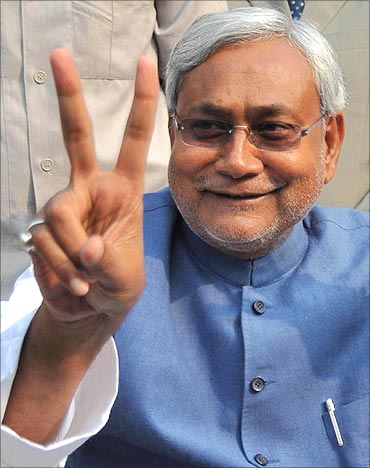

Photographs: Reuters

There was deterioration in Bihar's fiscal position in terms of trends in 2009-2010 compared to the last two years, Controller and Auditor General report said.

Although the state maintained a revenue surplus during these years and had already achieved the 12th Finance Commission recommendation of eliminating revenue deficit, there was a decrease in the revenue surplus during the period under review, said the CAG report on the state's finances for the year ended March 31, 2010.

The report was tabled by deputy chief minister S K Modi in the state assembly.

. . .

All's not well with Bihar's finances

Image: The land of Lord Buddha.The report, however, said the fiscal deficit which was well within 3 per cent of the gross state domestic product increased to 3.4 per cent during the year, which too was within the revised recommendation of 3.5 per cent.

It suggested the need to reduce non-plan expenditure as the revenue expenditure was 80 per cent of the total expenditure, of which 74 per cent was under the non-plan head which included expenditure on salaries, pension payments, interest liabilities and subsidies, which constituted 77 per cent of non-plan revenue expenditure.

. . .

All's not well with Bihar's finances

Image: Patna city.A CAG review showed that the average return on government's investments in statutory corporations, government companies, cooperative banks and societies varied between 0.24 to 0.38 per cent during the last three years.

The government paid average interest on borrowings at rates ranging from 6.48 per cent to 7.93 per cent and this was obviously an unsustainable proposition.

The report suggested that the state government should, therefore, initiate steps to seek better value for money in its investments.

Otherwise the high cost of borrowed funds invested in projects with low financial returns, would continue to strain the economy.

. . .

All's not well with Bihar's finances

Increasing fiscal liabilities accompanied by negligible rates of return on government investment and inadequate interest cost recovery on loans and advances might result in a situation of unsustainable debt in the medium to long term unless suitable measures are initiated to reduce the Non-Plan revenue expenditure and to mobilise additional resources, through tax and non-tax sources.

The report said that during 2009-10, there was an overall savings of Rs 10,546 crore (Rs 105.46 billion), which was a result of the total savings of Rs 10,644 crore (Rs 106.44 billion), being offset by excess expenditure of Rs 98 crore (Rs 980 million).

This excess expenditure required regularisation under Article 205 of Constitution, it said.

article