| « Back to article | Print this article |

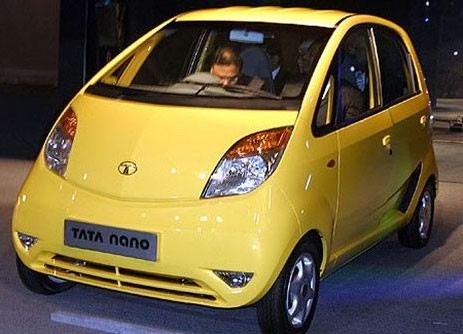

Selling the Nano: Tata Motors shifts into high gear

The Nano became a major attraction for Keralites during the Onam festival in August last year after Tata Motors, India's biggest vehicle maker, began accepting bookings for the small car.

The excitement among potential buyers who queued up at showrooms was palpable; they were the first in the country to get an opportunity to reserve a Nano, 15 months after Tata Motors closed bookings.

The small wonder tapped into the festive spirit and was very well received, according to anxious Tata Motors executives and dealers in Kerala.

Click NEXT to read on . . .

Selling the Nano: Tata Motors shifts into high gear

Dispatches of the Nano to dealers, on the back of a speedy ramp-up at the company's new plant at Sanand in Gujarat, peaked at 9,000 units in July, a month before Onam.

This was primarily done to stock showrooms with enough units of the Nano to meet any major spurt in demand.

With a further increase in production, the company added 10 more states to the open bookings list by November.

In addition, Tata Motors tied up with several banks and NBFCs to provide easy finance. Multiple print and out-of-home advertising campaigns were also launched.

Despite such extensive efforts, production at Sanand tanked two months ago. Tata Motors delivered only 509 units of the Nano to dealers in November, against over 3,000 in October.

Click NEXT to read on . . .

Selling the Nano: Tata Motors shifts into high gear

About 6,000 surplus vehicles were reportedly parked in open fields within the Sanand factory complex during that period.

The company, however, maintained that customer purchases were much higher and on expected lines, without disclosing actual figures.

Tata Motors reasoned that the decision to moderate production at Sanand was aimed at bringing down Nano inventories at dealerships.

As a general practice worldwide, buyers postpone their purchases in November and December to the New Year to gain the psychological advantage of the date of registration of the vehicle.

The company extended open sales of the Nano to all states on January 3, hiking dispatches of the car from its factory by nearly eleven-fold to 5,784 units in December, compared with the discouraging levels reported in November.

Click NEXT to read on . . .

Selling the Nano: Tata Motors shifts into high gear

"We have had open sales in Maharashtra, Uttar Pradesh, West Bengal, Gujarat, Punjab and Karnataka for a long time now. There has been substantial progress in retail sales in these states, which has resulted in higher dispatches," said a Tata Motors spokesperson.

Although company officials are discreet about the Nano's retail numbers, sources say that the car sold more than 3,000 units in November and an equal number in December. The vehicle is expected to sell in excess of 5,000 units this month.

While Tata Motors readily hiked prices of the Indica, Indigo and other vehicles by an average of 1 per cent last week on the back of surging raw material prices, it has, however, avoided raising Nano prices for the time being.

Click NEXT to read on . . .

Selling the Nano: Tata Motors shifts into high gear

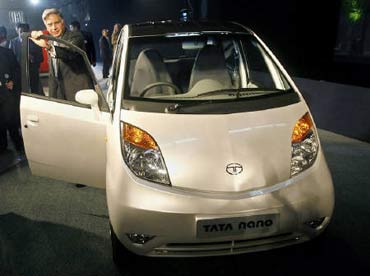

The base variant of a BS-IV Nano is priced at Rs 1.5 lakh (Rs 150,000) in Mumbai, ex-showroom, while the high-end LX variant carries with a pricetag of Rs 2.03 lakh (Rs 203,000).

A standard 1 per cent price hike on the car would make it dearer by Rs 1,500-2,000.

In addition to the 289 access points specially created for the Nano, besides about 585 passenger vehicle dealerships, Tata Motors is now looking to tap into its commercial vehicle sales & service centres in the rural areas to further engage potential customers.

"To expand the Tata Nano network, we can use Tata authorised service centres, which have a very wide reach. Sales & service centre for commercial vehicles are spread out in rural areas and can be tapped later for the Nano," said the company spokesperson.

Click NEXT to read on . . .

Selling the Nano: Tata Motors shifts into high gear

Tata Motors has now brought on board 29 banks and other financial institutions to furnish loans to customers wanting to buy a Nano.

This includes in-house vehicle financing arm Tata Motor Finance, which promises clearances in two days, while offering 100 per cent finance.

Understandably the contribution of TMF is much higher than other institutions and is increasing, according to the company spokesperson.

Although TMF provides more expensive loans (at 11-15 per cent) than other banks like State Bank of India (8-11.5 per cent), it involves the least amount of paperwork.

To make finance more easily available, Tata Motors is also holding discussions with financial institutions that have difficulty in classifying the consumer profile of the Nano.

Click NEXT to read on . . .

Selling the Nano: Tata Motors shifts into high gear

Because the Nano is positioned between a two-wheeler and a compact car, some financial institutions have classified an applicant as one who has the capacity to fund the purchase of a two-wheeler, but not a car. This is one of the main reasons most applications were rejected by banks.

Tata Motors has recruited close to 1,500 individuals to work with customers and financial institutions at the local level such as cooperative banks.

These new recruits are also responsible for engaging in a dialogue with consumers while increasing the Nano's exposure and general interest in the car.

Although volumes presently generated by the Nano are far less than earlier projected by the company, parts suppliers and dealers are optimistic of a recovery in the coming months, especially after top executives of Tata Motors recently reassured them of better prospects.

When the Sanand plant was launched, Nano vendors were given much higher projections for parts supplies to sustain the production of 9,000-10,000 units a month in the initial months.

They were told this would be ramped up to nearly 20,000 units by March end.

"Tata Motors executives have assured us that demand will revive in the coming months following open sales in all states and several other promotional steps. This will definitely push up volumes," said a hopeful Gujarat-based vendor.

Click NEXT to read on . . .