| « Back to article | Print this article |

Highlights of the Union Budget 2012-13

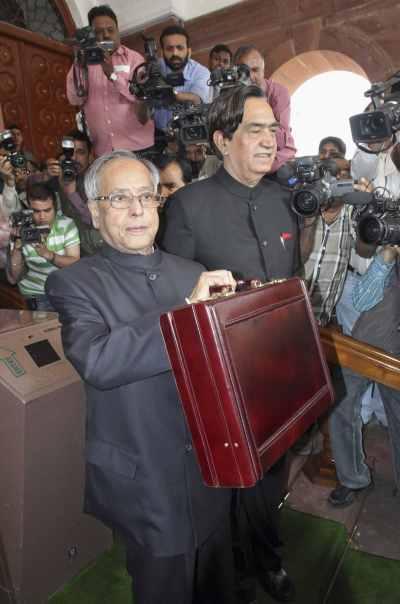

Finance Minister Pranab Mukherjee presented the Union Budget for 2012-13 on Friday.

Following are some of the key highlights of the Union Budget 2012-13, presented by Finance Minister Pranab Mukherjee in the Parliament on Friday.

Tax burden for individuals to come down: Income tax exemption limit raised from Rs 1,80,000 to Rs 2,00,000; 10 per cent tax for 2-5 lakh income; 20 per cent for 5-10 lakh and 30 per cent beyond Rs 10 lakh; Savings bank account interest up to Rs 10,000 exempted from tax.

Many services and goods to cost more: No change in corporate tax rate, but standard rate of excise duty, as also service tax rates, raised from 10 per cent to 12 per #162 No change in peak customs duty of 10 per cent on non-agri goods.

Large cars, imported bicycles, cigarettes, bidis and some imported jewellery to cost more; branded silver jewellery may get cheaper.

Boost for capital markets: Securities Transaction Tax on cash delivery reduced by 25 per cent to 0.1 per #162 A new Rajiv Gandhi Equity Saving Scheme to allow income tax deduction to retail investors in stocks.

Click NEXT to read more...

Union Budget 2012-13: Complete coverageHighlights of the Union Budget 2012-13

Economy expected to gain ground: GDP growth rate pegged at 7.6 per cent in 2012-13; Subsidy Expenditure to be checked and higher tax revenues targetted; Rs 30,000 crore to be raised from disinvestment.

Capital boost to financial and infrastructure sectors: Rs 15,888 crore to be provided for capitalisation of public sector banks and financial institutions; Infrastructure investment of Rs 50 lakh crore in 12th period, with half from private sect#8744 Tax free bonds of Rs 60,000 crore to be allowed for financial infrastructure projects.

Fight against black money: White paper on black money in current session of Parliament; Introduction of compulsory reporting requirement for assets held abroad; tax collection at source on high-value cash purchase of bullion, jewellery, immovable property and trading in coal, lignite and iron ore.

Greater scrutiny of closely-held companies for funds; Taxation of unexplained money, credits, investments, expenses at highest rate of 30 per cent irrespective of income slab.

Click NEXT to read more...

Union Budget 2012-13: Complete coverageHighlights of the Union Budget 2012-13

Tax reforms: Direct Taxes Code (DTC) at earliest; GST network to be operational by August 2012; Central Excise and Service Tax being harmonized. A General Anti-Avoidance Rule (GAAR) to be introduced to counter aggressive tax avoidance.

Attracting foreign funds: Efforts on to allow FDI in multi-brand retail and permitting foreign airlines invest in domestic players; External borrowings to the extent of USD one billion for aviation companies; Qualified Foreign Investors to get access to corporate bond market.

Tax relief for stressed sectors: Sectors like agriculture, infrastructure, mining, railways, roads, civil aviation, manufacturing, health and nutrition, and environment to get duty relief; Turnover limit for compulsory tax audit for SMEs raised from Rs 60 lakh to Rs 1 crore.

Farming for growth: Target for agricultural credit raised to Rs 5,75,000 crore; Interest subvention for short-term crop loans to farmers at 7 per cent interest continues; additional 3 per cent for prompt paying farmers.

Click NEXT to read more...

Union Budget 2012-13: Complete coverageHighlights of the Union Budget 2012-13

Financial Highlights of Budget 2012-12:

Direct proposals to give in net revenue loss of Rs 4,500 crore and net gain of Rs 45,940 crore from indirect taxes, resulting into a net gain of Rs 41,440 crore.

Fiscal deficit targetted at 5.1 per cent of GDP in 2012-13, down from 5.9 per cent in 2011-12; Central Government debt at 45.5 per cent of GDP.

Total expenditure budgeted at Rs 14,90,925 crore; plan expenditure at Rs 5,21,025 crore, 18 per cent higher than 2011-12 budget; non-plan expenditure at Rs 9,69,900 crore.

Click NEXT to read on...

Highlights of the Union Budget 2012-13

Gross Tax Receipts estimated at Rs 10, 77,612 crore, 15.6 per cent higher than original budget estimates and 19.5 per cent over the revised estimates for 2011-12.

Net tax to the Centre in 2012-13 estimated at Rs 7,71,071 crore; Non-Tax Revenue Receipts estimated at Rs 1,64,614 crore and Non-debt Capital Receipts at Rs 41,650 crore.

Total expenditure for 2012-13 budgeted at Rs 14,90,925 crore, including Rs 5,21,025 crore of Plan Expenditure and Rs 9,69,900 crore as Non-Plan Expenditure.

Defence services get Rs 1,93,407 crore; any further requirement to be met.

Union Budget 2012-13: Complete coverage