| « Back to article | Print this article |

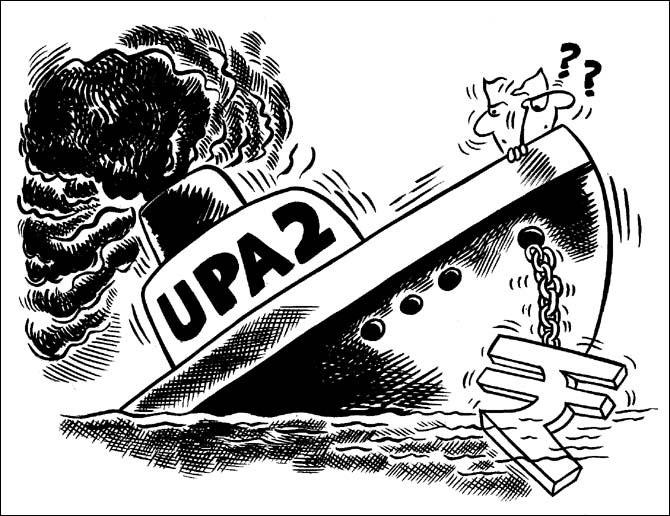

Chidambaram faces mounting deficit in election year

Finance Minister P Chidambaram, who has committed not to cross the deficit target, finds it hard to either raise diesel and cooking fuel prices or cut the fertiliser subsidy.

The fiscal deficit in the first three quarters inched closer to the budgeted target for the whole year, suggesting the finance minister of Asia's third-largest economy faces a challenge to meet the target.

The government is facing a shortfall in tax collections and revenue receipts from the sale of government shares in state-run companies as economic growth slows to less than 5 per cent this fiscal year, from near double digits before the 2008 global crisis.

However, the subsidy bill - mainly for selling oil, fertiliser and food at cheaper rates - is likely to touch near Rs 300,000 crore (Rs 3 trillion), against a budgeted target of Rs 221,000 crore (Rs 2.21 trillion).

The fiscal deficit reached Rs 516,000 crore (Rs 5.16 trillion) during April-December, or 95.2 per cent of the full-year target, compared with 78.8 per cent a year earlier, government data showed on Friday.

Click on NEXT for more...

Chidambaram faces mounting deficit in election year

Net tax receipts were at Rs 518,000 crore (Rs 5.18 trillion) in the first nine months of the current fiscal year to March 2014, while total expenditure was Rs 11,64,000 crore (Rs 11.64 trillion).

Factory gate duties were down 6.9 per cent at Rs 102,000 crore (Rs 1.02 trillion) during April-December from the year-earlier period, while customs tax receipts rose 4.3 per cent to Rs 1.24,000 (Rs 1.24 trillion) - much lower than the 13.6 per cent annual growth target.

Analysts and the central bank remain concerned about widening oil subsidies as the government has only partially increased diesel and cooking gas prices.

"(The government) needs to strive for a deft balance between fiscal consolidation and economic growth by focusing on quality of government spending," the Reserve Bank of India said in its quarterly report earlier this week.

Click on NEXT for more...

Chidambaram faces mounting deficit in election year

Finance Minister P Chidambaram, who has committed not to cross the deficit target, finds it hard to either raise diesel and cooking fuel prices or cut the fertiliser subsidy, as the government faces a national election by May.

"The budget deficit had almost hit its full-year target by November and is unlikely to hold below the government's target shortfall of 4.8 per cent of GDP," Moody's Analytics said in a research note last week.

Officials say deficit would be met by cutting funds for ministries like rural, urban development, defence and education as India cannot afford a downgrade by ratings agencies. India's deficit is the highest among the BRICs nations of Brazil, Russia, India, China as well as South Africa.

The government also plans to defer some subsidy payments to next year, while focusing on speeding up the sale of stakes in state-run firms and minority stakes in some private companies.

It has raised only Rs 5,098 crore (Rs 50.98 billion) so far this fiscal year from the share sales against a budgeted target of Rs 54,000 (Rs 540 billion).

Click on NEXT for more...

Chidambaram faces mounting deficit in election year

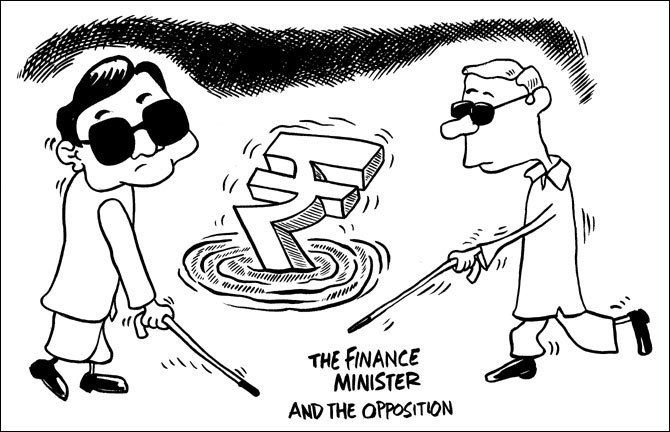

Political pressure

After taking charge in August 2012, Chidambaram had cut down investment spending by nearly Rs 100,000 crore (Rs 1 trillion), which helped contain the fiscal deficit at 4.9 per cent of GDP in 2012-13 against an earlier estimate of near 6 per cent.

But ahead of the elections, Chidambaram is under political pressure from the ruling Congress party to allocate funds liberally to woo voters.

On Thursday, Prime Minister Manmohan Singh's Cabinet rolled back an earlier decision to rein in the subsidy bill by raising the number of subsidised cooking gas cylinders for households at the demand of the ruling Congress party's vice president, Rahul Gandhi.

It is likely to increase the annual cooking fuel subsidy bill by Rs 5,000 crore (Rs 50 billion) to Rs 85,000 crore (Rs 850 billion).

While recognising Chidambaram's efforts to resist political pressure, the ratings agencies warn against the temptation to rain cash on voters in the lead-up to the May election.

"No doubt there will be some of this, but too much largesse risks blowing out the budget deficit and could add to financial market volatility," Moody's Analytics said last week.

Additional reporting by Rajesh Kumar Singh

© Copyright 2025 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.