| « Back to article | Print this article |

Will the Budget make you happy? Check this out

With the budget day, February 28 approaching, everyone is wondering: Can Finance Minister Pranab Mukherjee save the day for his coalition government?

At a macro level, tackling the challenges of inflation and corruption while giving an impetus to GDP growth and investment flow would be a tough balancing act.

And then, of course, there are the various expectations and demands of coalition partners, industry captains, and powerful lobbies, within and outside the government.

The UPA government has its hands full

- Food inflation has reached double digits in 2011

- A spate of scams in the public and private sector continues to undermine the public and investor sentiments

- There is a need to enthuse investors by restricting fiscal deficit to 5%, well below the existing targets

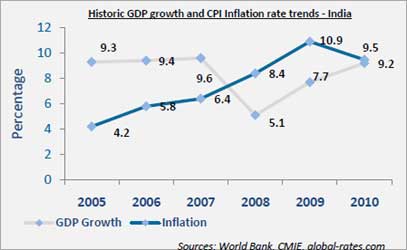

- GDP growth is yet to rebound fully back to pre-recession levels

Dion Global Solutions has come out with a pre-budget primer, which takes a ring-side view of what may be in store.

Click NEXT to read on . . .

Will the Budget make you happy? Check this out

New in Budget 2011 - The Direct Taxes Code

In 2011, the government plans to table a new taxation structure in the upcoming budget, titled the Direct Taxes Code (DTC).

The DTC aims to replace the age-old Income Tax Act, and is seeking to simplify tax regulations.

Having put the first draft of the DTC in the public domain for discussions in early 2010, the government has since revised it due to sharp criticisms on provisions impacting not only corporate but also long-term savings schemes, and now plans to roll out only a diluted and limited version of the original DTC.

The salaried class is expected to be largely comfortable with the DTC, though revisions to capital gains taxes on real estate, stocks, mutual funds and other investments are likely to dampen the overall enthusiasm a bit.

While the DTC may retain the Exempt-Exempt-Exempt (EEE) regime previously being followed for savings schemes including government provident funds, public provident funds and recognised provident funds, it may also add PE, life insurance and annuity schemes to the EEE ambit, along with retirement benefits, including gratuity and leave encashment.

Click NEXT to read on . . .

Will the Budget make you happy? Check this out

Capital gains on stocks, mutual funds and other sources may now be taxed as income from an ordinary source, even though STT (tax on equity transactions) may not be withdrawn.

A percentage of long-term capital gains (over one year) may become taxable as part of income, while tax on short term gains may remain unchanged

This could impact capital formation and the development of capital markets, which the government has historically been trying to encourage

Wealth tax norms, however, should remain largely unchanged, with the exception of a possible increase in the threshold limit for applicability of wealth tax by Rs 700,000, providing some respite to the wealthy.

Investments in new Ulips may no longer receive EEE benefits, though EEE benefits will remain for older Ulips.

Click NEXT to read on . . .

Will the Budget make you happy? Check this out

Pacifying measures - Sops for the common man

Pranab Mukherjee will also need to pull a few rabbits out of his hat, to pacify the seething mood of the masses, especially with the elections in his home state of West Bengal approaching.

The tax-exempt limit is likely to be raised from its current figure of Rs 16,000 to Rs 180,000.

Investment in infrastructure could get friendlier, though, as the deduction towards investment in long-term notified infrastructure bonds could go up from Rs 20, 000 to Rs 30,000.

Housing could be the balancer between helping banks increase liquidity, and helping citizens cope with inflation. While interest rates on home loans could be raised, an increase in the income-tax deduction for home loans (to Rs 300,000 from the current Rs 150,000) is also likely. There is also a slim chance that tax holidays for developing affordable housing (Section 80IB) could be reinstated.

Oil prices do not seem to be deregulated in the budget, though it is likely that the import duty on crude oil could be brought down to zero from its current 5%. This would mean some small respite in the consistent hike of petrol prices. Diesel prices are likely to be deregulated.

Click NEXT to read on . . .

Will the Budget make you happy? Check this out

Excise duty on automobiles is likely to be hiked, though the auto industry is urging the government to reduce the additional Rs 15,000 tax imposed on big cars so that the difference with small cars can be minimized, while retaining the current excise on small cars.

Cellphones, too, are likely to become more expensive, as it is possible that an import duty may be imposed on handsets to encourage the local telecom sector. Service providers that provide bundled imported handsets (especially BlackBerry) could be affected.

FDI norms may also be liberalized for radio, direct-to-home, and cable. FDI norms for single-brand retail are likely to be relaxed to allow 100% FDI, and raised to 51% for multi-brand retail. This should generate employment, and make shopping a lot cheaper.

The FDI relaxation trend may also spillover to include BFSI.

Click NEXT to read on . . .

Will the Budget make you happy? Check this out

Agriculture sector The food challenge

With food prices being as high as they are, the number one issue on the UPA's agenda has to be what to do with the agriculture sector. With demand-side aspects beyond the control of government, measures have to be taken to address supply-side constraints and bottlenecks. Here's a list of expected measures

An increase in the agriculture credit target for banks is likely.

The agriculture ministry has asked for a reduction in interest from 5% to 4% for farmers who pay their bills on time.

To improve productivity and automation, a tax exemption on expenses incurred on new technology and other inputs can be expected.

Due to the rise in demand and higher prices, the food subsidy bill could go as high as INR 90, 000 crore, especially when seen in conjunction with the National Advisory Council's recommendation on guaranteed grain supply.

Various other measures are also expected, including opening up of more procurement and distribution centers for food grains, promoting greater investment in agricultural infrastructure (including raising bank credit targets) and increased expenditure on irrigation in a bid to enhance overall agriculture sector productivity.

Click NEXT to read on . . .

Will the Budget make you happy? Check this out

Budget 2011 for India Inc

Given that the current corporate tax rate including surcharges and cess is 33.22%, the DTC proposes 30%.

Several chambers of commerce have been lobbying for lowering the rate to 25%. Since the approach followed by India has largely been that of increasing revenues as opposed to cutting costs, it is likely that service tax might be hiked from its current 10% to 12%.

The interest subsidy for exporters of 2% is unlikely to be extended, especially since India's exports are likely to cross $200 billion over the current fiscal.

The government is also looking to promote corporate debt instruments to supplement funding in infrastructure, and banks may now be allowed to raise money through infrastructure bonds. Banks may also be allowed to provide guarantees for bonds issued by companies.

This would help improve the risk profile of a company and enable it to access the market at cheaper rates, while encouraging investor participation in an otherwise sluggish corporate bond market.

Another issue that corporates need to watch for relates to the introduction of IFRS in phases from April 1, 2011.

While larger multinationals, which are already used to the standard internationally, may not have much trouble with it, smaller enterprises might face some teething troubles.

Will the Budget make you happy? Check this out

Two taxes everybody is talking about

The Goods & Services Tax (GST)

- Aimed at fiscal consolidation

- Does away with the various layers of tax and applies one tax

- Given the thumbs up almost unanimously from all sectors, especially those with complex value chains, such as pharma, as they suffer from the multi-stage taxation structure

- Stuck in a deadlock, and unlikely to be implemented before 2012

Minimum Alternate Tax (MAT)

- Applied on companies if they are otherwise not liable to pay tax

- Current rate is 18%, revised from 15%

- The industry is demanding a reduction back to 15%

- May be raised to 20% to supplement revenue collection

- Rise might be tempered by an abolition of surcharge on corporate tax

Click NEXT to read on . . .

Will the Budget make you happy? Check this out

Corruption & black money - Bringing India's money home

In recent times, the corruption & black money has tarnished India image to a larger extent. With the population baying for blood due to the recent spate of scams, the black money classes have a lot to watch out for.

The government has made Tax Information Exchange agreements with ten countries, which rank among the world's most notorious tax havens. The coming week should see a lot of movement of funds out of these areas.

These include the Bahamas, Bermuda, British Virgin Island, Isle of Man, Cayman Island, British island of Jersey, Monaco, St Kitts and Nevis, Argentina and Marshall Island.

The government has also decided to define taxable assets as inclusive of the deposits of individuals in banks located outside India.

While currently there are no provisions for declaration of money held in foreign banks that money accrues interest, which is not always repatriated to India. This amounts to avoidance and in some cases even evasion.

The government has also initiated the process of negotiations with 65 countries to amend the existing Double Taxation Avoidance Agreement.

Another amnesty scheme along the lines of the Voluntary Disclosure of Income Scheme can be expected, though given the current mood it is likely to be mothballed.

Click NEXT to read on . . .

Will the Budget make you happy? Check this out

A look at some other key sectors

Infrastructure: It remains a focus area this budget, with many big incentives expected.

The government has targeted infrastructure investments of $1 trillion for the 12th Five Year Plan.

Easier lending norms for infrastructure can be expected, including interest rates on infrastructure projects of not more than 7-8 per cent, and relaxation of FDI regulations.

Click NEXT to read on . . .

Will the Budget make you happy? Check this out

Power:

An extension on the tax holiday under section 80I-A given to units in the power sector which succeeded in starting their operations before April 1, 2011 is also likely.

Click NEXT to read on . . .

Will the Budget make you happy? Check this out

Pharma:

The manufacturing cost of pharma products in India is nearly half the cost incurred in the US.

However, a multi-stage taxation structure exists i.e. customs duty on imports, central excise duty on manufacture, central sales tax (CST) / value added tax (VAT) on sale of goods, and so on.

The introduction of a Goods & Services Tax aims to do away with all these, and apply just one tax.