| « Back to article | Print this article |

Ambani: Bears caused Rs 3 lakh crore loss, probe sought

Hit by a massive sell-off in stocks of various group companies, Reliance Anil Dhirubhai Ambani Group today said it is a victim of a bear cartel that has caused a market value loss of over Rs 3 lakh crore (Rs 3 trillion) across the infrastructure sector in the past two weeks.

A day after the group's stocks fell by up to 19 per cent, ADAG managing director Gautam Doshi said that the group has written to market regulator Sebi, the stock exchanges and intelligence agencies to look into the matter.

"There have been concerted efforts to destabilise the markets and the investor sentiments," Doshi said, adding that rumour-mongering by unscrupulous elements have contributed to the sharp fall in the group stocks. "In the past two weeks, this illegal bear cartel has destroyed market value of over Rs 3 lakh crore in the infrastructure sector," he added.

Click NEXT to read on . . .

Anil Ambani: Bears caused Rs 3 lakh crore loss!

Doshi said the group intends to take strong legal action against those behind the spread of the rumours, as well as those making irresponsible statements about the group.

Doshi also said the group companies, Reliance Infra and RNRL, as well as their statutory auditors, have not received any notice from auditing regulator ICAI with regard to the consent settlement reached by the two companies with Sebi.

The group stocks, however, on Thursday bounced back, defying the overall bearish sentiment in the broader market and surged by up to 11 per cent in early trade.

Click NEXT to read on . . .

Anil Ambani: Bears caused Rs 3 lakh crore loss!

Reliance Infrastructure, which shed 25.14 per cent in on Wednesday's session, shot up by 10.97 per cent this morning.

Another major gainer from the Anil Ambani camp was Reliance Communications, which advanced by 7.22 per cent to an early peak of Rs 101.70, after hitting a record low of Rs 90.80 on Wednesday.

Following the debacle on the bourses on Wednesday, the Anil Dhirubhai Ambani Group had issued a statement after the markets closed, alleging, "a series of completely baseless and motivated rumours have been spread today by our unscrupulous corporate rivals."

Click NEXT to read on . . .

Anil Ambani: Bears caused Rs 3 lakh crore loss!

"This (rumour-mongering by rivals) has been accompanied by vicious and illegal bear-hammering of our listed stocks to create panic and destabilise the markets," the group had said.

"We have made a formal complaint to SEBI and the stock exchanges to immediately investigate these illegal trades and take appropriate action to safeguard the interests of our over 11 million investors," it added.

Shares of Reliance Broadcast Network also went up by 5.37 per cent, while Reliance Capital jumped by 10.51 per cent, Reliance MediaWorks by 9.31 per cent and Reliance Power by 5.3 per cent on Thursday.

Click NEXT to read on . . .

Anil Ambani: Bears caused Rs 3 lakh crore loss!

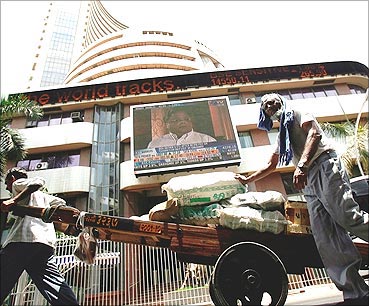

Meanwhile, the BSE benchmark Sensex was trading lower by 149.87 points at 17,442.90 at 1050 hours.

"A series of completely false and baseless rumours against our group have been circulated on Wednesday by our corporate rivals and an illegal bear cartel," Doshi said.

He said that the group has sought an immediate probe into the "concerted efforts to destabilise the capital markets and create panic amongst investors."

Click NEXT to read on . . .

Anil Ambani: Bears caused Rs 3 lakh crore loss!

"The market regulatory authorities are equipped with the most advanced electronic surveillance systems and we are confident this deliberate pattern of price hammering and manipulation will quickly be exposed," he added.

Doshi also expressed surprise at "the distorted reporting in a section of the media, attributing certain observations to the ICAI."

"Reliance Infra has not received any queries from ICAI on its accounts for any year. ICAI has simply asked for copies of audited balance sheets, which are already in the public domain and have been circulated to over 1.5 million shareholders," he said.

Click NEXT to read on . . .

Anil Ambani: Bears caused Rs 3 lakh crore loss!

Doshi said that ICAI has sought to know "why Reliance Infra has chosen to implement a policy of rotation of statutory auditors. It has been explained to ICAI that this policy, voluntarily adopted by Reliance Infra, is recommended by the Union ministry of corporate affairs. This policy is also entirely in line with international best practice."

Doshi said that Reliance Infra would "continue to extend all cooperation to ICAI and respond to any queries, if and when raised."

"At the same time, we would urge discretion to be maintained by a professional body like ICAI, especially in relation to price-sensitive comments and observations to the media.

Click NEXT to read on . . .

Anil Ambani: Bears caused Rs 3 lakh crore loss!

"Reliance Infra intends to take the strongest legal action against any irresponsible and defamatory media reports on these and related matters," the group managing director said.

About the consent order issue, he further said that the proceeds of the certificates/deposits referred to in the Sebi Consent Order were repatriated to India by Reliance Infra in 2007-2008, more than 3 years ago.

The group stocks have witnessed heavy value erosion since the passing of the January 14 consent order, wherein the two group firms -- Reliance Infra and RNRL (now merged with Reliance Power) -- had agreed to pay Rs 50 crore as settlement charges and abstain from investing in listed stocks for about two years.