| « Back to article | Print this article |

Ambani gets more BofA shares worth Rs 72 lakh

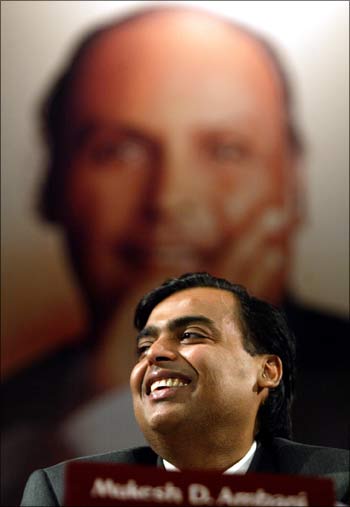

Within weeks of granting shares worth about Rs 11 lakh (Rs 1.1 million), Bank of America has given fresh shares worth over Rs 72 lakh (Rs 7.2 million) to Mukesh Ambani as part of his annual fee for being a director of the United States banking major.

The Indian billionaire industrialist joined Bank of America's board in March and his appointment was approved by the US banking giant's shareholders last week.

Ambani has so far got shares worth about Rs 83 crore (Rs 830 million) in two tranches and might get a total of over Rs 1 crore (Rs 10 million) of annual compensation in cash and stocks, going by the bank's director, compensation policy.

However, the bank has not so far disclosed its specific director fees for Ambani, who heads one of India's biggest corporate houses Reliance Industries. The Reliance group's presence spans across energy, retail and telecom businesses and plans are under way for financial services sector entry.

Click NEXT to read on . . .

Ambani gets more BofA shares worth Rs 72 lakh

As chairman and managing director of RIL, Ambani was paid Rs 15 crore (Rs 150 million) for the financial year ended March 31, 2011 -- an amount unchanged for past three years now.

In a filing with the US regulator SEC, Bank of America said that it allotted 13,061 of its shares, worth about $160,000 (nearly Rs 72 lakh) on May 11 to Mukesh Ambani.

The shares have been allotted as 'a portion of the annual retainer' fees to Ambani as a director and 'the grant, vesting and settlement of this award are conditioned on the receipt of any necessary Indian regulatory approval', the filing noted.

Following this allotment, Ambani's total holding has risen to 14,896 Bank of America shares.

Click NEXT to read on . . .

Ambani gets more BofA shares worth Rs 72 lakh

Earlier on April 1, Bank of America had allotted 1835 Bank of America shares, worth over $24,500 (about Rs 11 lakh), to Ambani as first tranche of his annual retainer fee.

Bank of America appointed Ambani as an independent director on its board on March 16, while his appointment was approved by majority vote by the shareholders on May 11.

Ambani's election was supported by shareholders owning over 576 crore (5.76 billion) shares of Bank of America, while those holding about 33.8 crore (338 million) shares voted against his appointment, the bank said in another SEC filing.

Click NEXT to read on . . .

Ambani gets more BofA shares worth Rs 72 lakh

Ambani is the first non-American to join the board of one of the world's largest financial institutions, which commands a market value of over $120 billion and had a revenue of more than $111 billion last year.

The bank pays a total of $240,000 (over Rs 1 crore) to its non-management directors in cash and stocks.

This includes a cash award of $80,000 and restricted stock award of $160,000. The stocks are allotted under the Bank of America Corporation Directors' Stock Plan, which restricts sale of these shares within one year of allotment.