| « Back to article | Print this article |

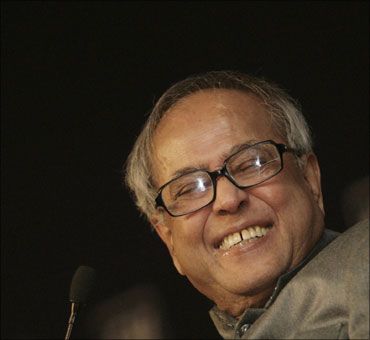

FM not in the mood to cut income tax rates

Those looking for income-tax relief in the forthcoming Budget to fight rising food prices are likely to be disappointed.

According to a senior finance ministry official, "the Direct Taxes Code has to be implemented next year and considering DTC is a composite plan, it will not be a good idea to implement it in bits and pieces".

Any change in the personal income-tax rates in the coming Budget, therefore, was highly unlikely, said the official.

The complete structure is set to come into force in full and not step-by-step. This clearly indicates that though the next Budget Session is set to be stormy; on the income-tax front, Finance Minister Pranab Mukherjee is unlikely to disturb the tax rate structure in a major way in the Budget for 2011-2012 and maintain peace in this critical area.

Additional inputs: PTI

Click NEXT to read on . . .

FM not in mood to cut income tax rates

Finance Minister Pranab Mukherjee is not in a mood to cut taxes but may continue with stimulus in the budget for 2011-12, feel industry representatives who met him for Pre-Budget interactions.

"Finance Minister is not in a mood to cut taxes because it will affect fiscal deficit targets. . . . .It appears that FM has at least agreed to continue with stimulus packages," Videocon chairman Venugopal Dhoot told reporters after a three hour long meeting.

Echoing similar views, Ficci President Rajan Bharti Mittal said, "we have asked to maintain excise duty at the current level. . . .Let the interest rate not harden up because industry is in investment mode so that those investments does not become unviable."

He also suggested for corporate tax reduction from the existing level of 30 per cent to 25 per cent. Industry chamber Federation of Indian Chambers of Commerce and Industry also made a recommendation for opening up defence and retail sectors for foreign players.

Click NEXT to read on . . .

FM not in mood to cut income tax rates

"We have suggested for opening up of sectors like defence and multi-brand outlets," Mittal added.

To help the industry from the aftermath of the crisis, the government and the Reserve Bank of India provided a stimulus to the economy to tide over the turbulence.

The government reduced tax rates and raised public expenditure, while the RBI released more funds into the system.

Click NEXT to read on . . .

FM not in mood to cut income tax rates

The Direct Taxes Code Bill, 2010, was introduced in the Lok Sabha on August 30 last year and it was proposed to implement the Code from April 2012.

The Income Tax Department had chalked out a plan for the preparation and its implementation from next year, said the official. A few changes due to political compulsions, however, should not be ruled out completely, said the official.

The department is focusing on developing an integrated technology platform to ensure a smooth transition to DTC from the existing Income Tax Act. The Code offers an opportunity for the Income Tax Department to integrate its people, process and technology through an integrated technology platform.

According to the Central Board of Direct Taxes, the idea is to prepare for the transition with a detailed outreach programme both for the taxpayers and departmental personnel.

Click NEXT to read on . . .

FM not in mood to cut income tax rates

The department has also envisaged to make use of the opportunity to move towards a fully automated technology-driven system and integrate the compliance process chain through a common technology platform.

The department was also in the process of drafting the final rules associated with various sections of DTC, said the official.

In view of the economic recovery, Mukherjee had started the process of withdrawal of stimulus by raising tax rates in the 2010-11 Budget.

With the economy recording a growth rate of 8.9 per cent in the first half of the current fiscal, Mukherjee is expected to further withdraw the stimulus with a view to reduce the fiscal deficit, which is expected to be about 5.5 per cent of the gross domestic product in 2010-11.