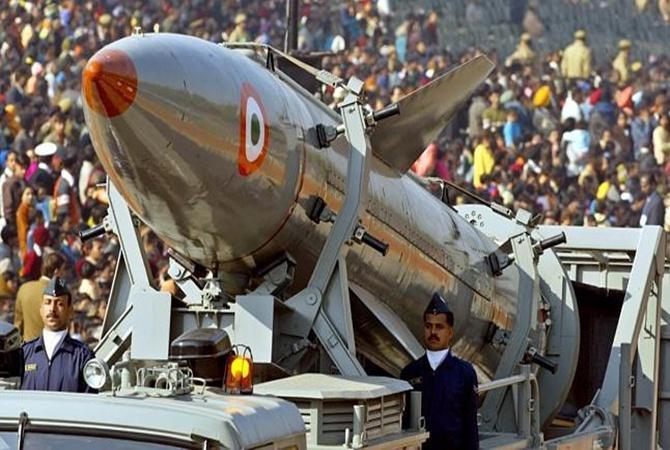

Photographs: Reuters Swaraj Baggonkar in Mumbai

With access to foreign investment becoming easier, a host of Indian companies vie for a share of the $100-billion budget for equipment.

When it comes to high-mobility, multi-purpose personnel carriers like the Humvee, which is the transport backbone of the US Army, India lags far behind.

But in three years from now, the world's third-largest armed force could have its own Humvee-like light combat vehicle - produced indigenously.

With the opening up of defence production to private sector, with 49 per cent foreign participation, domestic automotive companies such as Tata Motors, Mahindra & Mahindra and Ashok Leyland are all in the running for this order.

"This vehicle can adapt itself for many uses. It can be used as a troop carrier or an ambulance, or for reconnaissance purposes. It can even carry small radars," says Vernon Noronha, vice-president (defence & government business), Tata Motors.

The vehicle will weigh 5 tonnes and will have eight or nine variants, he adds. Request for proposals for this class of vehicle will be out as early as September, believes Noronha, followed by year-long trial and testing.

…

Battle heats up for a share of the defence pie

Photographs: Reuters

The Humvee-like troop carrier is only one of the machines Indian companies are hoping to supply to the country's armed forces.

It is estimated that over the next seven years or so, India will buy equipment worth $75 billion to $100 billion. And domestic companies hope to bag a large chunk of those orders.

At least eight Indian companies are eyeing the Rs 52,000-crore (Rs 520 billion) contract to supply the heavily-armoured Future Infantry Combat Vehicle, or FICV, to the Indian Army. With annual service and maintenance agreements, this figure would swell further.

At Rs 20 crore (Rs 200 million) apiece, the vehicle, which can be used both on land and in water, will have an anti-tank guided missile system and a machine gun. The government is also working on contracts for rocket launchers, combat vehicles, troops carriers, light-strike vehicles, missile carriers, radars, mounted gun systems, submarines and transport planes, to name a few.

…

Battle heats up for a share of the defence pie

Photographs: Reuters

Though Finance Minister Arun Jaitley has raised the defence budget 12 per cent to $38.35 billion (Rs 2.3 lakh crore), because of the limited reach of state-owned producers of defence goods, India remains the largest importer of arms in the world.

More than 65 per cent of the country's defence needs are met from outside India. Now, as the government tries to progressively replace the Soviet-era military hardware, the stress is on greater involvement of private entities.

For example, earlier this month, the government cleared the project for the production of military transport aircraft which is open only to the private sector.

The government wants to replace the 56 Avro transport aircraft bought in the 1960s. Over a dozen private companies, including Tata Motors, Mahindra & Mahindra, Ashok Leyland, Bharat Forge, Pipavav Defence, Titagarh Wagons, Larsen & Toubro and MRF, are eyeing the contract that is worth over Rs 60,000 crore.

…

Battle heats up for a share of the defence pie

Photographs: Reuters

Sources say over the last one month, activity at the defence ministry has gathered significant pace. "The frequency of meetings has increased. The government is inviting us (private sector) to explain its needs. We see a very positive environment ahead," says Noronha.

The government's decision to increase foreign direct investment in defence manufacturing to 49 per cent from 26 per cent has also given a boost to private companies. "International defence companies are eager to do business in India and are already in talks with many local companies," says a senior executive of an automobile company. There is the hope that complex technology, details of which are closely guarded by foreign companies, would now be shared with the Indian partners.

Collaborations are already under way. Chennai-based Ashok Leyland, which has been supplying the Stallion military truck to the army, has forged a tripartite agreement to manufacture mounted gun systems with French gun-maker Nexter and engineering giant Larsen & Toubro.

…

Battle heats up for a share of the defence pie

Photographs: Reuters

Mumbai-based Tata Motors is holding talks with some producers of foreign defence goods, while Pipavav is in the advanced stages of bagging an Indian Navy contract to modernise or replace up to 100 ships over the next decade. The Australian unit of Swedish giant SAAB is assisting Pipavav in this venture under a technical partnership agreement.

In addition to Tata Motors, 13 other companies of the Tata group have interests in the defence sector and are looking forward to orders worth Rs 8,000 crore (Rs 80 billion). Tata Advanced Systems, for instance, makes airframe components for the C-130J heavy-lift transport military aircraft, while Tata Power SED has worked on integrated guided missile systems and multi-barrel rocket launchers.

In some cases, private companies are not willing to wait for the product requirement to come to them. Instead, products are being developed in advance.Tata Motors, for example, has developed a 12X12 truck (the second of its kind in the world), which can haul inter-ballistic missiles to any part of the country. And the Kalyani group, the promoter of Bharat Forge, is in the process of developing mine-protected vehicles, a ground penetrating radar and ultralight gun system.

…

Battle heats up for a share of the defence pie

Photographs: Reuters

Can corporate India catch up?

The road ahead, however, is long and challenging. While a handful of private Indian companies have been in the defence business for the last few decades, they are, however, no match for their western counterparts, some of whom have been around for over 200 years.

Major General K B Kapoor (retd), director, Centre for Joint Warfare Studies, says, "Technology has both hard and soft components. While India is very strong as far as the soft components are concerned, it still lacks in the hard components of technology, which necessarily means military hardware."

Known for frugal engineering, Indian companies will face the challenge of consistently maintaining the highest standards of quality. Delays or alterations to projects leading to cost escalation that could hinder government approvals will also have to be taken into account, say market watchers.

S P Shukla, president (group strategy & defence sector), Mahindra & Mahindra, says, "Stage I is about defining the specifications followed by request for prototype. Next comes the making of the prototype according to the specifications. Generally, these projects run into thousands of crores of rupees. This segment is not for companies with a small balance sheet."

…

Battle heats up for a share of the defence pie

Photographs: Reuters

Mahindra & Mahindra has five operational companies under defence. It is the only business house in India that is engaged in projects meant for all the three wings of the armed forces - the army, navy and air force.

Since the FDI limit was raised, the group has opened talks with several potential partners. Though Shukla declines to divulge details of the projects the group is working on, he admits that the company is in the race for the FICV project.

Others, such as the Kalyani group of Pune, are asking for speedier licences and better clarity on the issue of ownership. The Baba Kalyani-led group is looking at a number of segments, including artillery systems, armoured vehicles, futuristic ammunition, air defence systems, defence electronics and protected vehicles.

"It is important to address the problems associated with approvals and grant of industrial licences in a time-bound manner," says Amit Kalyani, executive director, Bharat Forge. "Currently, licences are in the pipeline for many years and we still do not have clarity on the issue of ownership and investment through Foreign Institutional Investor or the portfolio route."

The delays are palpable. Sometime in 2003, the government had announced that Mahindra & Mahindra had been issued a licence to make small firearms.

The government was to initially procure 50,000 of these guns and order another 200,000 if their quality was found to be good. Mahindra & Mahindra immediately got down to work and tied up with an Austrian company called Steyr. It worked hard to customise the gun for Indian conditions. But there was no headway in this decision. The licence has since expired.

However, the problems notwithstanding, a beginning has been made. And the private sector hopes to make the most of it.

FORCE MULTIPLIERS

Company and their projects

TATA MOTORS

FICV*, light-strike vehicle, light-support vehicle, troop carriers, light-armoured multipurpose vehicle

MAHINDRA & MAHINDRA

FICV

ASHOK LEYLAND

Mounted gun systems, troop carriers

TATA ADVANCED SYSTEMS

Aerostructures, radar systems, missile systems

PIPAVAV

Warships, underwater vehicles, weapons and sensors

LARSEN & TOUBRO

Weapons launchers, submarines, radars, unmanned aerial vehicles

MRF

Tyres for fighter jets

* Futuristic Infantry Combat Vehicle List is not exhaustive

Source: Industry

article