Preeti Khicha in Mumbai

With a price tag of just Rs 100,000, the Nano was meant for all those Indians who wanted to drive a car but couldn't afford to buy one.

Once it's out on the road, pundits had said, the market will explode.

Every nook and cranny of the country will be crammed with the small wonder.

Ratan Tata, chairman of the Tata group, had told The McKinsey Quarterly when the Nano was being conceived that such a car could sell up to a million pieces in a year.

It was a jolt of sorts for all when Tata Motors reported the sale numbers for November 2010: It had sold only 509 Nanos.

The slide had actually started earlier.

Nano sales had peaked at 9,000 in July and then fell to 8,103 in August, 5,520 in September and 3,065 in October.

November, of course, was the lowest point for the car that was launched amid much fanfare in March 2009.

. . .

Nano: It has been a topsy-turvy ride

Image: The Tata Nano interior.These numbers, to be fair, show what Tata Motors has sold to its dealers and not what the customers bought from the dealers.

So it doesn't capture fully what's going on at the market place, though it somewhat mirrors the trend.

One way to find out is to check the inventory with the dealers, but Tata Motors dealers are tightlipped about it.

Automobile experts insist that dealers do not like to hold large inventories because of the cost attached to it.

But the Tata Motors dealers may have picked up large stocks of the Nano in view of the launch-time euphoria, and that perhaps could be the reason for the low November numbers.

Whatever the reason, the dip in the sale graph is worrisome.

The car market has grown at a fast clip per cent in the last several months.

The two-wheeler market, which the Nano was supposed to feed on, too has shown no signs of a slowdown in months together.

. . .

Nano: It has been a topsy-turvy ride

Image: Ashok Vichare, the first owner of Nano, gets the keys from Ratan Tata.Photographs: Prasanna D Zore/Rediff

Bumpy beginnings

The Nano experienced hiccups even before it was born.

Work at the Nano factory at Singur in West Bengal had to stop midway in October 2008, thanks to the agitation over compensation to the landowners led by the firebrand Mamata Banerjee.

The company, a week later, announced that it had got land at Sanand in Gujarat for the factory.

(Rivals have alleged that it came along with huge tax incentives thrown in by the state government.)

Meanwhile, as a makeshift arrangement, Tata Motors began to roll out the Nano from its plant at Pantnagar in Uttarakhand.

This plant is dedicated to the Ace mini-truck; the engineers said they could put together up to 50,000 Nanos in a year -- not enough for open sales where customers walk into a showroom and drive out in a car.

So, the company decided to go for advance bookings, which is a good way to gauge the demand and streamline production.

. . .

Nano: It has been a topsy-turvy ride

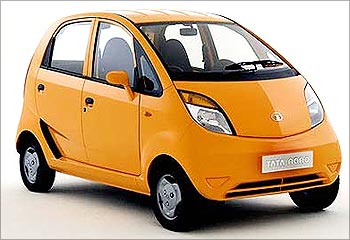

Image: The Tata Nano.The bookings were opened on March 23, 2009 and closed on April 25, 2009 -- as many as 206,000 people applied, 100,000 were shortlisted by June, and the first delivery was made in July by Ratan Tata in Mumbai.

The Sanand factory went on stream in June 2010; the company has started to do open sales in several states like Kerala, Karnataka, Maharashtra, Uttar Pradesh, West Bengal, Chhattisgarh, Madhya Pradesh, Andhra Pradesh, Bihar, Gujarat and Punjab.

It hopes to cover the whole country by March.

This may be a good indication that the supply constraints on the Nano have begun to lift, though some observers say production is yet to peak because all component suppliers have not been able to set up shop near the Sanand factory.

But the booking days, most experts insist, worked against the Nano. People who missed out in the lottery were unhappy.

The deliveries were to be completed over the next year-and-a-half; some lost interest midway and cancelled their bookings.

. . .

Nano: It has been a topsy-turvy ride

Image: Ratan Tata (left), chairman of the Tata Group, and Gujarat's Chief Minister Narendra Modi.Photographs: Amit Dave/Reuters

Though Tata Motors had said the 100,000 bookings will be delivered by December 2010, there were just 71,000 Nanos on the road as of November 2010.

As this includes sizeable off-the-shelf numbers as well, cancellations clearly have been huge.

There was also some bit of confusion in the market -- advance booking for an automobile, after all, is not something the current generation of Indian car buyers has heard of.

Moreover, it is no longer a Rs 100,000-car.

The cheapest you can buy a Nano in the country is around Rs 124,000 (ex-showroom); the top variant can cost up to Rs 205,000.

Spread over 60 or even more installments, the difference doesn't add up to much.

But the catchy Rs 100,000-tag is gone, though the Nano remains the cheapest car in the world.

There were also a few incidents of the car catching fire. Tata Motors, on its part, claims the fires were caused by the addition of foreign electrical equipment like music systems and air-conditioners which were not supported by the car.

. . .

Nano: It has been a topsy-turvy ride

Image: Employees work inside the newly inaugurated plant for the Tata Nano car at Sanand.Photographs: Amit Dave/Reuters

The company adds that internal and international experts have twice analysed the Nano in 2010 and arrived at the conclusion that the reasons for the incidents in a few Nanos are specific to the cars, and there are no generic defects.

It also claims that over 80 per cent of the current Nano owners are either satisfied or very satisfied with the car. But don't these incidents still play on the consumers' mind? Has this caused the demand for the Nano to taper off in recent times?

None of the top Tata Motors executives was available for comment in the holiday season.

Reviving confidence

On talking to a wide range of people inside the company and in the trade, it is clear that a new strategy for the Nano is now in place.

To begin with, having taken into account the highly-publicised fire incidents, Tata Motors is ready with additional safety measures.

"We are providing enhanced features in the exhaust system and electrical system to make the car more robust. Existing customers too can avail of the benefits at no additional cost," says a company spokesperson.

. . .

Nano: It has been a topsy-turvy ride

Image: Assembly plant in the Nano factory.Photographs: Amit Dave/Reuters

To revive confidence in the brand's safety, Tata Motors has now put on offer a four-year or 60,000-km, whichever comes earlier, warranty for the Nano, the highest ever in the Indian automobile history.

Previously, the warranty on offer was valid for 18 month.

The new warranty has been extended to old Nanos as well. It is also offering an annual maintenance contract at just Rs 99 a month, which takes care of all parts except tyres and battery.

Will it work? Some feel it might. This, anyway, is the right thing to do, everybody agrees.

"Like the (South) Korean automobile companies in the US, who had to take corrective measures to restore consumer confidence, these steps will enable the company bring the consumers back to the showroom," says PricewaterhouseCoopers leader (automotive practice) Abdul Majeed.

. . .

Nano: It has been a topsy-turvy ride

Image: Nano assembly plant.Photographs: Amit Dave/Reuters

"Word-of-mouth is very strong in India and it is crucial for Tata Motors to focus on increasing volumes in order to build faith in the product."

There have been other issues too.

"The profile of the person who applied for the Nano was of a two-wheeler owner. Previously, the company did not have any arrangement to address this kind of a consumer and hence it was extremely difficult for the buyer to obtain finance," says Vineet Hetamasaria of PINC research.

Tata Motors executives admit that the company had no fix on the customers who had taken the booking route -- there was no way to tell if they needed finance to buy the car. Thus, Tata Motor Finance, a group company, which finances a very large portion of Tata Motor's sales, did only 10 per cent of all Nano sales in 2009.

Tata Motors has awoken to this opportunity, and wants to ensure that the Nano buyers get loans easily.

Tata Motor Finance promises that it will process the loan application in just 48 hours, and there is no payment required upfront.

. . .

Nano: It has been a topsy-turvy ride

Image: Nano assembly plant.Photographs: Amit Dave/Reuters

This is much faster than automobile loans at any other bank.

The company has set up quick and hassle-free financing arrangements with public sector banks, private banks, non-banking finance companies and co-operatives.

"We provide 80 to 100 per cent finance for the Nano, depending on the customer's profile. The loan usually takes nine days to process and we charge an interest of 12.5 per cent," says the manager of an HDFC Bank branch in Kolkata.

There was also a mismatch between the hype that surrounded the Nano and the touch points where potential buyers could experience the car.

Tata Motors has recently launched Nano Access Points in the cities where open sales have begun.

"We have set up 110 such points where customers can experience, test drive or test ride (several do not know how to drive) the car," says the spokesperson.

"These special centres are in addition to our 240 dealerships which have 540 sub-showrooms under them."

. . .

Nano: It has been a topsy-turvy ride

Image: Tata Nano.These Nano Access Points will only act as consumer touch points; in case a visitor is ready to purchase the car, he will be transferred to the dealership under which the Nano Access Point operates.

The company has stationed 1,200 trained people at the dealerships to sell the Nano.

To boost consumer confidence, Tata Motors is also organising interactive product displays at hotels and dealerships, and is inviting owners and prospective buyers to share their views on the car.

Reaching the target

There have been other course-corrections as well. Tata Motors, at the time of the car's launch in 2009, had depended heavily on the media for brand promotion -- the marketing plan was as unconventional as the car.

The Nano was projected as the next big thing from India. This had indeed touched an emotional chord with most Indians.

All the advertising campaign now needed to do was to inform people about the features. Most new cars have to bond with the buyers as well as inform them about the features; the Nano's task was simpler.

. . .

Nano: It has been a topsy-turvy ride

Image: Some of the Nano team members with Ratan Tata at the Auto Expo in Delhi.Photographs: Courtesy: Tata Motors

There was a heavy focus on the online media, including blogs and social-networking sites, to create a buzz about the car, especially among the youth who were seen as prime candidates for the Nano.

In fact, the innovative use of the media to advertise the launch of the Nano fetched three awards at Emvies 2009 organised by the Advertising Club of Bombay.

Cannes 2009, world's most coveted advertising awards, had conferred the Bronze Lion for Best Use of Mixed Media to the Nano launch advertising.

That may be fine, but did the company's focus on the online media in those days alienate buyers in small towns and villages who are not that familiar with the internet?

Some analysts feel that the company also did not reach the two-wheeler audience properly, who were the Nano's primary target.

"Many of these consumers are reluctant to walk into a showroom and buy a car," says one of them.

. . .

Nano: It has been a topsy-turvy ride

Tata Motors would benefit by adopting a strategy similar to companies like Hero Honda and Maruti Suzuki which have an effective distribution team in place to reach out to buyers in Tier 2 and Tier 3 towns.

Maruti Suzuki, for example, has on its rolls rural sales executives who visit small towns and villages to build relationships with rural consumers.

"Even though the sales potential might be only 10 units per month, it helps them connect with the brand," adds the analyst.

Life seems to have done a full circle now. Tata Motors has recently launched a television commercial, 'Key to your happiness', which plays on a theme that hopes to appeal to middle-class families in small towns.

"In addition to semi-urban and rural audiences, the company also needs to tailor communication for multiple-car households," notes an analyst.

That could be the next challenge.

. . .

Nano: It has been a topsy-turvy ride

Image: Nano on display at a Westside store in Prabhadevi, Mumbai.Photographs: Sahil Salvi.

Moving ahead, success will depend on how effectively the company straddles the two different consumer segments which have different needs and aspirations when buying a car.

However, despite the drop in sales in November, analysts are still positive about the future of the Nano.

With the steps that the company has taken, demand will see an uptake in the next few months, they reckon.

"The Nano is a good product and definitely has the potential to do well not only in India but also in the global markets," says an analyst.

Tata Motors is indeed developing special variants of the Nano for the European and US markets.

The high-end models, costlier than the models sold in India, will be launched over the next two years.

It is still early days, and only when open sales are launched pan-India in March 2011 will the final word on the Nano come out.

article