (cost-push) factors and must be tackled comprehensively.

Having the RBI raise repo rates further to tackle inflation will be the worst choice — and not one the RBI should be forced to make. The solution to managing inflation is not a food story alone, but food does play a central role.

The food inflation must be managed by supply-side factors, but on the demand side the burden must not be on monetary policy alone — fiscal policy must play a key role as well.

The writer is director-general of the Union government’s Independent Evaluation Organisation.

article