Photographs: Reuters

The original big boys - Tata, Birla, Ambani - were not the stars of the decade, says T N Ninan.

If you look at the wealth created, as defined by the value of all the shares listed on the stock exchanges, then stock value has multiplied over sixfold, from Rs 11.2 lakh crore in March 2004 to Rs 72 lakh crore in March this year.

Since nominal GDP multiplied 4.5 times in the same period, shareholder wealth grew faster than incomes — as you would expect.

Looking at the top 10 private business houses, and how well they did, presents a mixed picture.

…

How top corporates fared during Manmohan Singh's 10 years

Image: Bombay HousePhotographs: Courtesy, Tata Group

Sales grew handsomely over nine years to 2012-13 (the data are not yet in for last year), multiplying roughly tenfold.

But it would be useful to bear in mind, for the sake of perspective, that this figure was boosted by the big overseas acquisitions made by Tata in particular, and also by the Aditya Birla Group and others.

Domestic sales growth was more modest, as indeed was the performance on profits, which multiplied sixfold.

...

How top corporates fared during Manmohan Singh's 10 years

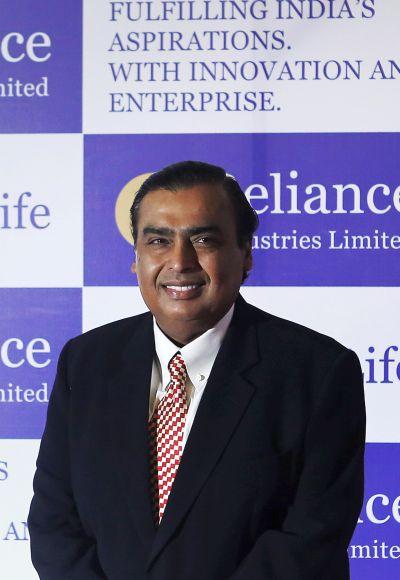

Photographs: Courtesy, Reliance

In other words, profit margins have been squeezed - pointing to the business strain and balance sheet stress that many companies have been experiencing in the sustained downturn.

The original big boys (Tata, Birla, Ambani) were not the stars of the decade.

Though they are still the largest in terms of sales, they now have competition on both profits and the market value of their companies.

...

How top corporates fared during Manmohan Singh's 10 years

Photographs: Reuters

Reliance, which could boast at one stage that it accounted for 30 per cent of the profits of the entire corporate sector, may now be able to account for less than 10 per cent of the total.

Indeed, Reliance has been overtaken by Tata Consultancy Services in market capitalisation

...

How top corporates fared during Manmohan Singh's 10 years

Photographs: Reuters

Infosys, meanwhile, has grown to rival the Aditya Birla Group in both profits and market value.

Vedanta, another group that has grown substantially through acquisitions, also matches the Aditya Birla Group on market capitalisation.

...

How top corporates fared during Manmohan Singh's 10 years

Image: Anand Mahindra, vice chairman and managing director of Mahindra & MahindraPhotographs: Truth Leem/Reuters

Groups like Mahindra and Bajaj have outdone the big three in terms of growth, while Bharti has suffered in recent years on both profits and market value, though sales have grown an astonishing 18-fold.

...

How top corporates fared during Manmohan Singh's 10 years

Photographs: Courtesy, Sun Pharma

Another star is Sun Pharma, whose sales have multiplied nearly tenfold while its market capitalisation has gone up nearly 20-fold. ITC, meanwhile, has risen to become the country’s third-most valuable stock.

While some of these groups have newly emerged into the big league, the simultaneous trend of established groups dropping out suggests that there is vitality in the marketplace.

...

How top corporates fared during Manmohan Singh's 10 years

Photographs: Reuters

The parallel story is the relative decline of listed public sector companies.

Ten years ago, ONGC and Indian Oil were together valued at 2.3 times Reliance; now they are worth only 1.1 times Reliance, and that is not because Reliance has done particularly well.

Ten years ago, the National Thermal Power Corporation was valued more than any private sector company other than Reliance; now it is outdone by perhaps 10 others.

...

How top corporates fared during Manmohan Singh's 10 years

Photographs: Reuters

The tendency to graduate into a conglomerate remains strong - as evidenced by Mahindra.

But as at other points of time in the last quarter-century, single-industry giants have emerged out of rapidly growing sectors - Sun in pharmaceuticals, Bharti in telecom and Infosys in information technology services being among the best examples.

None of these is in traditional manufacturing.

...

How top corporates fared during Manmohan Singh's 10 years

Photographs: Uttam Ghosh/Rediff.com

More stars would emerge if the economy could develop competitive strength in core manufacturing; automobiles have obvious potential to become world-beaters in small cars.

Overall, the market capitalisation of listed companies is slightly more than 60 per cent of GDP (substantially more than the ratios for Germany and Japan, but much less than those for the United States, the United Kingdom and for East Asian countries like South Korea).

There is plenty of scope for increasing the depth of the stock market and the value of the corporate sector.

article