| « Back to article | Print this article |

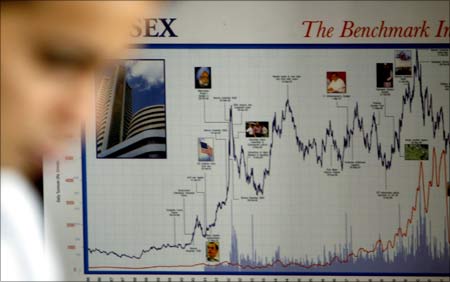

Indian stock markets losing Rs 100 crore per minute!

The bear run at the stock markets is costing investors dearly, with value worth over Rs 100 crore (Rs 1 billion) on an average being eroded every single minute of trade so far this year.

In total, the stock market wealth has come down by a whopping over Rs 11 lakh crore (Rs 11 trillion) since the beginning of 2011, as the benchmark Sensex plummeted by over 3,000 points.

The total average loss for every investor also stands at a staggering amount of Rs 10 lakh (Rs 1 million), taking into a total of little over 1 crore investors present in the market.

Click NEXT to read on . . .

Indian stock markets losing Rs 100 crore per minute!

The Sensex has come down sharply from 20,509.09 points at the end of 2010 to 17,463.04 points at the end of Thursday's trade.

During the same time period, investors' total wealth, measured in terms of cumulative value of their holdings in all listed stocks, has plunged from Rs 72,96,725.79 crore (Rs 72.967 trillion) on December 31 last year to the current level of Rs 61,94,190.42 crore (Rs 61.942 trillion).

While we are in the second month of the year, there have been 28 days of trade so far in 2011 after taking into account the holidays. On these days, the trade has been conducted for a total of 182 hours or 10,920 minutes, as markets remain open from 9 am to 3.30 pm only.

Click NEXT to read on . . .

Indian stock markets losing Rs 100 crore per minute!

Taking into account a total of about 182 hours of trade during these 28 days, the average loss for investors has been Rs 39,376 crore (Rs 393.76 billion) in every day of trade.

At the same time, the investors have lost an average of Rs 10.96 crore (Rs 109.6 million) in every minute of trade, while the per-second loss works out to be about Rs 1.6 crore (Rs 16 million).

There are about 19 million demat accounts in the country, but the total number of active stock market investors are estimated at little over 1 crore (10 million), after taking into consideration the inactive accounts and the fact that some might have more than one account.

Click NEXT to read on . . .

Indian stock markets losing Rs 100 crore per minute!

Accordingly, the average loss for every investor would be more than Re 1 for every second of trade, while the cumulative average loss for every investor so far in 2011 stands at over Rs 10 lakh.

However, there are some investors, mostly promoters, whose market value loss of whose stock holdings runs into thousands of crore (trillions).

The cumulative loss for all the promoters together is estimated at about Rs 6,00,000 crore (Rs 6 trillion) so far in 2011.

Click NEXT to read on . . .

Indian stock markets losing Rs 100 crore per minute!

On the other hand, the market value has come down by an approximately Rs 5,00,000 crore (Rs 5 trillion) for all the other types of investors, including mutual funds, other domestic and foreign institutional investors, HNIs (high net worth individuals) and retail investors.

The total investor wealth has fallen to near Rs 66.009 lakh crore (Rs 66.009 trillion) -- a huge dip of close to Rs 11 lakh crore (Rs 11,000 billion) since last Diwali on November 5, 2010, the day when the Sensex scaled its record closing level of 21,004.96 points.

Experts said that a huge dip in investor confidence is also corroborated by a considerable plunge in the trading turnover at the bourses.

Click NEXT to read on . . .

Indian stock markets losing Rs 100 crore per minute!

The average daily cash market turnover at the bourses have fallen to nearly Rs 15,000 crore (Rs 150 billion), marking a decline of over one-third from approximately Rs 23,000 crore (Rs 230 billion) in October-November 2010.

The current level of turnover is not even one-third of the record level of business volume witnessed in mid-2009, when the daily average turnover was close to Rs 50,000 crore (Rs 500 billion).

The intensity of current downward rally on the bourses can be gauged from the fact that only four stocks out of the 50 top blue-chips that make the Nifty index have given a positive return in the past one month.