Photographs: Danish Siddiqui/ Reuters

The Reserve Bank of India, in its first-quarter review of monetary policy, kept the benchmark policy rate constant at 8 per cent.

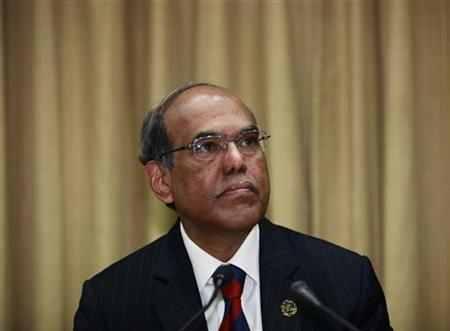

The only change it made was to lower the statutory liquidity ratio for banks from 24 to 23 per #162 RBI Governor Duvvuri Subbarao said that he wanted to ensure that "liquidity pressures do not constrain the flow of credit to productive sectors of the economy."

This is perhaps an odd concern. Withdrawals from the liquidity adjustment fund, which passed Rs 1.9 lakh crore on several days in March this year, are down to manageable levels -- as low as Rs 0.2 lakh crore last Thursday.

...

RBI's balance of growth and inflation may be wrong

Photographs: Rediff Archives

Meanwhile, non-food credit has shown a steady growth of around 17 per cent year-on-year in 2012.

It is not liquidity that appears to be the problem: the growth in credit notwithstanding, there are worrying signs that smaller enterprises are finding interest payments increasingly onerous.

Their increase in costs has driven the ratio of interest payments to profits in some sectors to levels at which investment becomes unlikely.

...

RBI's balance of growth and inflation may be wrong

Photographs: Danish Siddiqui/Reuters

Simultaneously, the RBI raised its inflation projection for April 2013 to 7 per cent from 6.5 per cent. Thus its concerns are understandable.

The review points out wholesale price inflation of well over 7 per cent has been persistent. Further, there are significant inflationary risks going ahead: a below-normal monsoon will push food prices upward, and world oil prices are high.

Growth projections for 2012-13 were also lowered by a massive 0.8 per #162 in April it said that it expected growth this financial year to be 7.3 per cent, and it has now revised this to 6.5 per cent.

...

RBI's balance of growth and inflation may be wrong

Photographs: Reuters

This suggests the RBI's balance of its twin objectives -- growth and inflation -- may be wrong. Indeed, even its own justifications seem to be contradictory.

In response to the sharp fall in GDP growth -- down from 8.5 per cent five quarters ago to 5.3 per cent for the first quarter of 2012 -- the central bank argues that "while the current rate of growth is clearly lower than trend, the output gap will remain relatively small."

This follows, of course, its own decision to lower trend growth by 0.5 per cent! Naturally, the output gap will now appear smaller -- though even a gap of 1.2 per cent (between 5.3 per cent and the "new trend" of 6.5 per cent) is not small, relatively or otherwise.

...

RBI's balance of growth and inflation may be wrong

Photographs: Reuters

Meanwhile, the RBI acknowledges that the sources of inflation -- food, driven by demand and the monsoon, and fuel, driven by international prices -- are beyond the control of monetary policy.

Meanwhile, the rise in prices of non-food manufacturing goods, the "core inflation" the RBI used to track, is now below 5 per cent.

Its only response to this fact is that "it has not declined to the extent warranted by the growth moderation."

...

RBI's balance of growth and inflation may be wrong

So which is it -- is the output gap "relatively small" or large enough to warrant an even larger decline in core inflation?

The RBI needs to consider whether it has lost the crucial balance between growth support and inflation-fighting that a central bank must maintain.

article