Photographs: Bazuki Muhammad/Reuters Sushmi Dey in New Delhi

Portuguese investment bank Espirito Santo has raised concerns over the accounting processes of Bangalore-based biotechnology company Biocon.

In a report released to the investment community on Monday, the Lisbon-based financial group has asked questions related to Biocon's accounting, mainly during its split with Pfizer on the $350-million insulin deal and its divestment of stake in AxiCorp.

Biocon has denied all the charges contained in the report, while replying to a questionnaire sent by Business Standard on the matter. Biocon said its accounting practices both in case of the deal with Pfizer and divestment in AxiCorp were in compliance with GAAP (Generally Accepted Accounting Practice) and the company had not incurred any additional gains or losses.

According to the report, which this newspaper has reviewed, Biocon booked a cash loss of around euro 10 million and a notional loss of euro 21 million in the AxiCorp deal. However, the company structured the deal in a manner that ensured no loss on sale in its P&L (profit and loss account).

Click on NEXT for more...

Biocon's accounting process comes under scanner

Photographs: Reuters

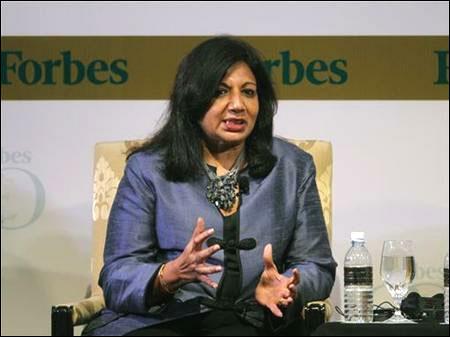

The report has alleged that Biocon has also not factored in its P&L the $200-million upfront milestone payment it received from Pfizer when the insulin deal between the two companies was called off. Instead, the company, owned by Kiran Mazumdar-Shaw, chose to keep it in its balance sheet and recognise it with R&D costs, the report said.

"BIOS' (Biocon's) shares have had an uninspiring run post the termination of the PFE (Pfizer) deal, which dealt a body blow to its biosimilar insulin aspirations. Whilst the deal is now terminated, it will continue to throw its shadow over future earnings, thanks to an aggressive accounting policy that will see BIOS shift biosimilar insulin R&D costs off the P&L. This, along with the use of a creative transaction structure for AxiCorp, leaves us frustrated with corporate governance standards at the company," Espirito Santo Investment Bank said in its report, downgrading the accounting and corporate governance rating for the company.

"There is absolutely neither any governance issue nor any accounting issue. Biocon has always adopted a very transparent reporting practice and has taken full care to ensure we are in compliance," Biocon said in an email response.

Click on NEXT for more...

Biocon's accounting process comes under scanner

Photographs: Reuters

Kiran Mazumdar-Shaw is a member of the committee recently set up by the government to suggest a framework for the "highest quality" of corporate governance in the country.

The committee is chaired by Godrej Group chairman Adi Godrej. In March, Biocon called off its deal with global pharma giant Pfizer to produce biosimilar versions of insulin and insulin analog products. Under the terms of the pact finalised in December 2010, Pfizer was to make upfront payments totalling $200 million.

Biocon was also eligible to receive additional development and regulatory milestone payments of up to $150 million and additional payments linked to Pfizer's sales of its four insulin biosimilar products across global markets.

Questioning Biocon's accounting process, the report says the firm, instead of factoring in the settlement amount received from Pfizer as a one-time gain, plans to adjust it with its research and development-related costs towards growing its innovative product portfolio of biosimilar insulin.

"In our experience, globally, post a deal termination, the balance of deferred revenues lying on the balance sheet is typically recognised in year-1 as a one-off revenue item. This is in line with the matching principle as the revenues from a terminated deal should not ideally be matched against costs of another deal (internal or external)," the investment bank said in its report.

Click on NEXT for more...

Biocon's accounting process comes under scanner

Photographs: Reuters

According to the bank report, there has been considerable confusion over the timing and accounting treatment of Pfizer's milestones payment through the P&L, as Biocon currently has deferred revenues of around Rs 49.3 crore (Rs 493 million) on the balance sheet.

However, Biocon maintained it was "the ideal way" to reflect the residual revenues and the ongoing costs in its books as it was only using it for R&D.

But, the investment bank was of the view the move was likely to inflate Biocon's earnings in the initial years.

"The removal of R&D from P&L will smooth Biocon's earnings over the coming three-four years and to that extent it will also inflate earnings. This is an issue as it could lead to consistent over-valuation," the report said.

While Biocon's auditors have also highlighted the accounting policy, adopted for recognition of deferred revenues after the Pfizer deal, as a matter of emphasis, the company claims it's a universal practice. "Further, these have not been qualified by the auditors," Biocon said.

Click on NEXT for more...

Biocon's accounting process comes under scanner

Photographs: Courtesy, Espirito Santo

The report also talks at length about Biocon's stake sale in its German subsidiary Axicorp GmbH, which the biotechnology firm had picked up in February 2008 for a consideration of euro 30 million.

Now, raising concerns over the "circular" nature of the AxiCorp transaction, the Espirito report points out that while Biocon sold its 77 per cent stake in AxiCorp for a nearly euro 40 million valuation, around 33 per cent higher than its acquisition cost of euro 30 million, the nature and structure of the transaction raise eyebrows as the company used a creative deal structure at the time of acquisition, which allowed it to pay euro 16-million cash for AxiCorp but required it to transfer the rights to biosimilar human insulin and glargine for Germany to AxiCorp for euro 14 million.

"Our analysis indicates that BIOS (Biocon) received only euro 5 million in cash for the divestment, which is surprising given that AxiCorp had a net profit of euro 5 million in FY11," the report said.

The investment bank, in its report, alleges that while it seems that Biocon made a profit on the transaction, in reality, there was a cash loss of euro 10 million and a notional loss of euro 21 million in buying back the intellectual property rights for the products.

article