Mukesh Ambani-led Reliance Industries' $7.2 billion deal with British giant BP Plc, cleared by the government on Friday, is seen as the biggest foreign direct investment into India.

The mega transaction, announced in February, was cleared by the Cabinet Committee on Economic Affairs (CCEA).

...BP gets nod to buy stake in RIL's blocks

Image: Protest against Posco.Photographs: Reuters.

RIL-BP's $7.2 billion deal is seen as the largest Foreign Direct Investment (FDI) after Japanese pharma major Daiichi Sankyo's buyout of Ranbaxy Laboratories for $4.5 billion in 2008.

Even though there are other bigger-size proposals, most of them are yet to materialise. For instance, South Korean group Posco's $12 billion investment for a steel plant in Orissa is yet to take off.

BP gets nod to buy stake in RIL's blocks

Image: Vodafone ZooZoo.Similar is the case with ArcelorMittal's around $30 billion investment plans across India.

Another mega transaction worth $11 billion was between Vodafone and Hutchison-Essar. However, there was no direct participation of any domestic firm, as the deal was between two foreign firms.

BP gets nod to buy stake in RIL's blocks

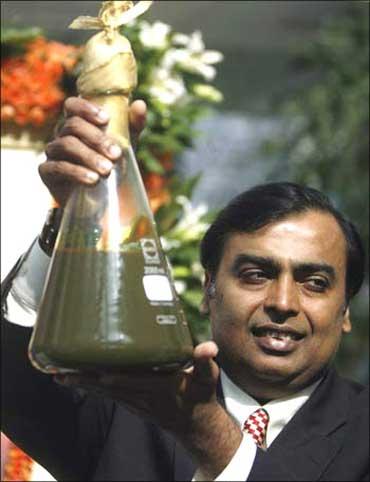

Image: Mukesh Ambani.The latest RIL-BP deal, one of the biggest in the Indian energy space, would see Mukesh Ambani firm selling 30 per cent stake in 23 oil and gas blocks to British entity.

"This is the single largest FDI in the history of India," RIL Chairman Mukesh Ambani had said earlier. Interestingly, Reliance Industries' failed attempt in 2010 to take control of petrochemicals major LyondellBasell, was valued at over $14 billion.

BP gets nod to buy stake in RIL's blocks

Image: Anil Agarwal, Chairman, Vedanta Resources.If the transaction had materialised, it would have been the largest ever by an Indian entity.

Going by estimates, last year alone saw the announcement of over 290 inbound transactions worth over $22 billion.

Among them were Vedanta Resources' planned $9.6 billion acquisition of a majority stake in Cairn India.

RIL-BP strikes BIGGEST FDI deal

Image: NTT DOCOMO.The NTT DOCOMO-Tata Teleservices joint venture worth $2.70 billion also brought in significant FDI inflows into India.

RIL-BP strikes BIGGEST FDI deal

Image: Bharti took over Zain.Other major transactions involving Indian entities are Hindalco's buyout of Novelis for $6 billion and ONGC -Imperial's $2.80 billion deal.

article