Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

Business Standard published two compilations recently. One was the annual list of richest Indians (the dollar billionaires) and the second was the list of highest paid corporate chief executives (the rupee crorepatis).

The former is a wealth ranking and the latter ranks annual incomes. There are 657 billionaires in the

Business Standard list and their combined wealth is 22 per cent of this year's nominal GDP.

Similarly, there are 893 chief executives from last year whose incomes exceeded Rs 1 crore (not counting stock options), and their combined income is about Rs 3,000 crore (Rs 30 billion).

Click NEXT to read on

Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

The numbers for these two lists have swollen by 16 and 11 per cent, respectively, since the previous year of compilation. In the aggregate, the wealth of the super rich and the income of the highest brackets have risen faster than GDP growth over several years.

India's rupee GDP has quadrupled since the early nineties, and per capita income has also gone up more than three times. But the income and wealth of the highest strata have soared much faster.

One consequence of this is that since the start of the noughties income tax collections have risen twice as fast as national income.

Of course, some of this is due to better tax administration. But, it does point to the question of rising inequality and differential spoils of economic growth.

Click NEXT to read on

Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

Official estimates of income inequality, based on a proxy of consumption inequality, continue to be moderate.

This is surely an underestimate. The measured Gini coefficient for India is around 0.35, much below Brazil, Russia and China. So, the official line is that inequality may be widening, but not alarmingly so, and India fares better than peers.

This raises three questions: (a) is the actual inequality much higher?; (b) as long as all social strata are doing better, perhaps at differential rates, how does it matter? Does inequality hurt growth?; (c ) if yes, what is the most appropriate way to redistribute the unequal spoils of growth?

Click NEXT to read on

Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

The third question's answer is operationalised partly through the Union Budget process. A Budget can be measured on many parameters, and its redistribution orientation is one of them.

Of course, merely announcing transfer payments to the poor does not make them happen. But the intent articulated in the annual Budget is the first step.

The Finance Commission, too, is a constitutional process that addresses imbalances.So, to return to the first question, is actual inequality much higher than what is captured by the Gini coefficient?

If you considered the value of human capital (acquired through education) a component of the overall wealth of individuals, wealth inequality is much worse.

Click NEXT to read on

Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

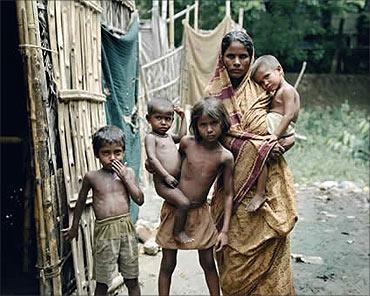

After all, less than 10 per cent of teenagers get into a college, and are condemned to lower lifetime incomes.

If you add to that the inequality of access to public services like health, drinking water, electricity and finance, the picture is worse. The best litmus test is access to jobs.

Most people stuck in low-paying and low-productivity agriculture pine for a stable job. Most politicians in the West brag about their record of creating jobs.

Similar is the case with China. In India, however, jobs growth in the organised sector has been near-zero for almost two decades.

Click NEXT to read on

Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

The tragic spectacle of 250,000 youngsters stampeding for 416 low-level government jobs at a recent recruitment camp in Bareilly is rather routine.

It is paradoxical that we have a severe drought of secure and stable jobs even as industry is unable to find able-bodied skilled and semi-skilled workers. Inequality in Indian society is worse when you add dimensions like access to education, health and livelihood.

The second question is whether inequality is bad for growth. Worsening inequality does not negate the fact that "all" classes in India have had their incomes increased, even adjusting for inflation.

It is just that in relative terms the rich got a disproportionate share of the ever-growing pie.

Click NEXT to read on

Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

If this were America, it wouldn't be a big problem; the society there is characterised by a social and economic churn. If someone is doing much better, it acts as an incentive for others.

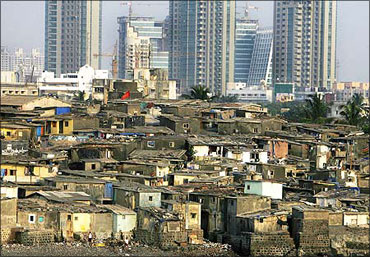

Billionaires' success becomes an aspiration motivator. But, because Indian society is rigid, socio-economic barriers remain entrenched across generations.

The in-your-face stark inequality is ultimately a potential trigger for social instability, rather than an incentive for new entrepreneurs.

Besides, how can an increase in the number of private security guards and gated communities be a sign of improving living standards?

Click NEXT to read on

Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

Inequality is a "public good" that affects all of us uniformly, and can hurt growth rather badly. After all, expenditure on fighting the Maoists can hardly be called productive.

The warning about widening social and economic inequality was given in a prophetic speech by B R Ambedkar in 1949.

He said, "How long shall we continue to live this life of contradictions? How long shall we continue to deny equality in our social and economic life? If we continue to deny it for long, we will do so only by putting our political democracy in peril.

We must remove this contradiction at the earliest possible moment or else those who suffer from inequality will blow up the structure of political democracy which this (Constituent) Assembly has so laboriously built up."

Click NEXT to read on

Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

Spoken decades before the scourge of the Maoists, Ambedkar was prescient in use of the phrase "blow up".

Which leads us to the third question: what is the appropriate form and strategy of redistribution?

Balanced growth has always been an implicit objective of economic planners and even the Finance Commission uses it in its formula.

The current government has used "inclusive growth" as a theme that permeates all policies.

Click NEXT to read on

Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

The annual Budget exercise, too, is influenced by the same mantra. But genuine redistribution calls for either direct cash transfers (not happening yet), accurately targeted provision of goods and services to the poor (plagued by leakages), or the creation of pure public goods.

Leaving aside the important issue of outlays vs outcomes, the Budget spending pattern is not really geared to any of the three categories mentioned above.

More than one fourth of all spending is on interest alone, which is actually regressive and not redistributive at all.

Click NEXT to read on

Can Budget bridge the rich-poor divide?

Last updated on: February 23, 2011 08:47 IST

This is also the case with defence. Subsidies that are meant for the poor get leaked to the non-poor. Since capital expenditure is residual, it mostly gets squeezed out.

Since Budgets don't have enough funds for public goods creation, the government has also resorted to the creation of rights, such as the NREGA or the right to food.

But these are inadequate substitutes for genuinely redistributive policies, which are also not anti-growth.

For that, we need policies that expand opportunities (labour reforms, exit policy for firms and bankruptcy code), reduce artificial hurdles (the Agricultural Produce Market Committee in agriculture) and the formation of a common economic market (the Goods and Services Tax).

Let's see if the FM can get the "gini" out of the bottle on the Budget day!

The author is chief economist, Aditya Birla Group. The views expressed are personal.

Source: