| « Back to article | Print this article |

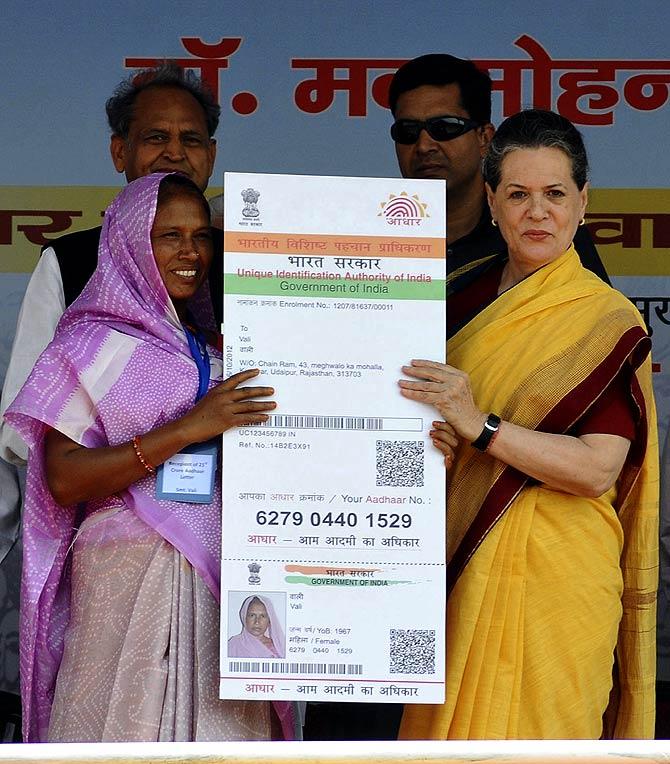

Changes that can make 'Aadhaar' a foolproof identity

At present, you can open a bank account using your Aadhaar number. You can even get a new mobile number with it.

However, when it comes to buying an insurance policy or investing in mutual funds, you will have to back your Aadhaar card with another government-authorised identification document like the Permanent Account Number (PAN). And, the role of the card may be limited to these few functions for now.

Click NEXT to read more....

Changes that can make 'Aadhaar' a foolproof identity

The plans to make Aadhaar a one-stop solution for many problems took a serious hit on Monday, when the Supreme Court directed the government to withdraw all orders mandating Aadhaar for availing any service.

The apex court also directed the Unique Identification Authority of India (UIDAI) to not to share any information pertaining to an Aadhaar cardholder with any government agency without the prior permission of the card holder.

Click NEXT to read more....

Changes that can make 'Aadhaar' a foolproof identity

The role of the card has been diminishing for some time. In September 2013, the SC ruled Aadhaar was not mandatory for essential services such as salary, provident fund disbursals and marriage and property registrations.

Last month, the Centre delinked Aadhaar from the cooking gas subsidy. All these led to Aadhaar’s relevance diminishing.

Says Abizer Diwaji, partner & national leader – financial services, at EY, “The government should see there is a need to refine this project to make it better.

If needed, they should make more changes to Aadhaar to make it a foolproof identity card like in the case with the US’ social security card.”

Click NEXT to read more......

Changes that can make 'Aadhaar' a foolproof identity

A former UIDAI official says the government had never given any executive order to the UIDAI for making Aadhaar mandatory. “It was the individual agencies that made it mandatory like MGNREGS, LPG distributors and so on.

Aadhaar is like the US’ social security card, having which will ensure benefits directly go into the bank account or benefits are to be taken in cash,” he said.

He added that cardholders’ information sharing is also not allowed by existing UIDAI policy. “There were some cases of information sharing on orders from lower courts. Otherwise, UIDAI is not authorised to share card holders’ information with any agency,” he explains.

Click NEXT to read more....

Changes that can make 'Aadhaar' a foolproof identity

The government started linking Aadhaar numbers to various social security schemes and bank accounts, in a way making it compulsory to own a card.

UIDAI officials say the objective of the mega project has gone awry.

The former UIDAI official said it remained to be seen what happens once Parliament passes the Aadhaar Card Bill and it becomes constitutionally valid. “Will the apex court reverse today’s judgement then?” he wonders.

Whether the next government will be keen on taking up the Aadhaar Bill in Parliament, remains.

So, experts advise those who don’t have an Aadhaar card to wait till the next government comes in and there is some clear decision on UIDAI. Those who already own a card should save it for the day the government decides to make it more relevant.