Finance Minister Pranab Mukherjee presented the Union Budget 2011-12 in Parliament on Monday. While the finance minister made the tax payers slightly happy by raising the exemption limit to Rs 180,000, he made many others unhappy.

So what has been the impact of this Budget on your daily life? Find out how what's cheaper and what's costlier after the Budget.

Let's first see what could be cheaper. . .

The Budget has made some items, including raw materials for syringe and needles, mobile parts and accessories like hands free headphones, incense sticks, sanitary nakpins and diapers, cheaper by reducing taxes.

Mobile phones to be costlier

However, mobile handset prices will become more expensive as Finance Minister Pranab Mukherjee on Monday announced one per cent hike in the Central Excise duty for 130 items, including phones.

Come April 1 and central excise duty on mobile phones will be raised from the current four per cent to five per cent.

. . .

Budget 2011: What's cheaper, what's costlier!

Budget 2011: What's cheaper, what's costlier!

Budget 2011: What's cheaper, what's costlier!

Budget 2011: What's cheaper, what's costlier!

Budget 2011: What's cheaper, what's costlier!

Budget 2011: What's cheaper, what's costlier!

Budget 2011: What's cheaper, what's costlier!

Budget 2011: What's cheaper, what's costlier!

Budget 2011: What's cheaper, what's costlier!

Budget 2011: What's cheaper, what's costlier!

Budget 2011: What's cheaper, what's costlier!

Air travel

The Budget also proposed to raise service tax on air travel by Rs 50 in the case of domestic air travel and Rs 250 on international flight by economy class.

Moreover, higher class travel in domestic sector will attract a service tax rate of 10 per cent bringing it on par with journeys by higher classes on international air travel.

. . .

Budget 2011: What's cheaper, what's costlier!

Big hospitals

With the finance minister proposing changes in service tax band, treatment in air-conditioned private hospitals, air travel and lawyer fees will cost more henceforth.

The government has proposed to put all forms of payments -- by individuals, insurance firms and business houses, for treatment in private hospitals with more that 25 beds and air conditioning facility under the service tax net resulting in an effective tax of five per cent.

. . .

Budget 2011: What's cheaper, what's costlier!

What is cheaper, what is costlier

What is cheaper, what is costlier

What is cheaper, what is costlier

Budget 2011: What is cheaper, what is costlier

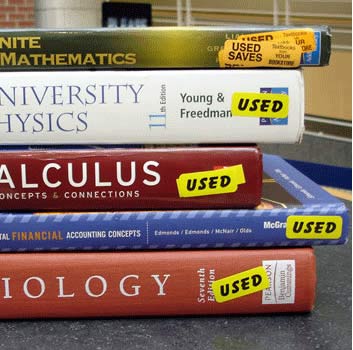

Notebooks, text books

According to the budgetary proposals, notebooks and exercise books, which were earlier exempted from excise duty will now attract one per cent duty without CENVAT credit facility. Moreover, a general effective rate of 5 per cent has been prescribed for these items and facilities.

Similarly, fountain pen ink, ball pen ink, geometry boxes, colour boxes and pencil sharpeners will also now attract a similar levy.

Educational text books are also expected to become costlier as paper used in printing them will no longer be exempted from excise duty.

. . .

What is cheaper, what is costlier

Vaccines, other than those included in National Immunisation Programme, will also register an increase as they will attract a concessional duty of one per cent without CENVAT credit facility.

article