Dipta Joshi in Mumbai

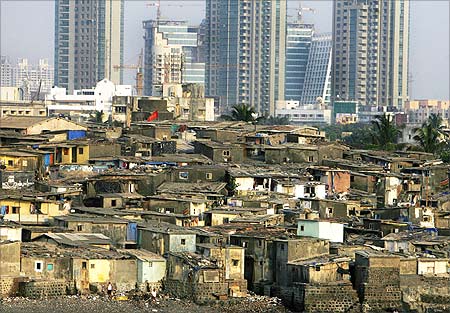

The penalty of Rs 630 crore (Rs 6.3 billion) on the country's largest property developer, DLF, by the Competition Commission of India has brought focus on the builder-buyer relationship.

The buy/sale agreement between the two parties is back in focus.

CCI's observations against DLF are symptomatic of a wider malaise.

"Smaller developers draft their buyer agreements based on what bigger industry players offer their customers," says Sanjay Sharma, managing director of Delhi-based Qubrex, a real estate consultancy.

. . .

Buying a home? Do this reality check first

CCI's order was based in part on the report presented by Qubrex on DLF's market share and its influence on the Gurgaon real estate market.

A little research would reveal the dice is heavily loaded in favour of builders and buyers are generally hapless.

Reality check: Though builders are supposed to specify the date of possession in the agreement, they delay signing it, even by a year, despite taking the booking money from the buyer.

This way, even if the project is delayed, the buyer can do little.

. . .

Buying a home? Do this reality check first

He pays 10 per cent of the property value while booking the flat.

And, another 20-25 per cent even before actual construction has begun, plus 10-15 per cent on signing the agreement.

This is beside any rental or interest outgo on home loans that an individual may be servicing.

. . .

Buying a home? Do this reality check first

The model agreement under the Maharashtra Ownership Flats Act mentions a uniform nine per cent interest penalty payment.

In practice, while builders charge an interest up to 21 per cent for payment delays by the buyer, the builder may pay as little as one per cent of the amount collected from the buyer towards the cost of the apartment if they delay giving possession of the apartment.

. . .

Buying a home? Do this reality check first

Image: Vaibhava Project, Bengaluru.At that rate, if a builder has to pay a penalty for a 2,000 sq ft apartment, costing Rs 2 crore (Rs 20 million), he will end up paying Rs 10,000 a month or Rs 120,000 as penalty for every year of delay.

The customer, especially if he has borrowed from a housing finance institution, would be paying a Rs 200,000 equated monthly instalment.

In effect, the buyer is borrowing from the bank at 10-12 per cent yearly interest to pay to the builder, while the builder is only compensating for the delay at the rate of around one per cent a year.

. . .

Buying a home? Do this reality check first

Others have now started selling these and also issue receipts, say property brokers.

"Hopefully, a Supreme Court order restricting the sale of open spaces will have an impact," says R R Singh, director of the Delhi-based National Real Estate Development Council.

. . .

Buying a home? Do this reality check first

The forfeiture clause included in the agreement would work against him.

In most cases, even before he is asked to sign the agreement, he has paid 10 - 35 per cent of the property's cost to the builder.

Opting out at this stage could see him losing either the entire amount paid till then or at least 10 per cent of the earnest money.

article