| « Back to article | Print this article |

Differing views on the Budget

Overall the Budget 2011-12 seems to be neutral and shows a similar trend as shown in the previous year Budget.

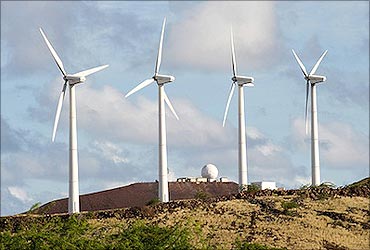

The Budget has given importance mainly to four aspects namely alternate energy or green energy, agriculture, education and infrastructure.

This is a good sign for the economic growth. Concessions for green energy will encourage the manufacturing and usage of such energy.

The backbone of the economy is agriculture and right measures have been taken to support and improve that.

Similarly the infrastructure has been provided around 20 per cent more than last year, which again is a good sign for the economic growth.

Finally the education which is very important has been given some boost with higher allocation, which is 30 per cent more than last year budget.

Industries depending on education verticals will find it more advantageous. Already they are on the rise and this will add to the growth of that sector.

Reform window is open

Union Budget 2011 has been overall positive as it has avoided being overtly populist and has kept the window open for further reforms.

FMs goal of fiscal deficit at 4.6 per cent for FY12 is consistent with the direction outlined by FRBM.

Other announcements on the introduction of a Bill to enable RBI to move on new banking licenses and FDI reforms, as well as the decisions to keep Excise Duty and Service Tax at existing levels have evinced a positive response from the markets and will be good for the investment climate.

The intention to move fertilizer and kerosene subsidies into direct mode using UID, instead of the PDS, will result in efficient delivery of subsidies and eliminate wastage.

Reform window is open

Nil excise on equipment for UMPP is also a positive move which protects domestic industry without creating tariff barriers.

Service tax on hospitality, insurance, healthcare, air travel etc will impact these sectors but should be seen in the context of eventually Service Tax becoming applicable on all services.

Allowing foreign investors to invest directly in Indian Mutual Funds seems like an interesting move to bolster MF flows.

Budget has been silent on many things like extension of STPI for IT Companies, retail FDI, etc, but overall FM has clearly indicated that government will be committed to fiscal consolidation and reforms.

Budget positive for education sector

The Union Budget 2011 has been particularly positive for the education sector, a prerequisite for any country's growth and development.

India is expected to clock an annual GDP of around 9 per cent in years and will also account for 25 per cent of the global increase in workforce over the next four decades.

On the flip side, India will have the highest number of illiterate adults and a large percentage of unemployable literate people.

The government's allocation of Rs. 52,057 crore (Rs. 520.57 billion) for the education sector and another one of Rs. 21,000 crore (Rs. 210 billion) specifically for the primary education segment is indeed an encouraging step to not just widely extend the benefits of education but also impact the quality to achieve global benchmarks.

Budget positive for education sector

Another positive announcement was an additional Rs. 500 crore (Rs. 5 billion) allocation for the national skill development fund.

Every sector in India is challenged with severe crunch of skilled workforce and such initiatives by the NSDC will no doubt help fill the gap by training about 10 lakh workers in the next 10 years.

But, the gap is widening and there will be a need for around 50 crore skilled workers across sectors in India by 2022.

The government and NSDC in particular should look at employing technology as a strategic partner to fast track and bridge this gap.

Budget targets growth

Overall, the Budget has targeted the growth aspects and has proposed clarity in regulatory regime going forward.

High importance has been given to development of infrastructure, education, agriculture and rural sector and e-governance initiatives along with showing roadmap for liberalised foreign investments.

Confidence has also been given through emphasis on enactment of DTC, GST and Companies Bill.

Proposed amendment in Indian Stamp Act,1899, would also clear air in the ambiguities of Stamp Duty regime specifically under "M and A".

Budget targets growth

Changes in Direct Tax provisions is as such minimal as DTC is already placed before Parliament.

However key changes include levy of MAT on developers of SEZ and units operating therein, which would make SEZ also taxable.

Similarly Alternate Minimum Tax is levied in case of Limited Liability Partnership at same rate applicable to MAT for Companies.

However, the rates of Excise and Service tax remained unchanged.

Pragmatic Budget

The Union Budget 2011-12 presented by the Finance Minister Pranab Mukherjee is a pragmatic one. The vision towards bringing down the fiscal deficit to 4.6 per cent next year, 4.1 per cent in 2012-13 and 3.5 per cent in 2013-14 is very welcome.

We hope the FM has drawn up a clear roadmap and that the government will take all necessary measures to deliver on this promise.

Another positive aspect of the Budget is that there is continuity in the overall direction and there are no dramatic changes in policy focus.

Infrastructure, urban and rural development and education continue to be focus areas for government spending.

Pragmatic Budget

On the insurance industry front, we would like to better understand the FM's proposal to move the Insurance Laws (Amendment) Bill, 2008 in Parliament.

The details of this bill were not shared in the budget speech but we do hope that this long pending bill to allow for a higher share of FDI in the insurance sector will be tabled soon.

Increasing the FDI cap to 49 per cent from the existing 26 per cent will bring in much needed capital to the industry and will help increase insurance penetration levels in the country.