Can the Hyundai Verna continue its dream run?

Last updated on: June 29, 2011 13:41 IST

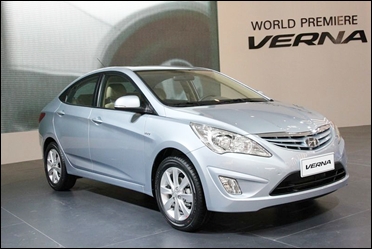

Image: Hyundai Verna.

Swaraj Baggonkar in Mumbai

The premium midsize segment (Rs 6.5-10 lakh) has always been a tricky one for all car manufacturers.

City was the first to crack it, though Honda's flagship model has been facing some speed bumps of late, prompting last month's decision to cut prices by as much as Rs 66,000.

The previous Hyundai Verna, showcased in India four years ago and positioned as a natural progression from the hugely successful Accent, also didn't exactly set the midsize car sales charts afire.

Can the Hyundai Verna continue its dream run?

Image: Verna Fluidic.

Enter the new Verna Fluidic, which was launched in the middle of last month.

The latest Verna, which looks nothing like its predecessor, was responsible for shoring up Hyundai's fortunes in May in a market that saw almost all car majors posting a steep decline in sales.

Can the Hyundai Verna continue its dream run?

Image: Hyundai Verna.

According to data provided by SIAM, 4,357 Vernas were sold by the end of May, which was a terrific figure in the context of the sub-2000 reported by other midsize car makers.

The only other model, which has been a reasonable success, is Volkswagen Vento at 3,000 units a month.

Can the new Verna continue its initial dream run?

Can the Hyundai Verna continue its dream run?

Image: Maruti's SX4.

Skeptics rightly point out that one swallow doesn't make a summer and it would be wrong to jump to any conclusion based on sales in the inaugural month where buyer curiosity plays a big role.

Maruti's SX4 and General Motor's Aveo, for example, also started with a huge promise (though their initial sales figures were nothing compared to the new Verna's), but failed to live up to the hype.

Hyundai admits the scale of the initial exuberance took even the company management by surprise.

Can the Hyundai Verna continue its dream run?

Image: Hyundai Verna.

Arvind Saxena, director, marketing and sales, Hyundai Motor India, says, "We had very high expectations from the new Verna although we didn't foresee such high number of bookings in the first month".

Hyundai has already received 20,000 bookings for the car and is looking at ramping up production to cut the waiting period.

The company had set a target of selling 45,000 units of the new Verna within a year of its launch. This means nearly half of that has been achieved in just one and a half months.

Can the Hyundai Verna continue its dream run?

Image: Hyundai Verna.

The management is thus confident that the Verna will be able to sell nearly twice the old variant last year.

That means an average 4,000 units per month, which is more or less the same as Honda City's average monthly sales.

Priced in the range of Rs 6.99 lakh - Rs 10.7 lakh, the new Verna is cheaper than Honda City whose entry model costs Rs 7.49 lakh even after the latest price cut.

Can the Hyundai Verna continue its dream run?

Image: Hyundai Verna.

This clever pricing is a key reason for Hyundai's confidence, the other being the "fluidic design" with its sculpted waistline and swoopy headlamps and tail lamps.

Besides, Hyundai has indeed pulled out all the stops for the car and has launched the new Verna with no less than 10 options, including a pair of 1.4 and 1.6 engines (both petrol and diesel).

Can the Hyundai Verna continue its dream run?

Image: 16-inch alloy wheel.

The diesel option could be a winner in a segment that is now 150,000-unit strong growing at 20-25 per cent and is awaiting the launch of several more models from Skoda, Ford Fiesta, Nissan and General Motors.

Other models presently fighting for share in this segment are Mitsubishi Lancer Cedia, Volkswagen Vento, Tata Manza, Fiat Linea and Chevrolet Optra Magnum.

While preferences such as comfort usually top the charts for compact car buyers, a growing number is increasingly becoming conscious about the running cost.

Can the Hyundai Verna continue its dream run?

Image: Honda City.

The earlier deterring factors such as higher maintenance costs and unclean emissions have been removed through better technology.

That is where the diesel option plays a critical role, which the new Verna provides and the Honda City doesn't.

Maruti SX4 had set the tone recently by coming up with a diesel engine. But City can't break into this space as Honda Siel does not have a diesel engine in its portfolio.

Can the Hyundai Verna continue its dream run?

Image: Infotainment system in Verna.

"At this point 78-odd per cent is diesel for the Verna. While petrol is widely accepted, diesel is increasingly becoming the preferred choice in the market because of obvious reasons. We eventually expect the ratio to settle at 70:30 in favour of diesel when the market steadies a bit", Hyundai's Saxena adds.

Honda admits the disadvantage. Jnaneswar Sen, senior VP sales and marketing, Honda Siel, says due to the high diesel subsidy, there is as shift in the demand pattern. "It's true that we are not able to cater to that segment due to the absence of a diesel engine in our portfolio".

Can the Hyundai Verna continue its dream run?

Image: Volkwagen's Vento.

But how does the new Verna compare with Volkwagen's Vento which also has a diesel option?

According to

BS Motoring, the Verna's new-generation engine is far quieter and smoother than the Vento's gravelly motor that gets boomy past 3,000 rpm.

Besides, the Verna is more efficient, delivering 16.1 kpl overall to the Vento's 15.3 kpl.

Can the Hyundai Verna continue its dream run?

Image: Cluster ionizer improves the quality of air inside the cabin.

The Verna's trump card of course is its price-to-performance-to-features ratio. That is exactly what most buyers in the premium C-segment tend to look at, and the Verna has more bases covered here.

At Rs 10.53 lakh, the loaded SX (O) costs nearly a lakh more than the Vento TDI Highline at Rs 9.49 lakh. But there's also the Verna SX without the extra airbags and some other features, at Rs 9.8 lakh (all prices ex-showroom, Mumbai).

These are the reasons why Saxena expects the new Verna to increase Hyundai's share in the premium mid-size segment to 25 per cent from about 18 per cent now.

article